Buyer goals and challenges—what advisors are hearing

Project management buyers often have clear expectations and repeat questions tied to their daily operations. Through direct conversations with our software advisors, we’ve gathered insights into buyer behavior and their tasks, revealing patterns in their priorities, challenges, and decision-making criteria.

- What common misconceptions do buyers have about project management software?

Many buyers assume project management software is just about basic task tracking or time logging. But the reality is more nuanced. Tools vary widely in how granular they get, some track time per task, others per project, and some offer automation that replaces manual entry. Misunderstandings often stem from not knowing how deeply these systems can integrate with workflows, resources, and milestones.

- What are some common problems buyers are trying to solve with project management software?

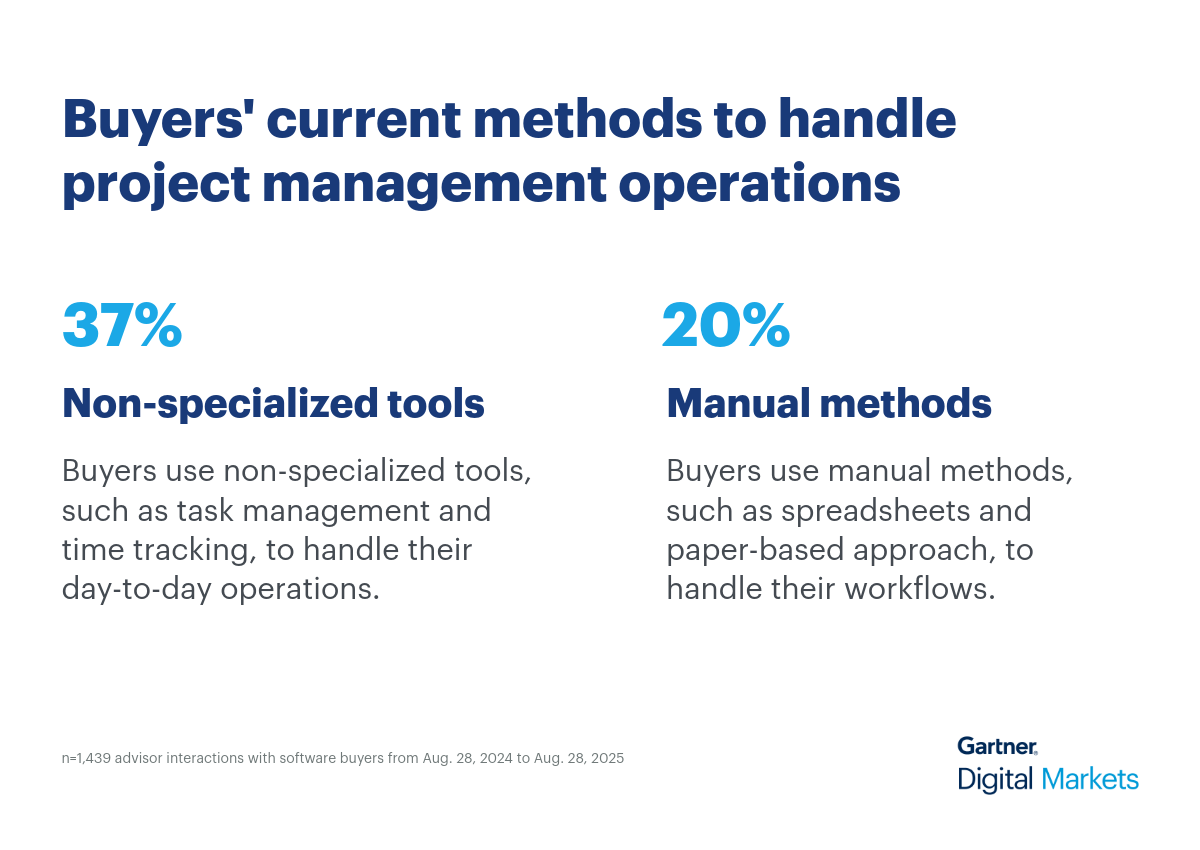

Buyers often face fragmented systems that don’t talk to each other. They’re juggling separate tools for time tracking, scheduling, and reporting, leading to inefficiencies and manual work. Project management software helps unify these functions, automate repetitive tasks, and provide clearer visibility for stakeholders.

- What are the integration requirements for project management software, and how important are they?

Integrations are critical. Buyers want project management tools that connect with payroll, accounting, CRM, and even business intelligence platforms. These links reduce manual data entry and improve reporting accuracy. While some features can stand alone, most buyers prefer systems that fit into their existing tech stack, especially for financial tracking and resource planning.

- Is there anything unique that buyers in this specialty specifically ask for?

Yes. Access control and external collaboration are top tasks. Buyers want role-based permissions so stakeholders see only what’s relevant. Many also need external user access or client portals, especially in professional services automation (PSA) setups. These features support secure collaboration across teams, clients, and departments without compromising data integrity.

Recommended actions for project management software vendors

Here are five strategic actions that vendors can take to better meet buyer expectations and stand out in a competitive market:

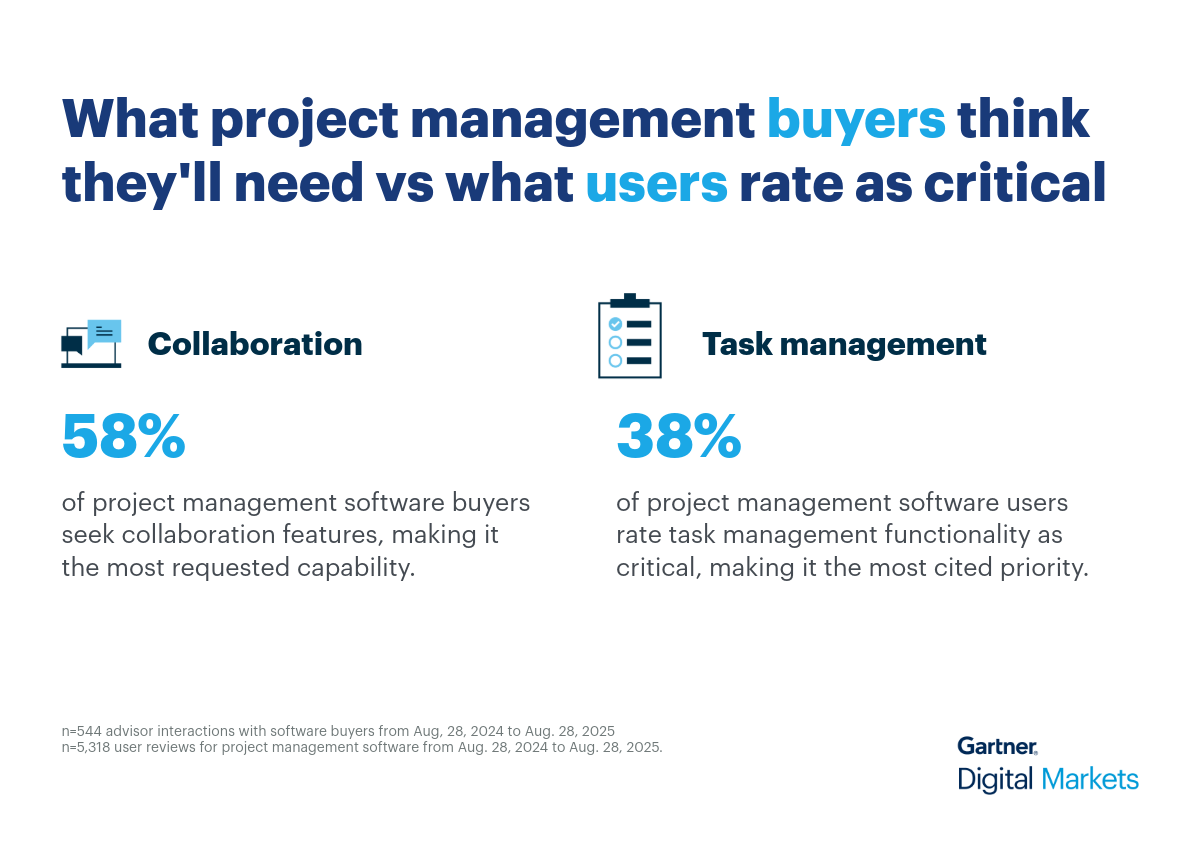

- Emphasize collaboration and task management upfront: Buyers prioritize collaboration (58%) during purchase, while users value task management (38%) for daily execution. Highlight how your software supports both strategic alignment and operational clarity. Use real-world examples to show how teams stay organized and meet deadlines.

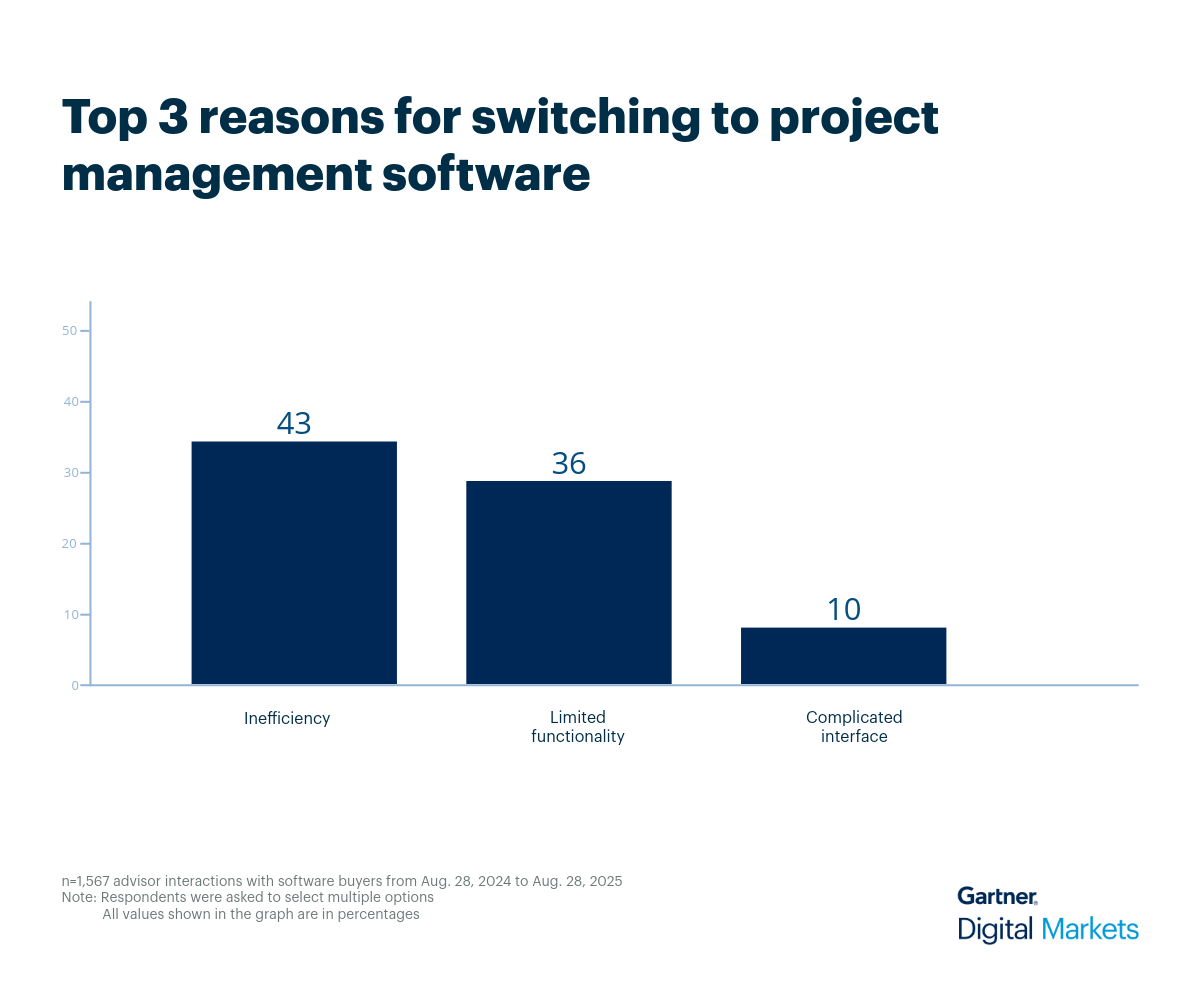

- Solve inefficiencies with purpose-built automation: 43% of buyers cite inefficiency and 36% cite limited functionality as reasons for switching. Showcase features like task dependencies, resource allocation, and time tracking that reduce manual work and unify workflows. Tailor demos to reflect common buyer pain points.

- Make onboarding and usability a selling point: A complicated interface deters adoption. Position your onboarding experience as a value driver—offer quick setup, intuitive UI, and responsive support. Use testimonials to show how easy adoption led to measurable improvements in project delivery and team alignment.

- Be integration-ready and security-conscious: Buyers want tools that connect with CRM, payroll, accounting, and BI platforms. Highlight available integrations and role-based access controls to support secure collaboration across teams and clients. These features are especially critical for PSA buyers and professional services firms.

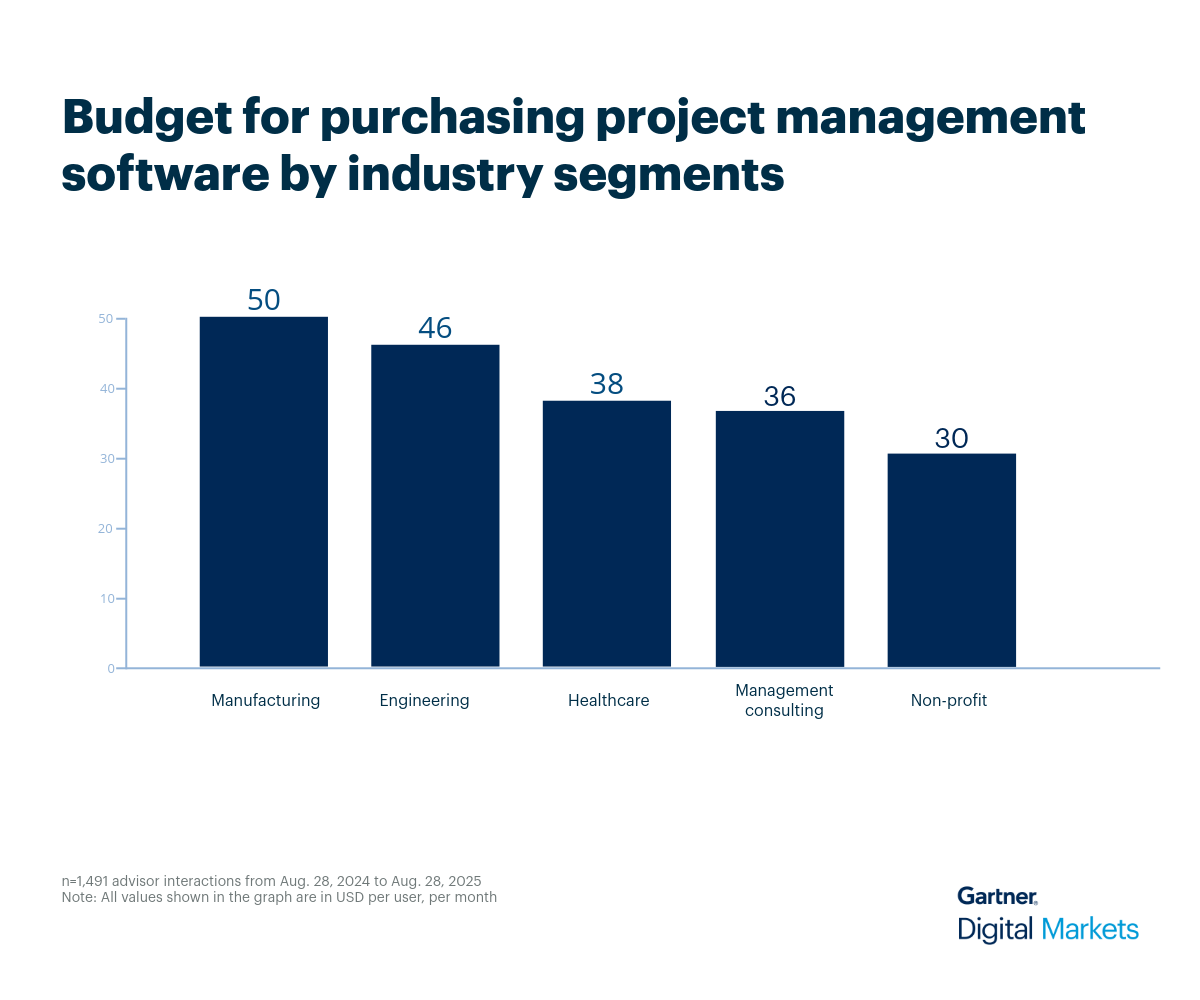

- Be transparent and pricing-aligned: Clearly display your pricing, aligning with the average budget of $36–$50/user/month. Offer tiered plans and ROI calculators to help buyers assess fit. Benchmark against trusted sources like the Capterra 2025 Shortlist to validate your positioning.

Rise above your competition with strategic insights

Project management software vendors face intense competition in a crowded market. With the right insights, you can identify buyer priorities and pain points, then tailor your messaging to address them directly and capture attention.

With more than 10 million active software buyers on our sites every month, Gartner Digital Markets can equip you with the strategic insights you need to level up your marketing strategy and become a leader in your category.

Log in to your Gartner Digital Markets account and optimize your profile to ensure buyers understand how your software meets their evolving needs.

Once your profile is ready, use this insight to build a high-quality sales pipeline and this resource to master follow-ups that convert leads into customers.