Buyer goals and challenges—what advisors are hearing

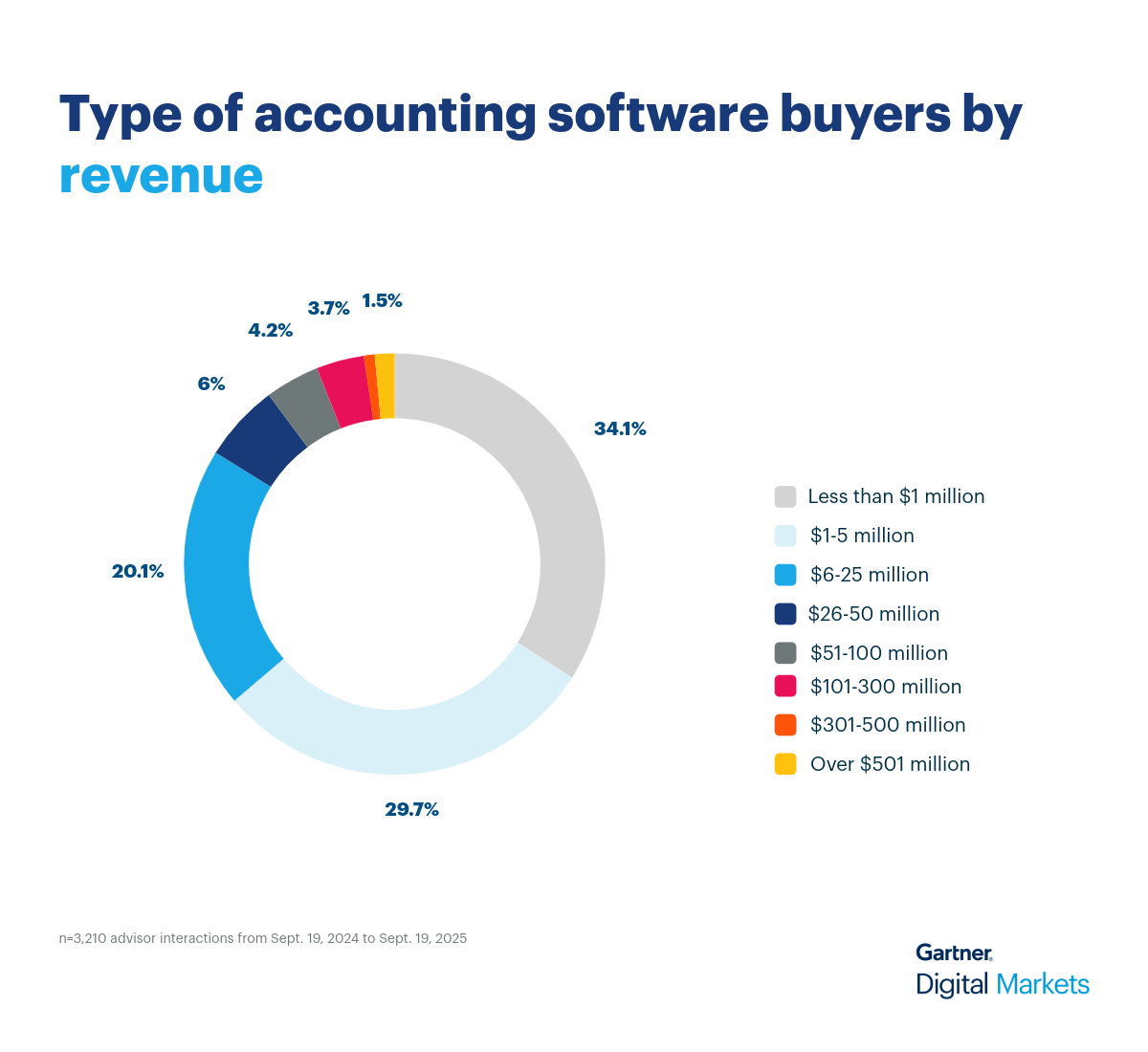

Sourcing managers and purchasers in the accounting space often come with specific expectations and recurring questions that reflect their unique operational needs. Through direct conversations with our software advisors, we’ve gathered insights into buyer behavior and their tasks, revealing patterns in their priorities, challenges, and decision-making criteria.

- What problems are buyers trying to solve with accounting software?

Many buyers are trying to move away from outsourcing depreciation tracking to CPA firms, which can cost thousands annually. They’re looking for accounting software that helps them manage assets internally, save money, and reduce reliance on spreadsheets—which often become too complex and error-prone as the business grows.

- Who typically needs accounting software?

Accounting software is primarily used by finance professionals—think CFOs, controllers, and accountants—who need tools to track depreciation, financial reporting, and compliance. Operational roles like production managers usually don’t engage with these systems unless there's a crossover into maintenance or asset tracking.

- What misconceptions do buyers have about accounting software?

Buyers sometimes expect accounting software to handle tasks like IT asset management, maintenance scheduling, or contract tracking. These features typically fall outside the scope of core accounting systems and may require separate tools or integrations. This confusion often surfaces during initial conversations.

- What integrations do buyers expect with accounting software?

Buyers often want accounting software to integrate with project accounting tools for tracking budgets and profitability, especially in industries like construction or architecture. Expense tracking and tax book features are also common asks, particularly around tax season when depreciation reporting becomes critical.

Recommended actions for accounting software vendors

Here are five strategic actions vendors can take to better meet buyer expectations and stand out in a competitive market:

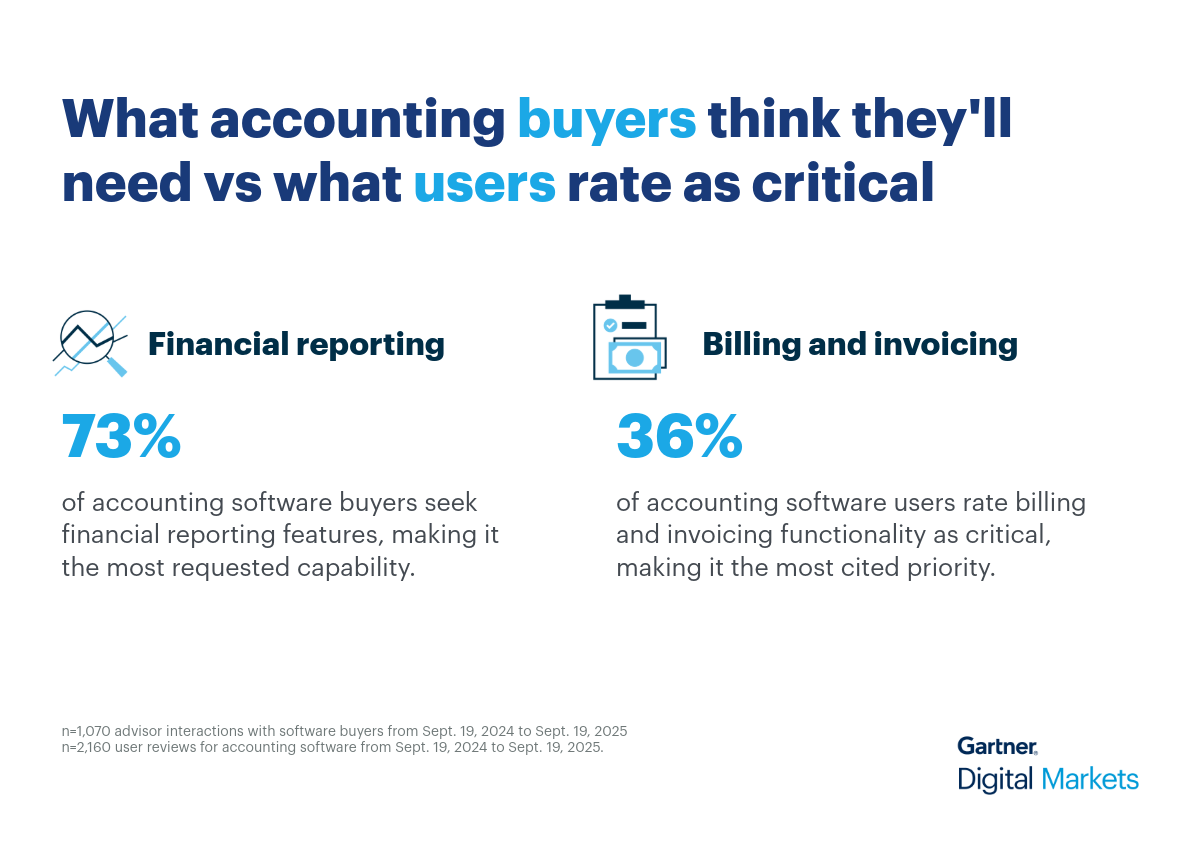

- Showcase financial reporting and billing as dual priorities: Buyers request financial reporting (73%) most during purchase, while users value billing and invoicing (31%) for daily operations. Highlight how your software supports both strategic oversight and operational efficiency. Use real-world examples to show how businesses manage cash flow and generate accurate reports.

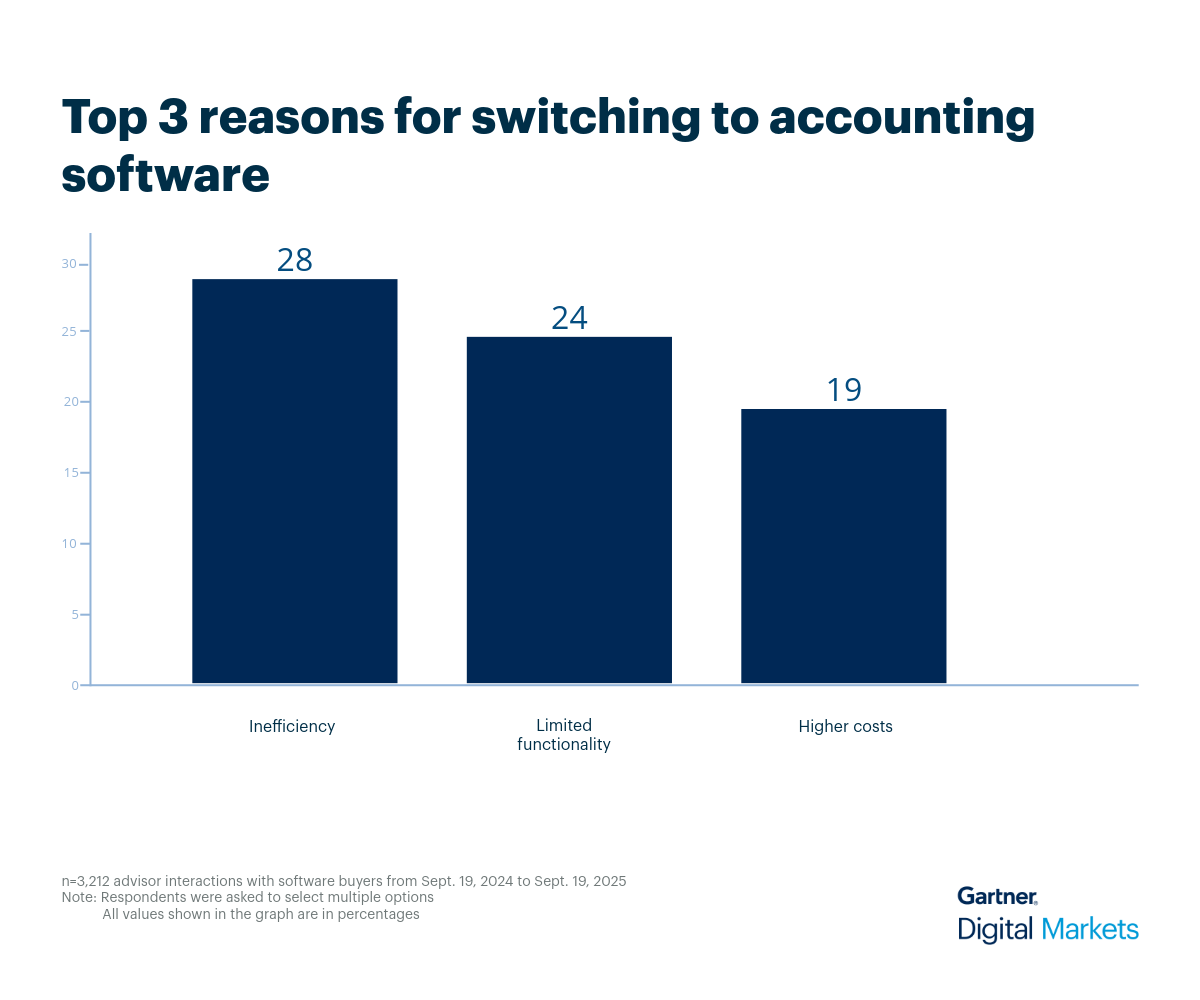

- Solve inefficiencies with automation and centralization: Notably, 28% of buyers cite inefficiency, and 24% say limited functionality is a reason for switching. Emphasize how your software automates reconciliation, tax calculations, and journal entries. Demonstrate how centralized financial data improves accuracy and simplifies audits.

- Be onboarding-friendly and support-driven: Many SMBs hesitate to switch due to setup concerns. Position your onboarding experience as a strength—offer fast implementation, intuitive training, and responsive support. Use client testimonials to build confidence and reduce buyer hesitation.

- Make sure you’re integration-ready and compliance-focused: Buyers expect integrations with payroll, inventory, and project accounting tools. Highlight how your software connects with existing systems and supports compliance through audit trails and tax reporting features. These capabilities are especially critical during tax season and audits, so double down on the benefits.

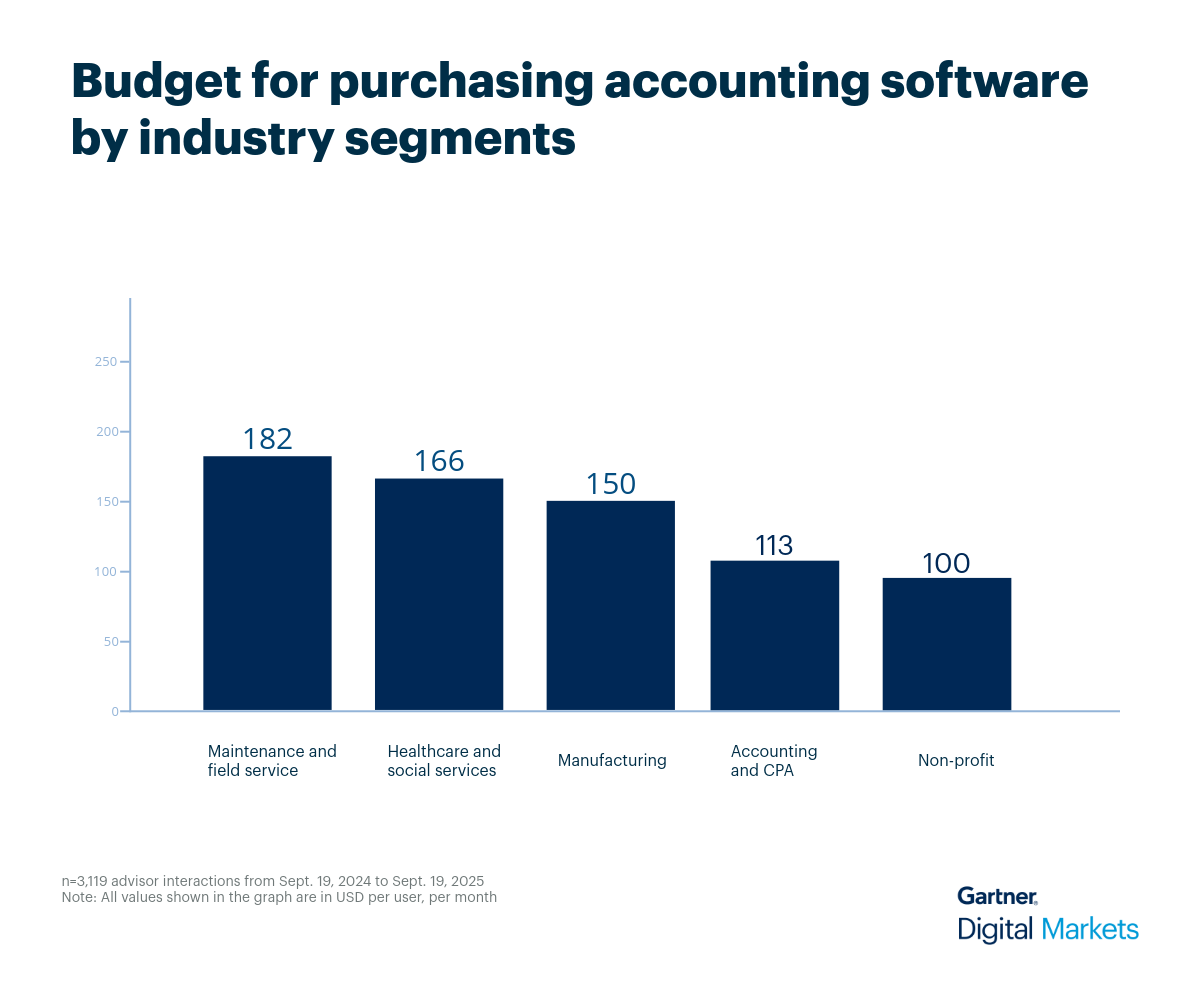

- Be transparent and pricing-aligned: Clearly display your pricing, aligning with the average budget of $100–$182 per user, per month. Help buyers shortlist your tool by benchmarking against trusted resources like the 2025 Capterra Shortlist for accounting software. Whenever possible, offer tiered plans to match different business sizes and needs and allow for room to grow and scale.

Rise above your competition with strategic insights

Accounting software vendors face intense competition in a crowded market. With the right insights, you can identify buyer priorities and pain points, then tailor your messaging to address them directly and capture attention.

With more than 10 million active software buyers on our sites every month, Gartner Digital Markets can equip you with the strategic insights you need to level up your marketing strategy and become a leader in your category.

Log in to your Gartner Digital Markets account and optimize your profile to ensure buyers understand how your software meets their evolving needs.

Once your profile is ready, use this guide to build a high-quality sales pipeline and this resource to master follow-ups that convert leads into customers.