In this environment, field service management software must prove its value quickly—automating technician dispatch, work order tracking, inventory control, and invoicing, to meet rising buyer expectations and tighter decision timelines.

To support this strategic shift, businesses actively search for field service management software solutions on Gartner Digital Markets’ buyer destination sites—Capterra, GetApp, and Software Advice. However, with so many field service management solutions available, how can buyers confidently choose the right one for their needs?

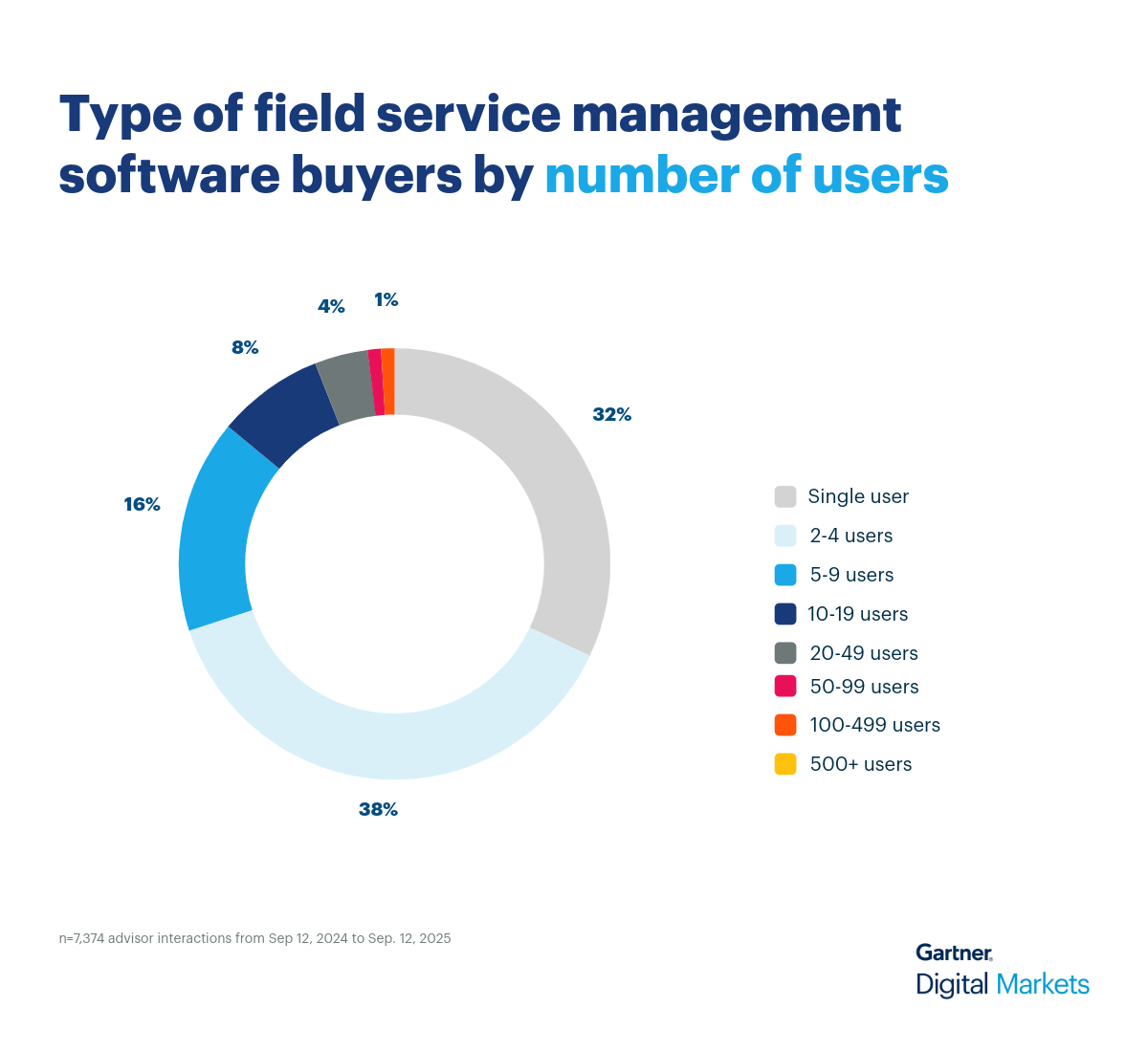

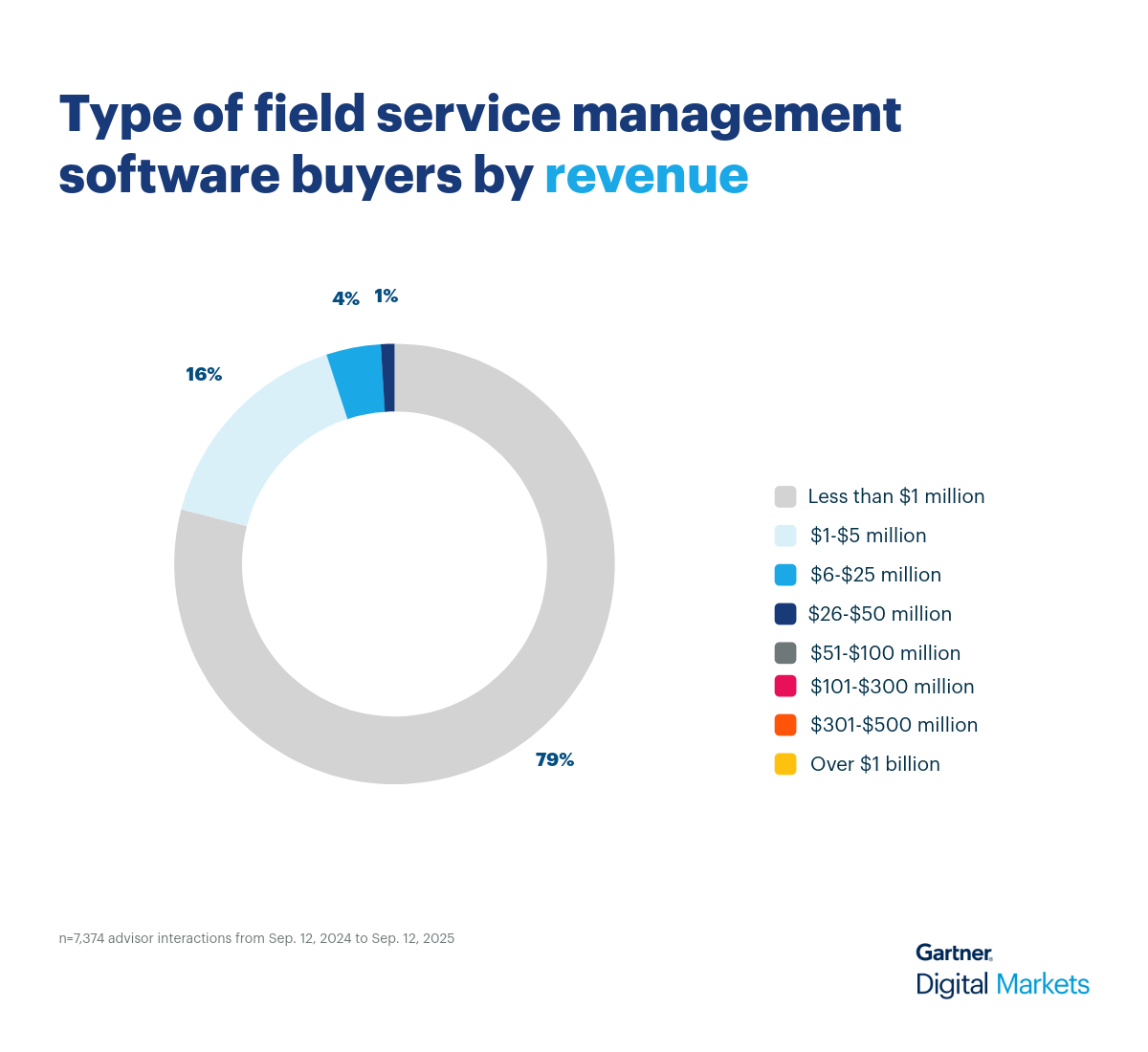

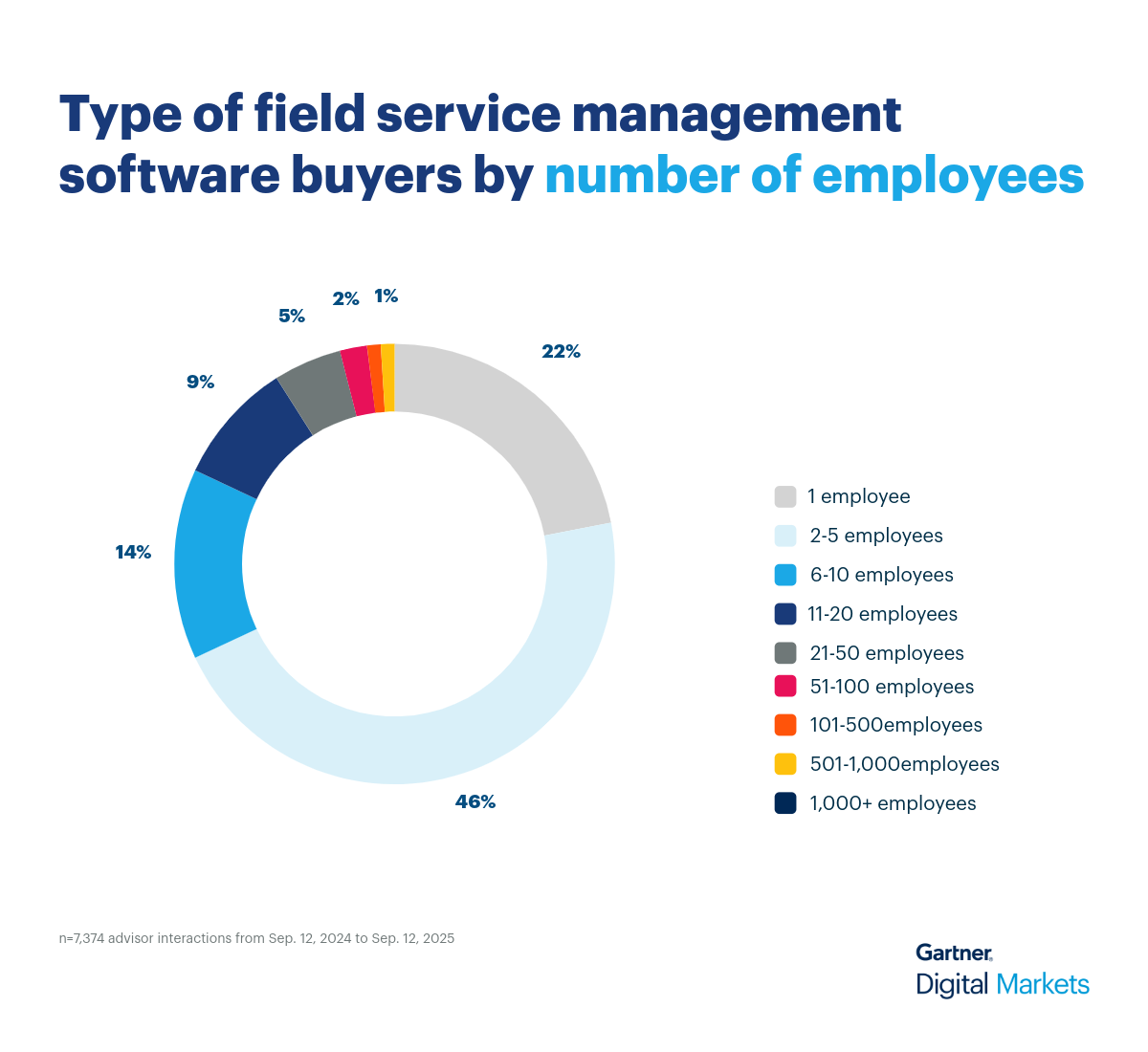

Our software advisors speak with thousands of buyers every year, qualifying them based on budget, authority, need, and timeline (BANT). We’ve analyzed these real buyer conversations to help vendors sharpen their messaging and position their field service management software to match what buyers are actually looking for.