Use cases for medical software

Beyond traditional medical sectors, dedicated software supports a wide range of industries, from family medicine and psychiatry divisions to medical spa and internal medicine, each with distinct workflows and specialized feature needs. For example:

- Family medicine organizations use medical software to manage patient records across age groups and coordinate care among general practitioners and specialists. It also streamlines appointment scheduling for high-volume, multi-provider practices.

- Psychiatry divisions rely on secure documentation tools for sensitive patient notes, telemedicine features for remote therapy sessions, and e-Prescribing for psychiatric medications, all while maintaining strict confidentiality standards.

- Medical spa businesses leverage it to manage client bookings, track inventory for cosmetic treatments, and ensure compliance with health and safety regulations. Integrated CRM features further help personalize services and retain clients.

- Internal medicine firms employ software for chronic disease management, lab result tracking, and integrated billing. These tools support long-term patient care and reduce administrative overhead for complex treatment plans.

- Physical therapy businesses use medical software to schedule therapy sessions, document progress notes, and automate insurance claims. Built-in exercise libraries and patient portals help improve engagement and outcomes.

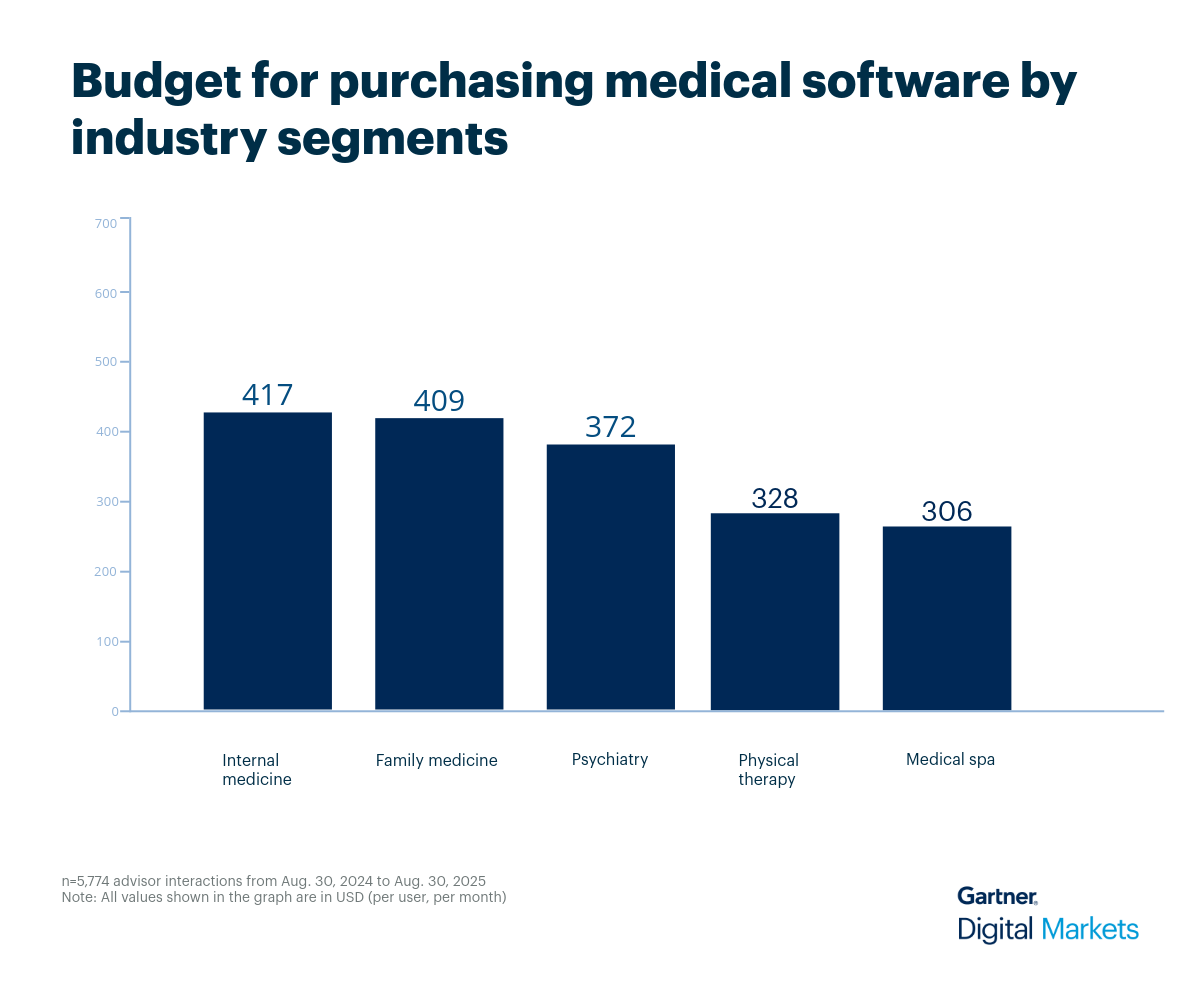

Average budgets for medical software across industries

Businesses across the top five industries are willing to allocate an average budget of $306 to $417 per provider, per month. Additionally, the overall average budget for purchasing medical software is approximately $390 per provider, per month.

However, the budget for purchasing medical software varies from one segment to another based on factors such as the size of the practice, complexity of workflows, regulatory requirements, and the need for specialized features such as mobile access, billing, or employee/patient scheduling.

Here’s how different medical industry segments budget (in dollars, per user, per month) for purchasing medical software.