Use cases for learning management software

Beyond traditional learning and development teams, dedicated LMS supports a wide range of industries, from nonprofits and consulting firms to healthcare and manufacturing companies, each with distinct workflows and specialized feature needs. For example:

- Nonprofits use LMS software to onboard volunteers, deliver mission-aligned training, and track compliance across distributed teams. With limited budgets and staff, automation and centralized access help streamline learning efforts.

- Consulting firms leverage LMS tools to train internal teams on service delivery standards and offer client-facing learning programs. These platforms also support branded course creation, enabling firms to extend their expertise through scalable training.

- Healthcare and medical organizations rely on LMS software to manage mandatory training, track certifications, and ensure compliance with industry regulations. Timely updates and audit-ready records are critical for maintaining patient safety and operational standards.

- Manufacturing firms use LMS platforms to deliver safety training, certify equipment handling, and standardize onboarding across multiple locations. The ability to track completion and performance helps reduce workplace incidents and improve productivity.

- Construction and contracting businesses make use of LMS tools to manage safety protocols, compliance training, and skill development for field workers and subcontractors. Mobile access and offline capabilities are especially valuable for teams working on remote job sites.

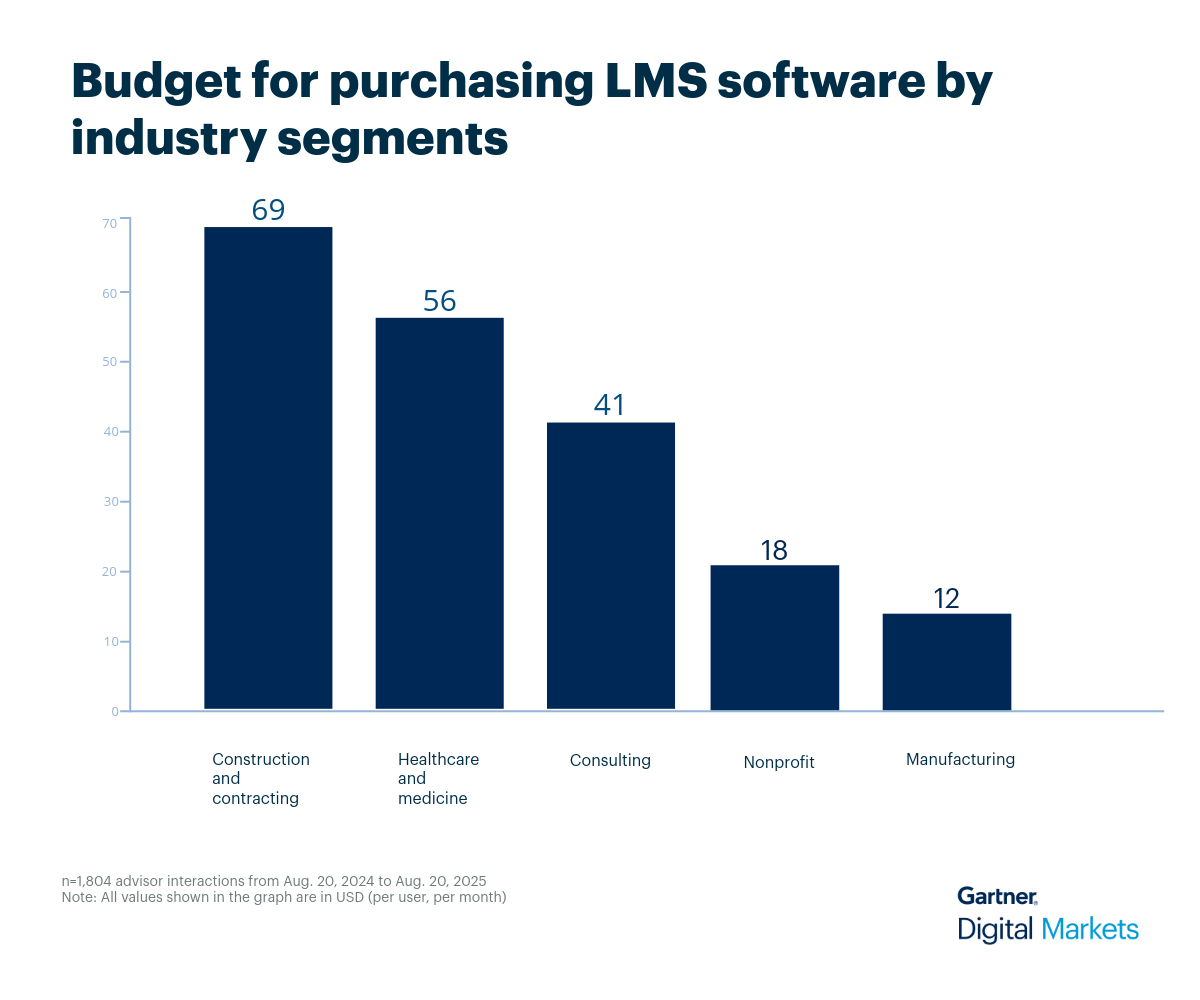

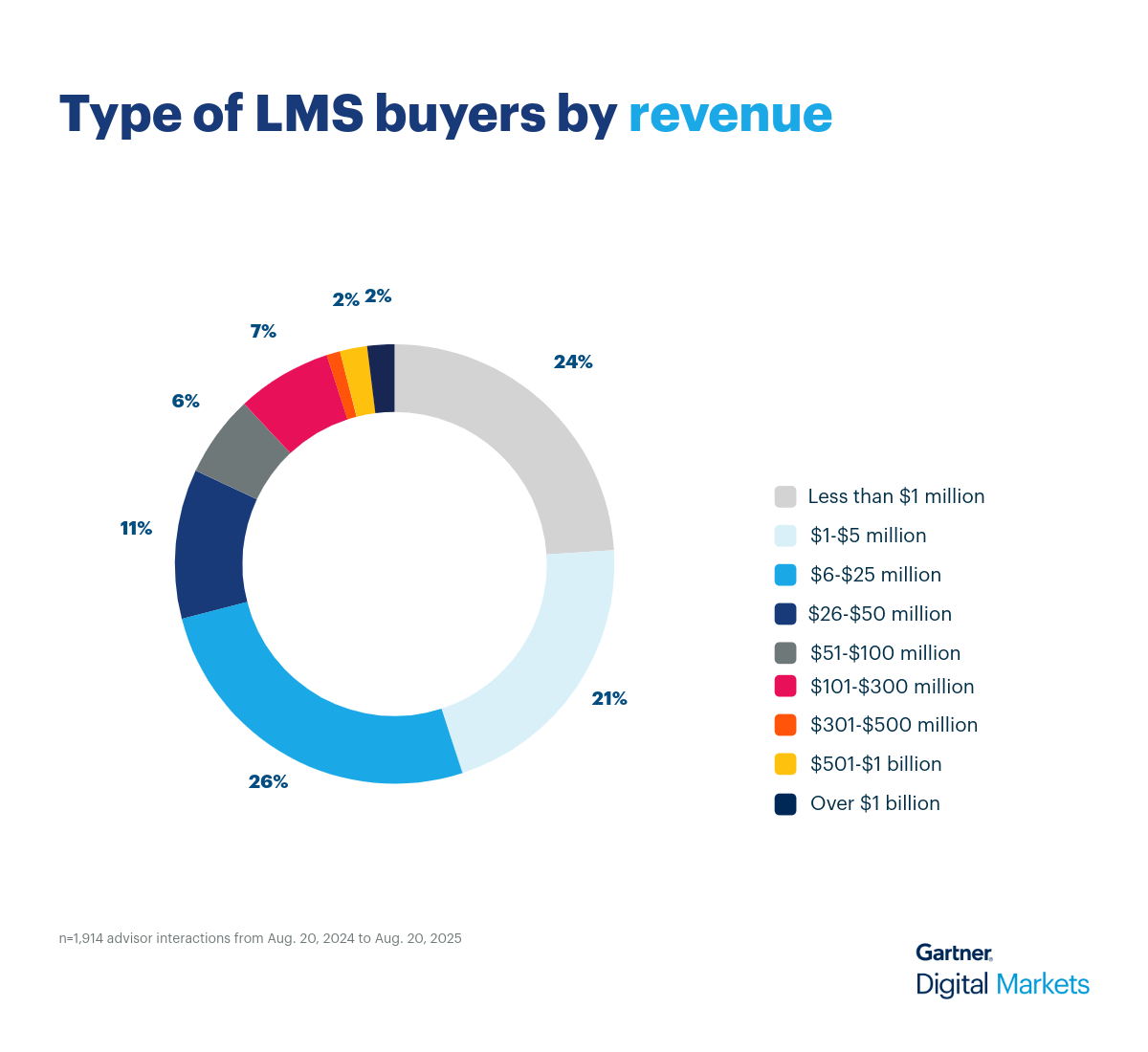

Average budgets for learning management software across industries

The gist: Businesses budget $12–$69 per user monthly, with a $37 average for LMS tools.

However, the budget for purchasing learning management software varies from one segment to another based on factors such as the deployment model, integration capabilities, the number of users and employees, customization level, and required functionality.

Here’s how different learning management industry segments budget (in dollars, per user, per month) for purchasing LMS.