In 2026, nearly every software buyer is evaluating products through the lens of artificial intelligence (AI). 77% of software buyers are increasing their budgets in 2026, and 42% cite adding new AI functionality as the primary driver. This surge shows buyers are excited about AI, but winning them requires understanding how they’re evaluating AI-powered solutions.

The 2025 Software Buying Trends survey revealed that AI spending was surging. So, this year we asked: what’s behind the demand? This year, we uncovered which AI features matter most to buyers and how they’re approaching adoption.

Read on to learn what the 2026 Software Buying Trends Survey* revealed about AI in the software buying journey, and how vendors can use these findings to position their offerings.

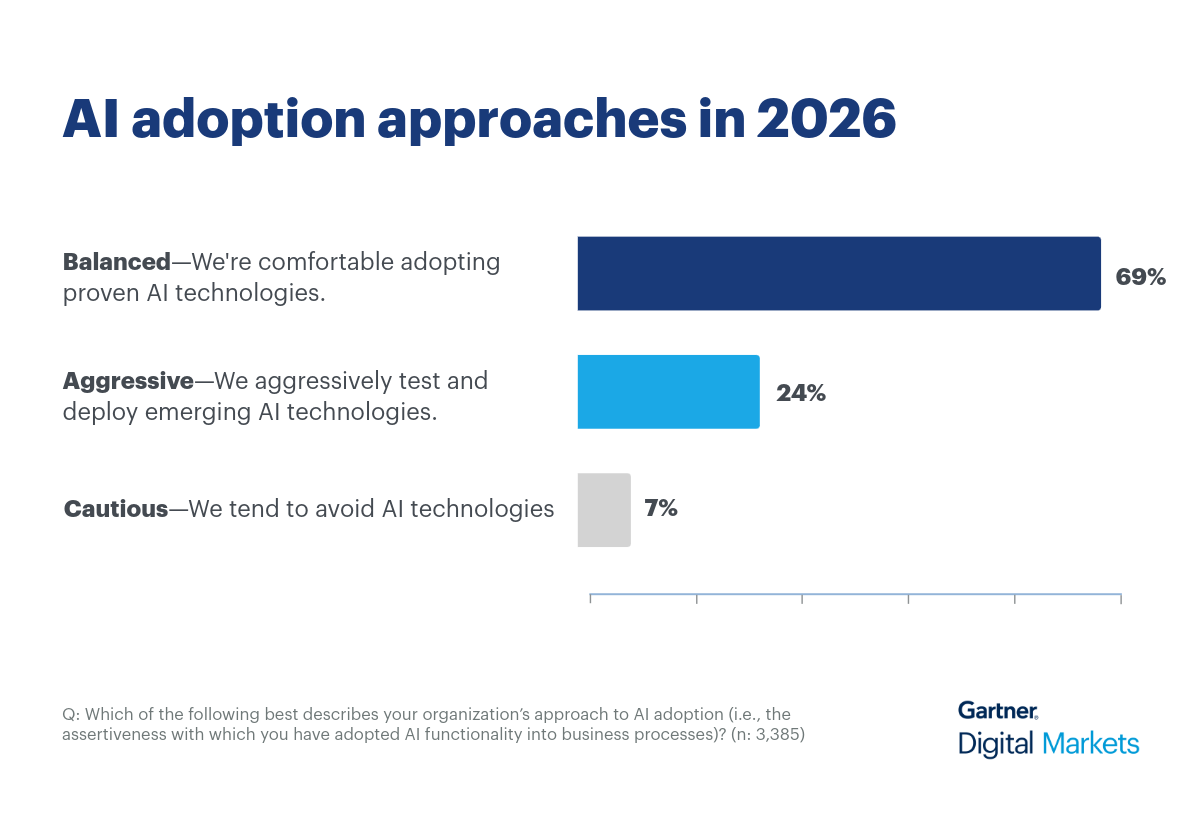

1. Most buyers take balanced approach to AI adoption

AI adoption is entering a maturity phase. Proven capabilities dominate buyer priorities. Only about a quarter of buyers are still in aggressive, early-adopter mode.

This split reflects two distinct buyer mindsets:

- Balanced adopters (69%), who want innovation but also reliability. They know that adopting AI is necessary to stay competitive, but their approach is tempered by caution and risk management.

- Aggressive adopters (24%), who are willing to pilot new tools and accept some risk for competitive advantage.

Whether you're selling AI chatbots, forecasting tools, or other functionalities, the 69/24 split means that the window for "revolutionary" positioning is narrow. Most buyers now evaluate AI tools the same way as any business tool: through the lens of ROI and investment risk.