Construction software buyers no longer rely on a single source when researching tools. From AI-powered search to peer recommendations and comparison platforms, their journey spans multiple channels. With only one in three buyers consulting vendor content, software providers must ensure their value is clearly communicated across every touchpoint, long before buyers land on their site.*

To stay competitive, providers must show up where buyers are actively searching—like Gartner Digital Markets’ destination sites: Capterra, GetApp, and Software Advice. With buyers comparing dozens of tools across these platforms, clear positioning and relevant messaging are key to standing out.

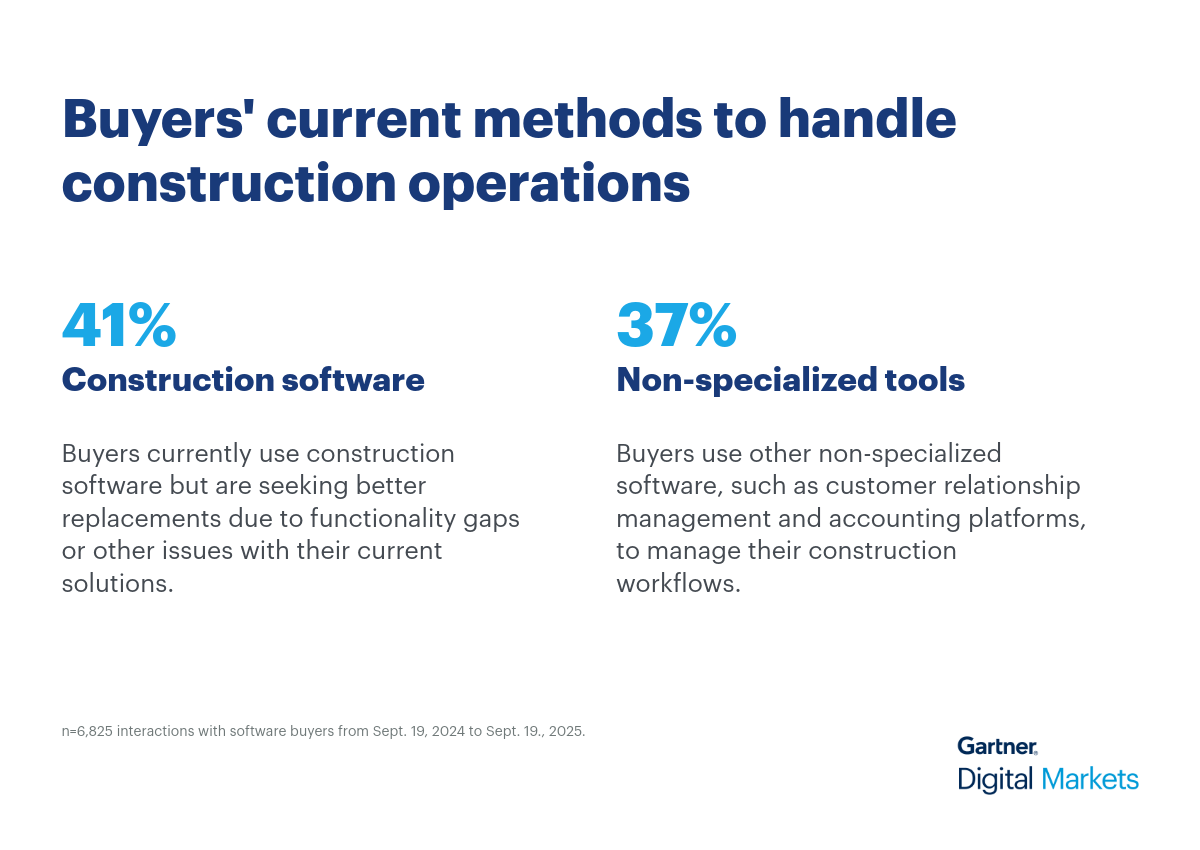

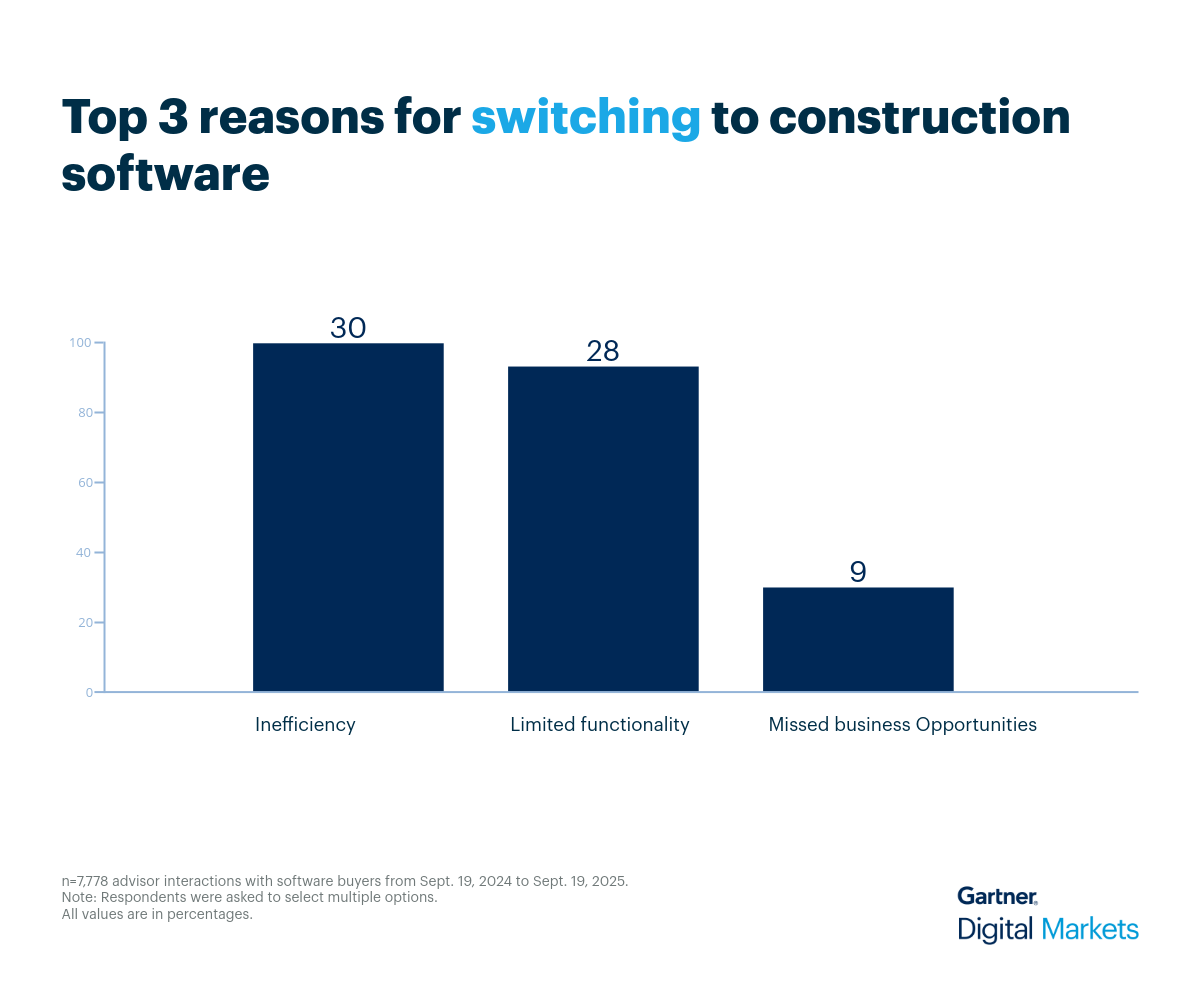

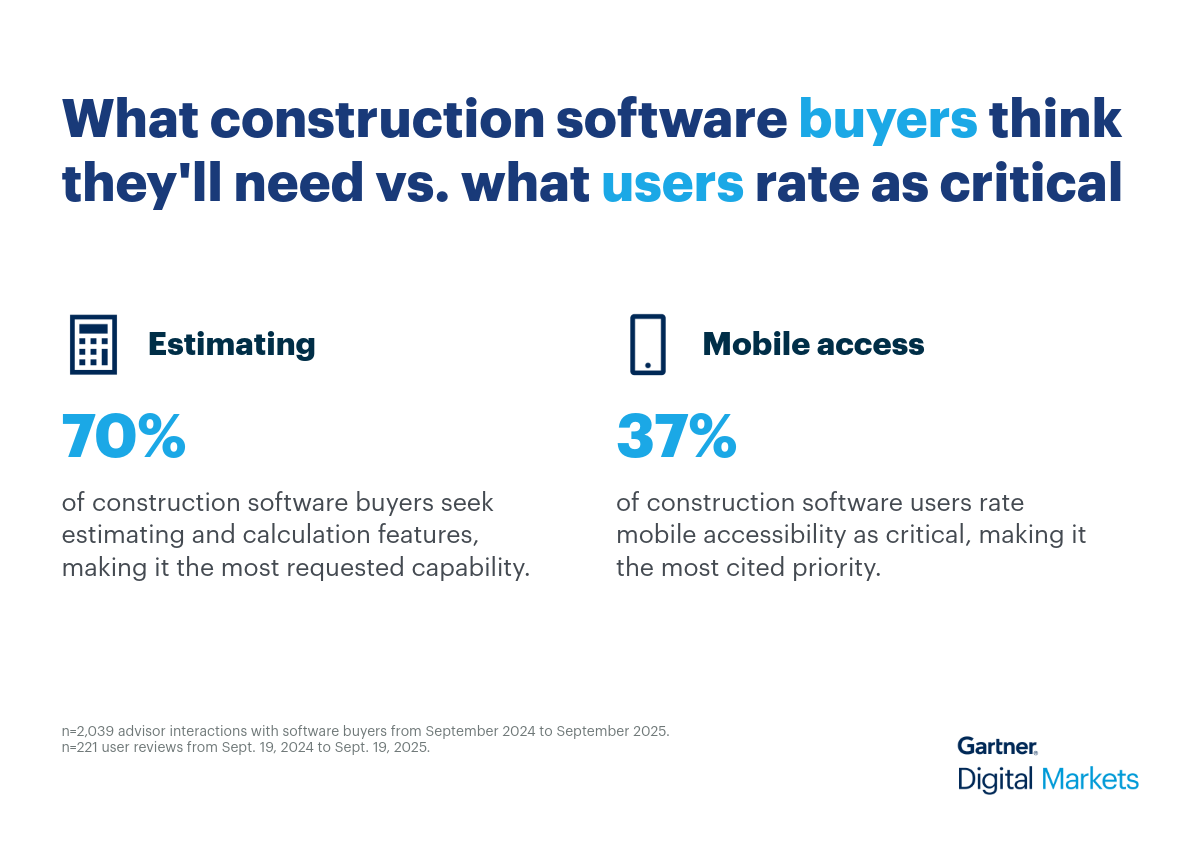

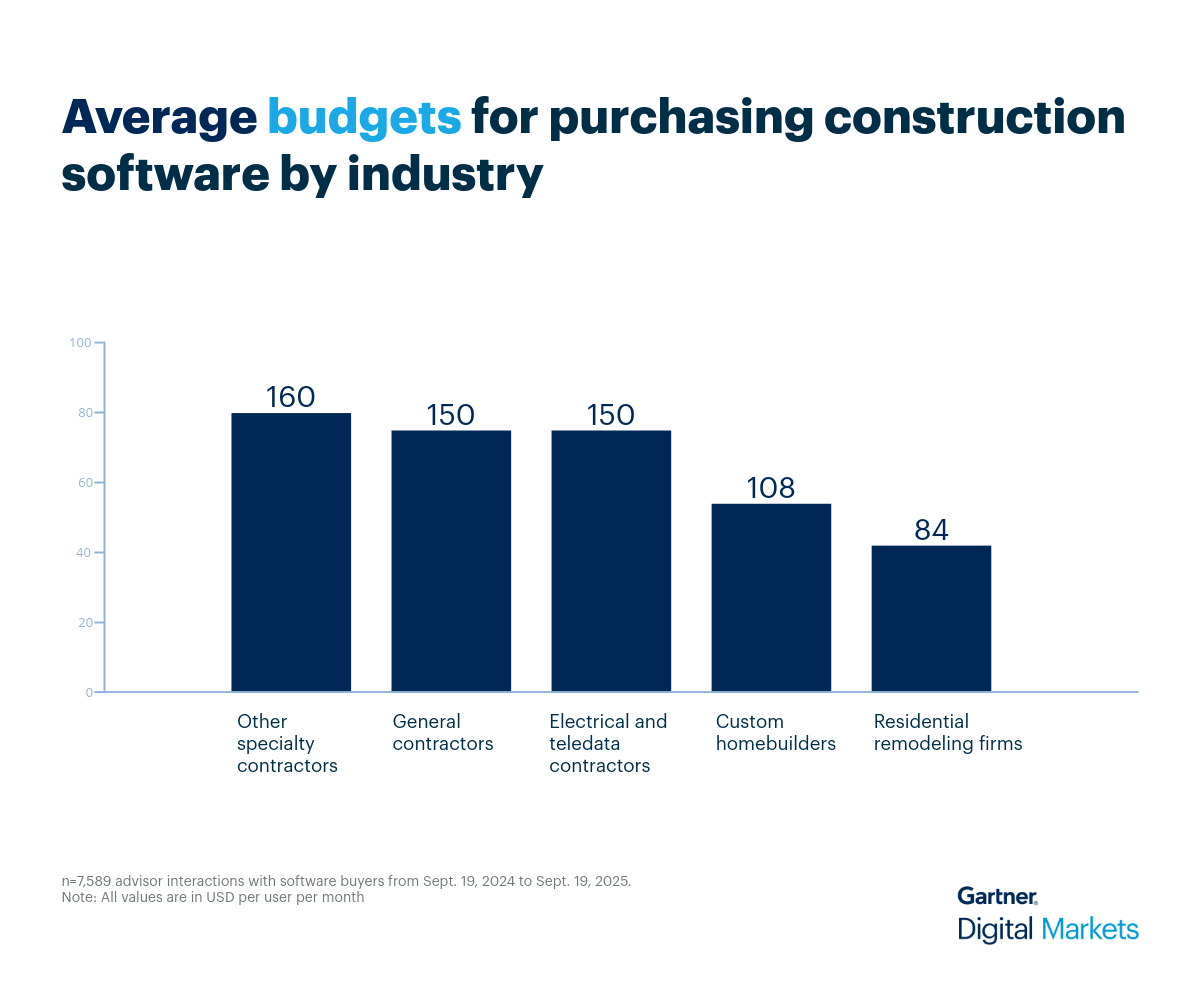

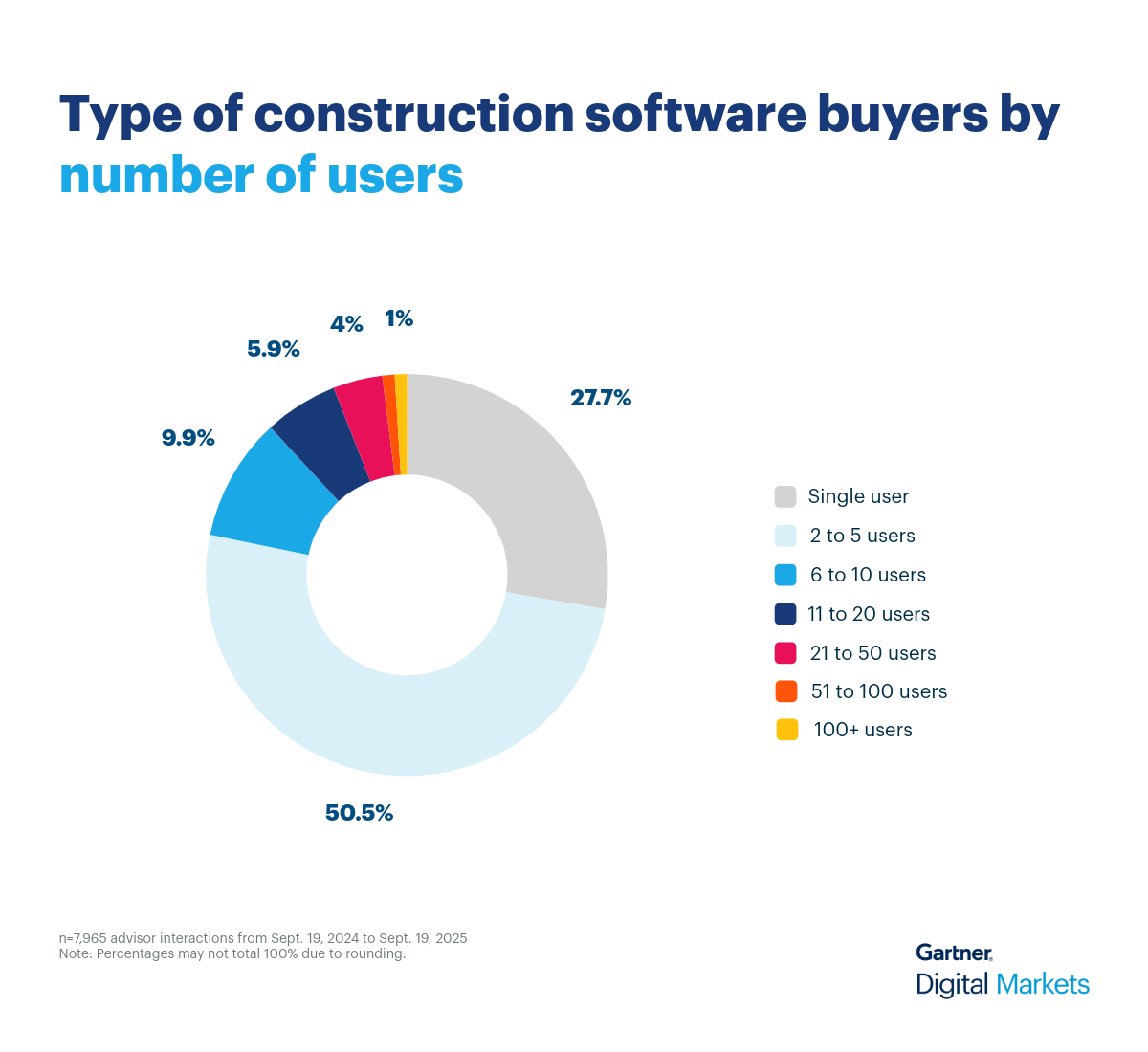

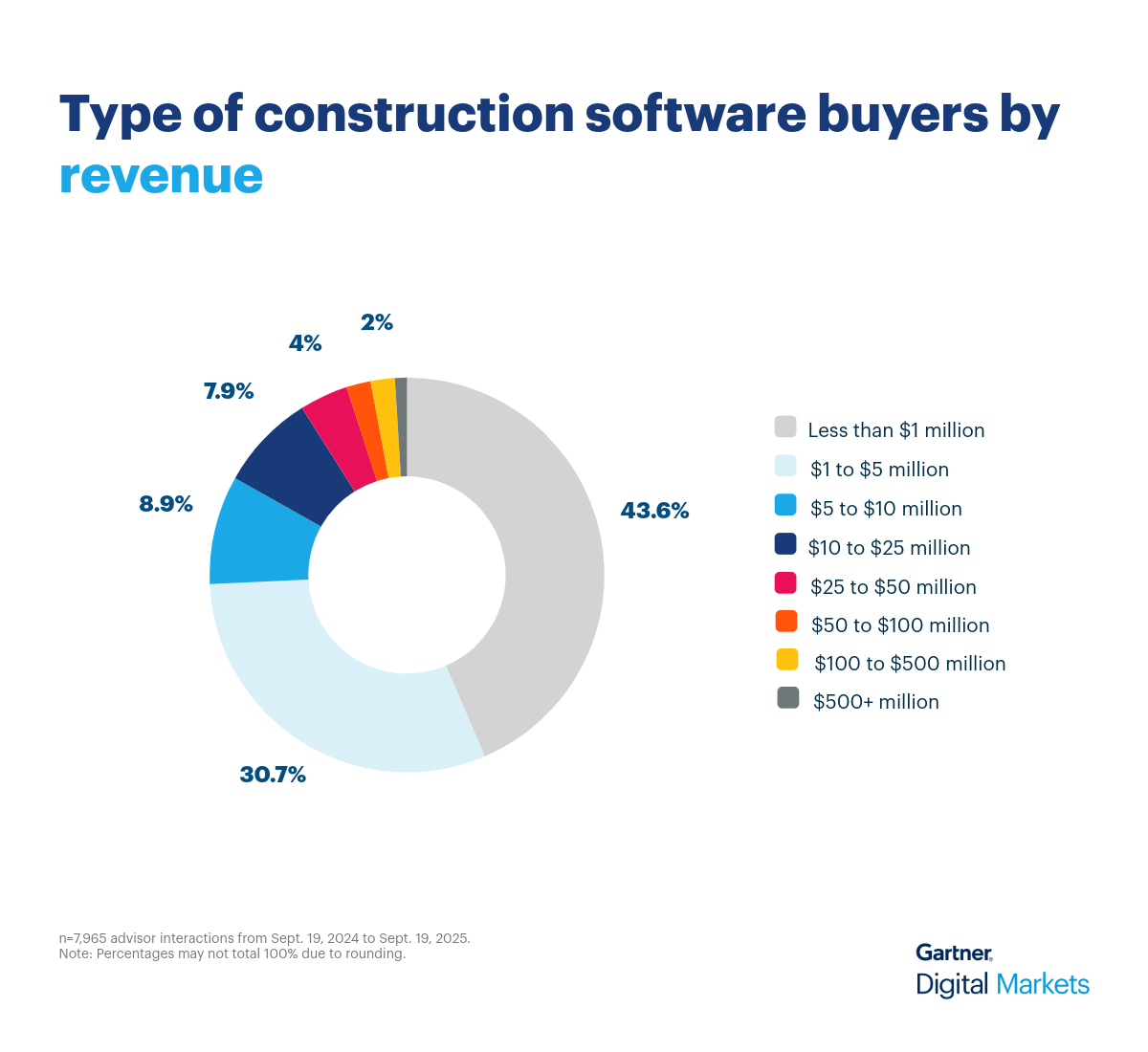

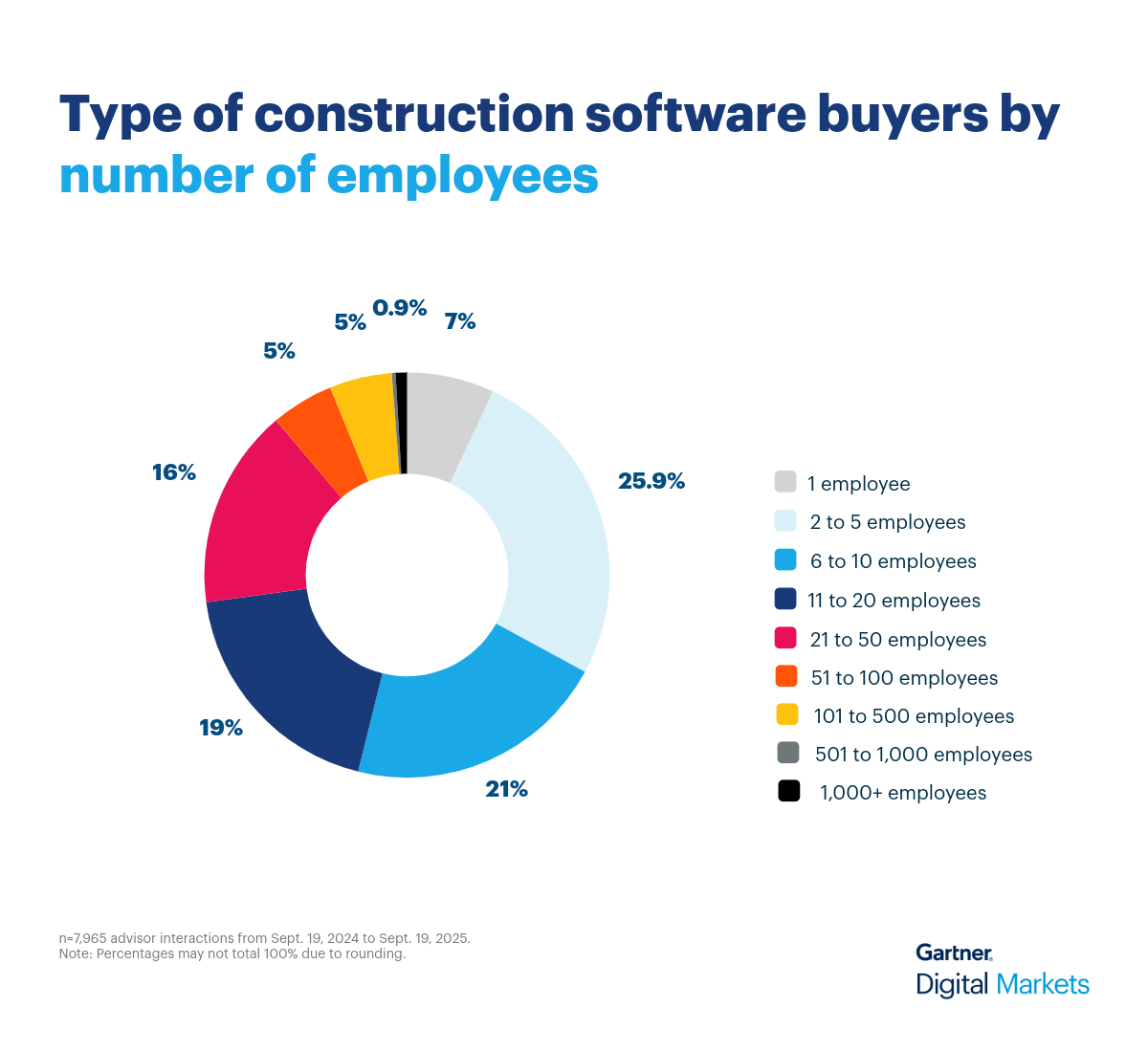

Our software advisors speak with thousands of buyers every year, qualifying them based on budget, authority, need, and timeline (BANT). We’ve analyzed these real buyer conversations to help vendors sharpen their messaging and position their construction software to match what buyers are actually looking for.**