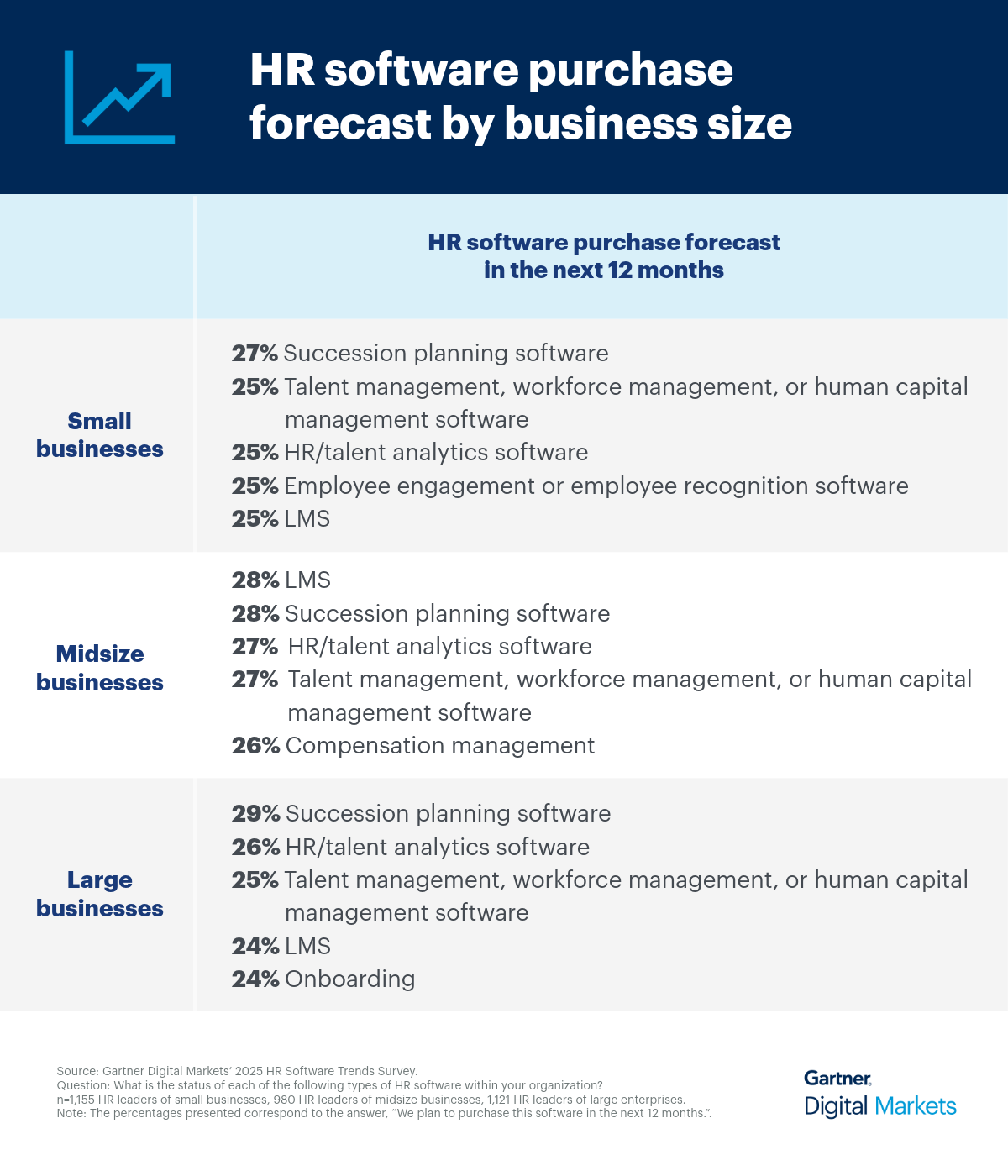

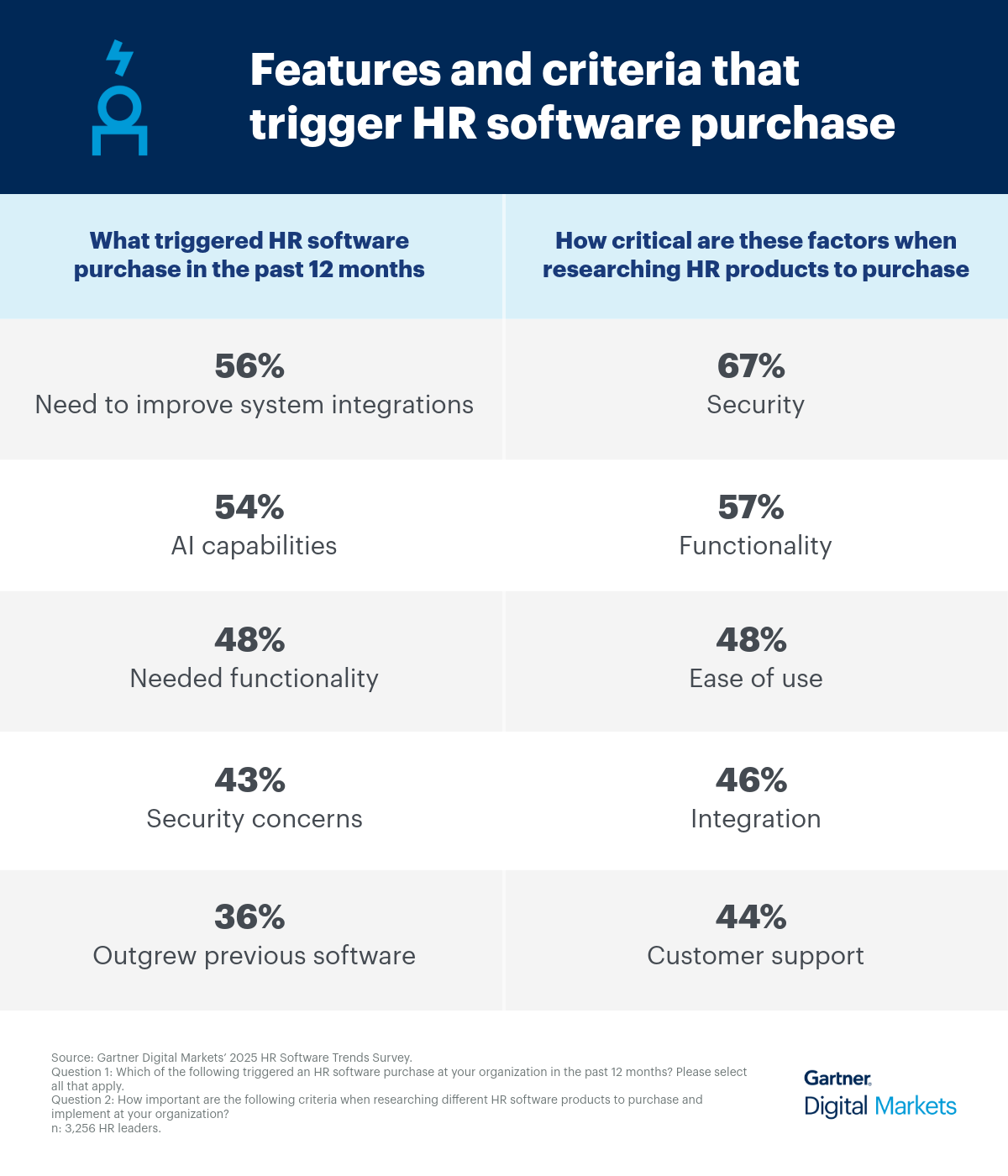

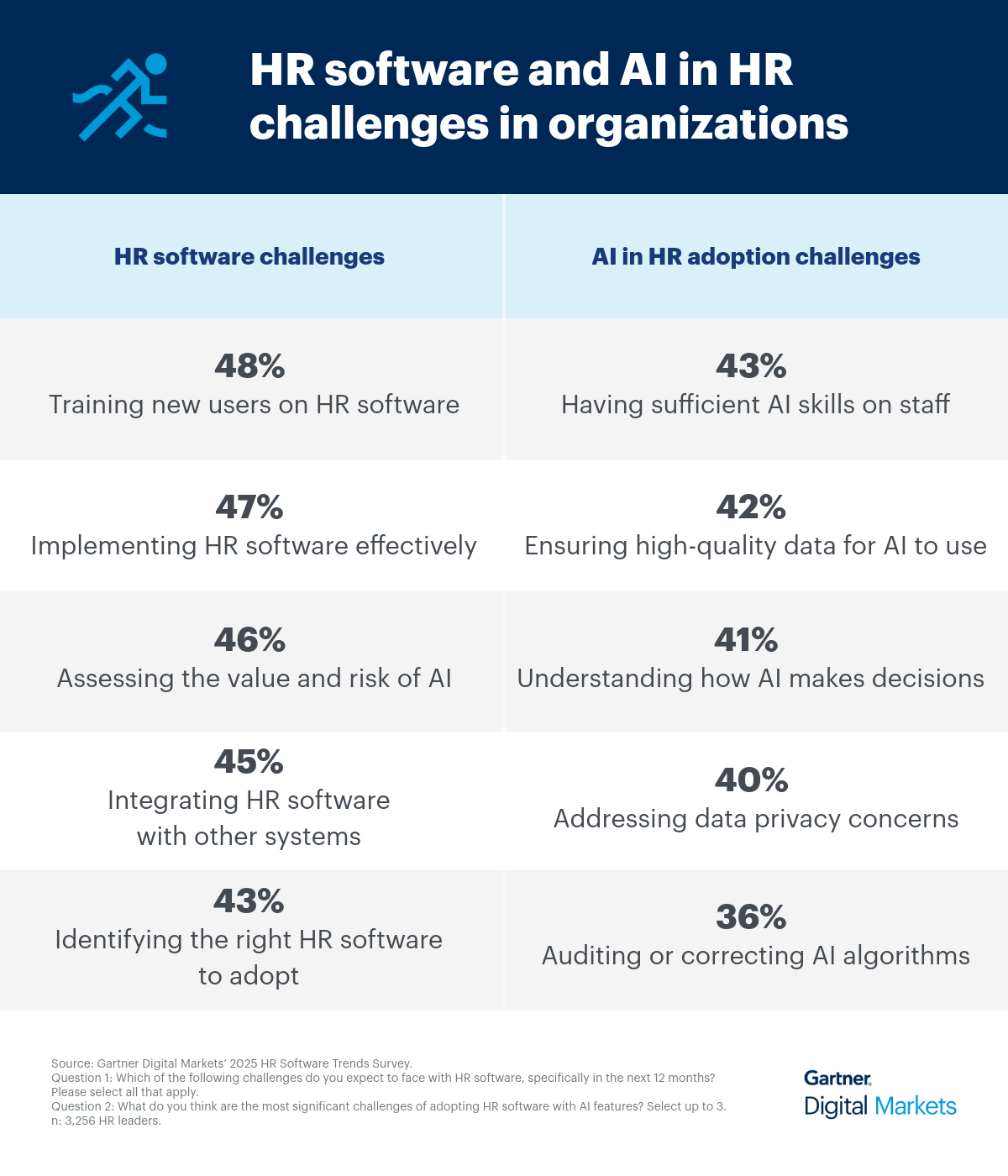

HR leaders are tasked with finding, training, and retaining talent while keeping employees engaged and well-supported. As organizations adopt more HR software to meet these demands, the big question is whether their current tech stacks are truly up to the challenge and if their future software investments are aligned with their most pressing HR needs. Gartner Digital Markets’ 2025 HR Software Trends Survey, conducted among 3,256 respondents across 11 countries, provides fresh insights into these questions.

This report explores how companies are building their HR tech stacks, what’s driving their software purchases, and which HR tools they consider essential. It also highlights the key challenges buyers face and actionable opportunities for HR software vendors to help organizations work smarter, bridge technology gaps, and achieve their business goals.