Use cases for HR software

Beyond traditional HR teams, dedicated software supports varied industries, from healthcare and nonprofits to construction and manufacturing, each with distinct workflows and specialized feature needs. For example:

- Healthcare and medical firms use HR software to automate candidate sourcing, track applications, and manage recruitment pipelines. Dedicated healthcare HR software solutions also manage complex shift patterns and rotations for medical staff, optimize workforce utilization, and ensure adequate coverage.

- Nonprofit organizations use the software to streamline volunteer recruitment processes, track applications, and manage onboarding tasks, such as background checks and training. The software delivers online training content and tracks learning progress, ensuring skill enhancement and compliance with nonprofit sector standards.

- Construction and contracting businesses use HR software to track and manage a diverse workforce across projects and job sites, including full-time employees, contractors, subcontractors, and temporary workers. The software helps construction managers maintain records of employee certifications (e.g., safety training, equipment operation), ensuring compliance with industry standards and regulatory requirements.

- Manufacturing firms use HR software to manage shift patterns, overtime, and workforce rotations to optimize production schedules and maintain operational continuity. The software automates payroll calculations, including shift differentials, bonuses, and deductions, ensuring accurate and timely payments aligned with production schedules.

- Maintenance and field service businesses employ HR software to automate onboarding procedures, including safety training, equipment familiarization, and compliance documentation, to accelerate new hire readiness for field deployment. Some HR solutions also optimize the scheduling and dispatching of technicians based on skills, availability, geographic proximity, and customer service requirements.

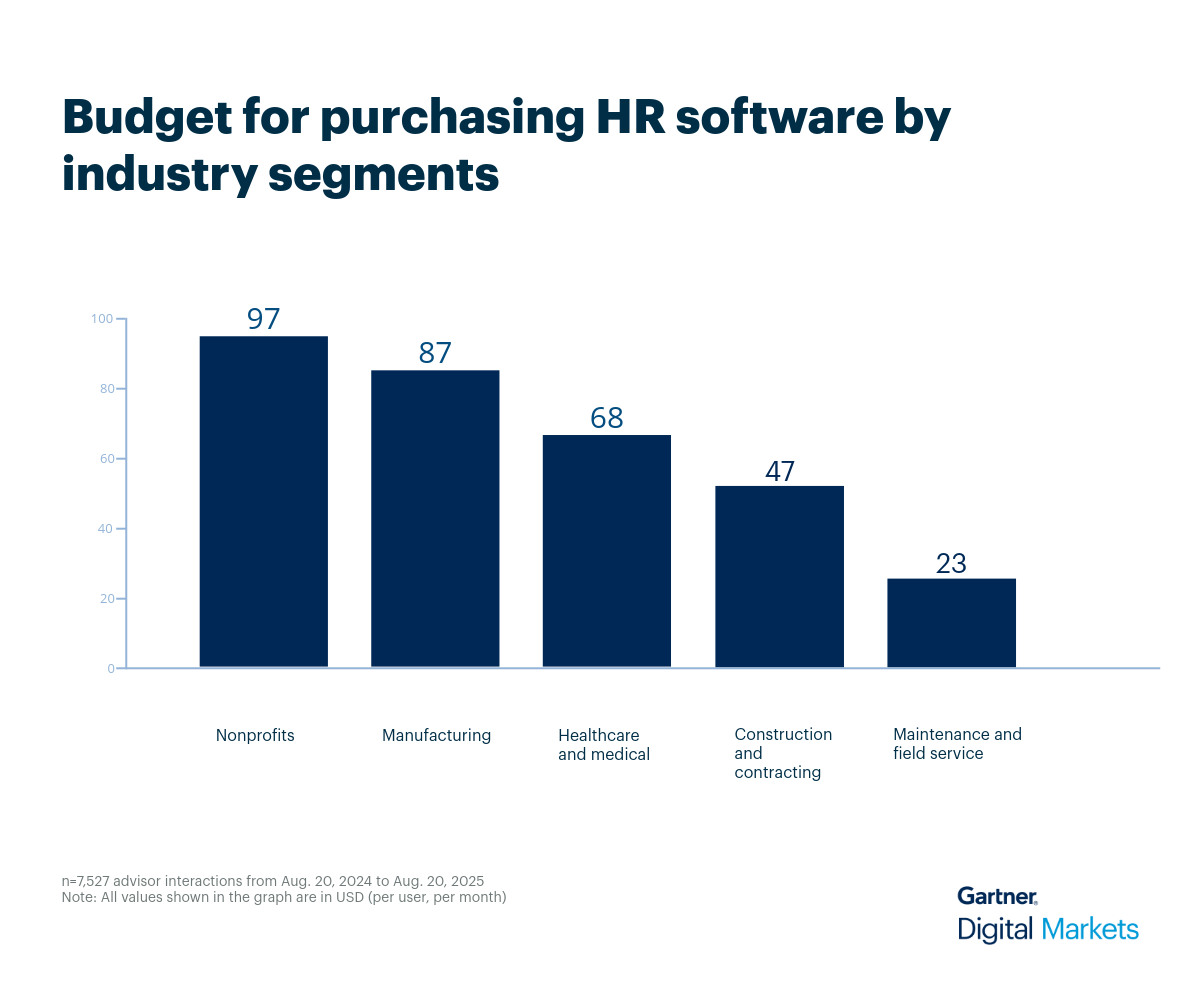

Average budgets for HR software across industries

Businesses across the top five industries are willing to allocate an average budget of between $35 to $160 per user, per month. Additionally, the overall average budget for purchasing human resources software is approximately $69 per user, per month.

However, the budget for purchasing HR software varies from one segment to another based on factors such as the size of the workforce, complexity of workflows, regulatory requirements, and the need for specialized features such as mobile access, multi-state payroll management, or resource optimization.

Here’s how different human resources industry segments budget (in dollars, per user, per month) for purchasing human resources software.