Buyer goals and challenges—what advisors are hearing

Buyers in the maintenance management space often come with specific expectations and recurring questions that reflect their unique operational needs. Through direct conversations with our software advisors, we’ve gathered insights into buyer behavior and their tasks, revealing patterns in their priorities, challenges, and decision-making criteria.

- What common misconceptions buyers have about maintenance management software?

Many buyers confuse maintenance software types, assuming one system can handle fleet, facilities, and production assets equally. Advisors often clarify that fleet maintenance tools, for instance, are built for vehicle tracking, while facility and equipment maintenance require different systems. Some buyers also expect broader compliance tracking, like driver certifications, but that typically falls under learning management systems. Understanding which category matches buyers’ operational reality is important to avoid regret later on.

- What are some common problems buyers are trying to solve with maintenance management software?

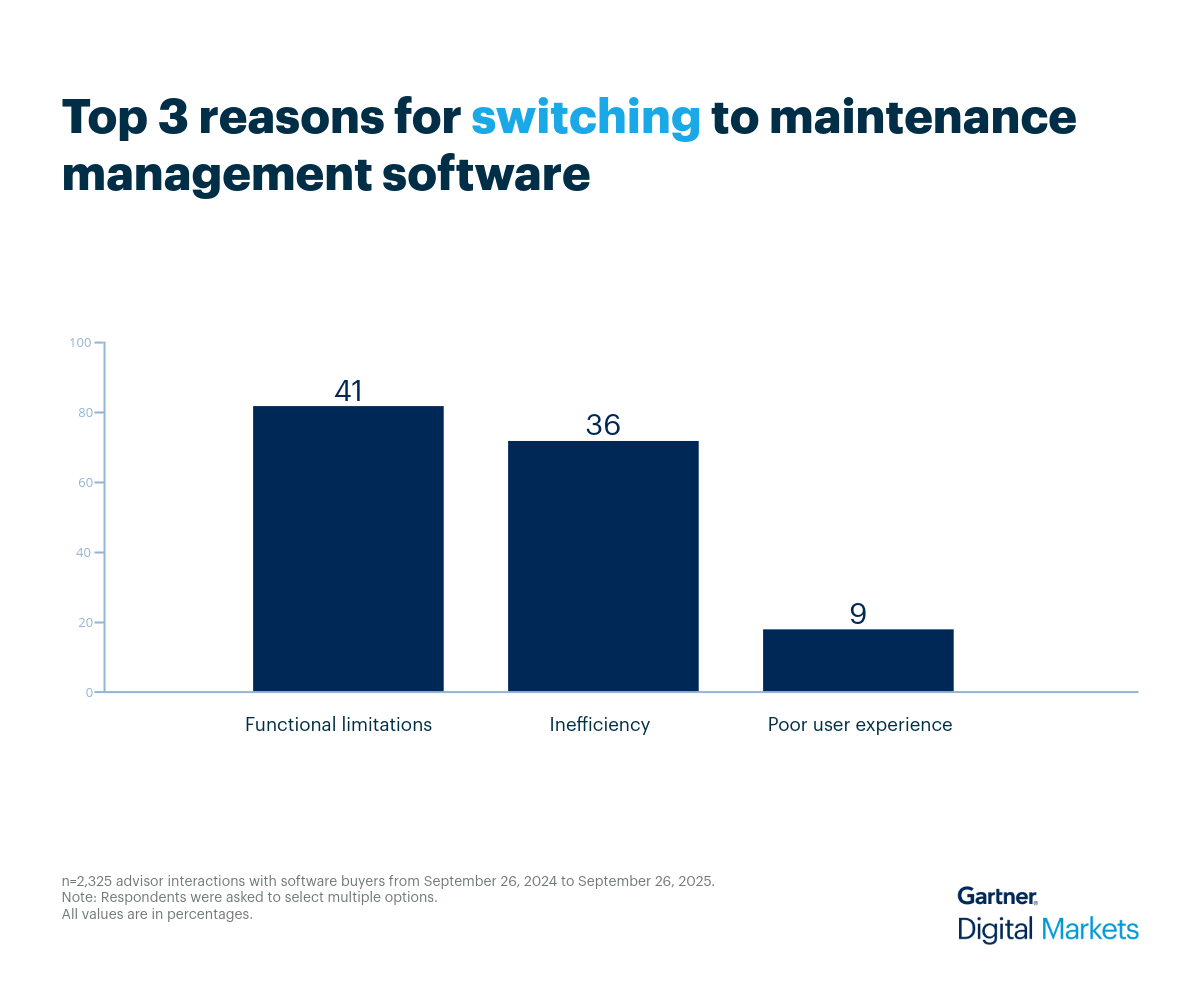

Buyers are looking to eliminate delays, missed service tasks, and disorganized workflows. Advisors consistently hear that paper logs, spreadsheets, and informal processes let critical tasks slip through the cracks, including regulatory requirements that determine whether assets can legally operate. They're seeking organized systems that ensure nothing gets overlooked and maintenance happens on schedule.

- What are the integration requirements for this kind of software and how important are these?

Integration needs vary by operational context. Companies managing supply chains, for instance, seek integration of work order management with customer orders and warehouse operations to reduce duplicate data entry and make processes more efficient. Some common integration requests include accounting systems for financial tracking.

- Anything unique that buyers in this specialty specifically ask for?

Some buyers prioritize legal compliance over mechanical upkeep, wanting tools that track equipment registration, inspections, and documentation. Government buyers often request systems that keep fleet maintenance, for instance, separate from other departments, reflecting their internal structure and reporting needs.

Recommended actions for maintenance management software vendors

Here are five strategic actions vendors can take to better meet buyer expectations and stand out in a competitive market:

- Focus messaging on operational pain points.

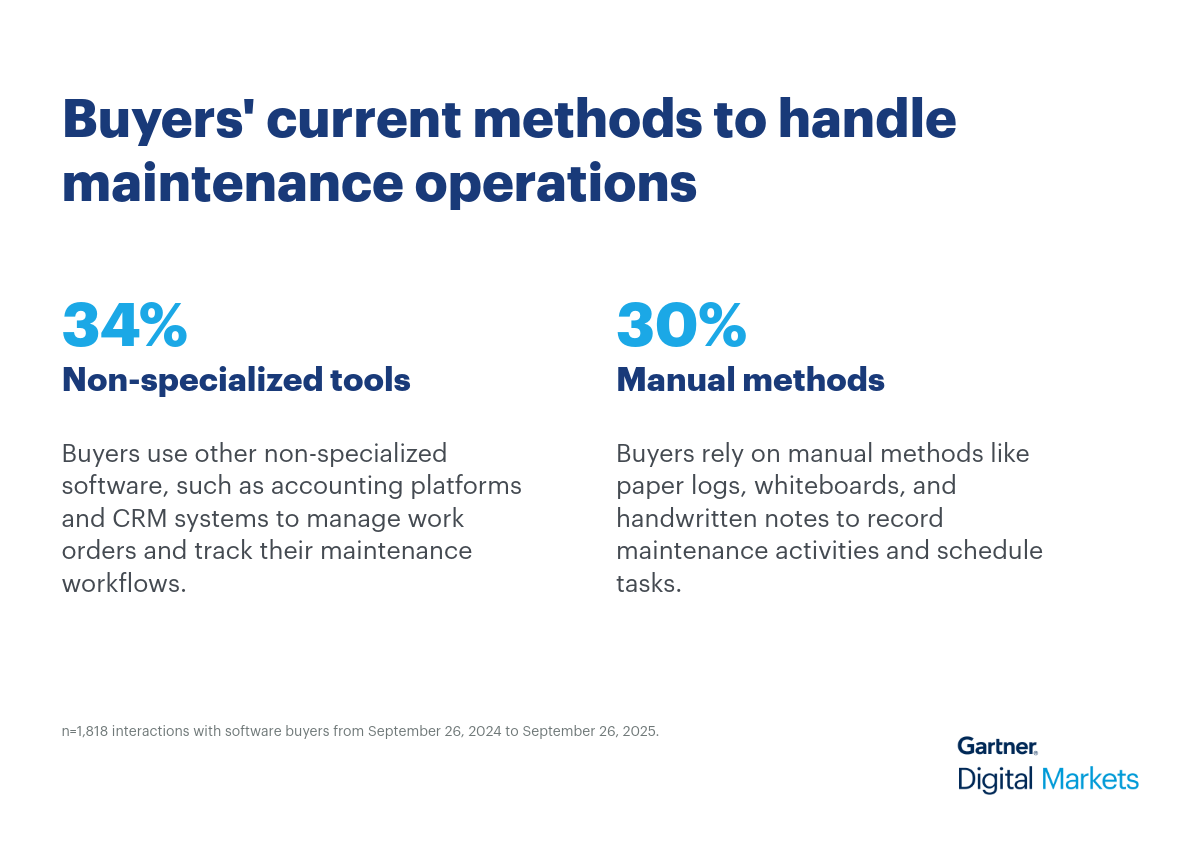

Directly address the inefficiencies and visibility gaps buyers face when using non-specialized software and manual methods. Clearly communicate how your solution automates preventive routines, centralizes asset tracking, and improves coordination across teams.

- Highlight preventive maintenance capabilities.

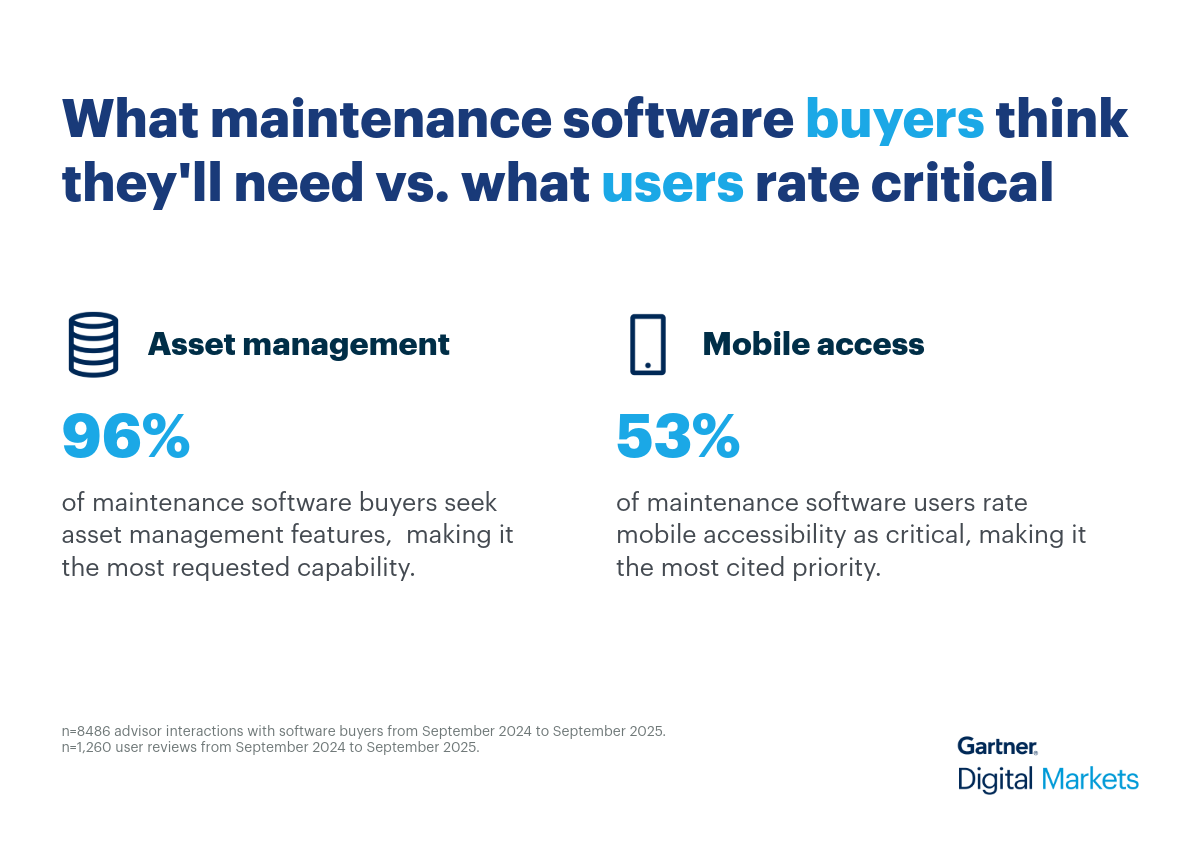

Preventive maintenance is the top priority for both buyers and users. Make it a headline capability in your demos and product profile. Show how your system automates service scheduling based on time, usage, or condition thresholds, and how it helps extend asset life and reduce emergency repairs.

- Tailor capabilities for industry-specific workflows.

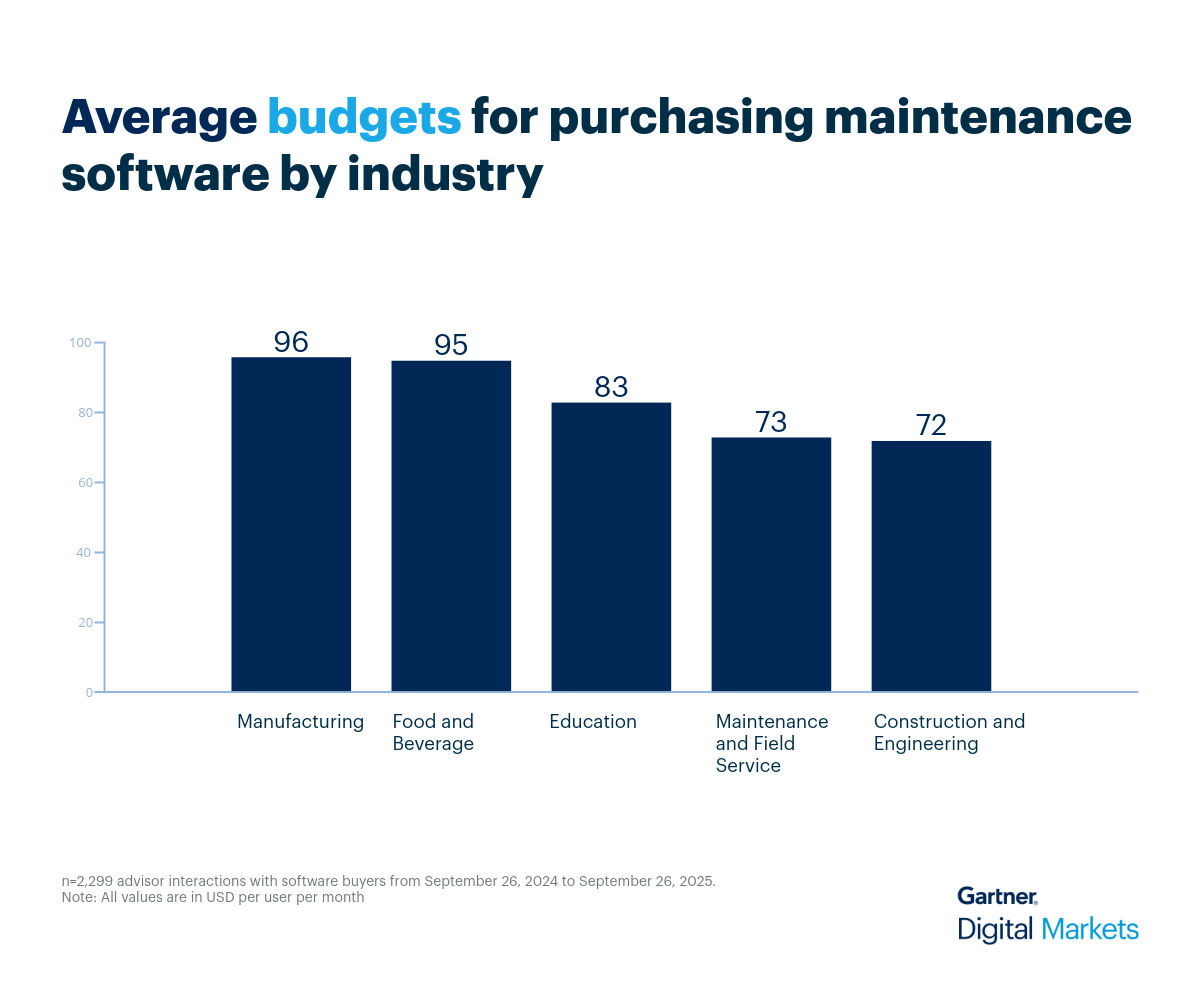

Different industries have distinct needs. Manufacturing firms want SCADA or IoT integration and cost tracking; food and beverage businesses prioritize sanitation schedules and compliance documentation; field service teams need mobile access and route optimization. Segment your messaging and demo flows to reflect these priorities.

- Be transparent in pricing and integrations.

With an average monthly budget of $92 per user, buyers are price conscious but willing to invest in tools that deliver operational value. Make sure your pricing is visible and competitive. Detail integration with accounting systems, which is the most requested, and showcase compatibility with other operational tools like inventory or ERP systems.

- Optimize your product profile for visibility and trust.

Update your Gartner Digital Markets profile to showcase buyer-valued features such as preventive maintenance, work order management, and asset tracking. Add social proofs such as industry awards and client testimonials to build trust.

Rise above your competition with strategic insights

When maintenance management software buyers have more options than ever before, success requires more than just feature-rich products. It demands a deep understanding of what actually drives purchase decisions in the maintenance management industry. By aligning your messaging with what buyers actually need, you can cut through the noise and earn attention from decision-makers actively searching for solutions.

With more than 10 million active software buyers visiting Gartner Digital Markets sites every month, you have access to strategic insights that can elevate your marketing strategy and position your product as a leader in your category.

Log into your Gartner Digital Markets account to optimize your profile, showcase your strengths, and ensure buyers understand how your software meets their evolving needs.

Once your profile is ready, learn how vendors are gaining a 79% advantage building a high-quality sales pipeline and leverage this resource to master follow-ups that convert leads into customers.