But buyer decisions are shifting mid-process—priorities like cost savings often change after integration and scalability checks. Vendors struggle to anticipate these evolving needs, making software selection a strategic challenge rather than a simple purchase.

With a multitude of tools on Gartner Digital Markets’ buyer destination sites—Capterra, GetApp, and Software Advice–how can vendors ensure they stand out and get their fair share of buyer attention?

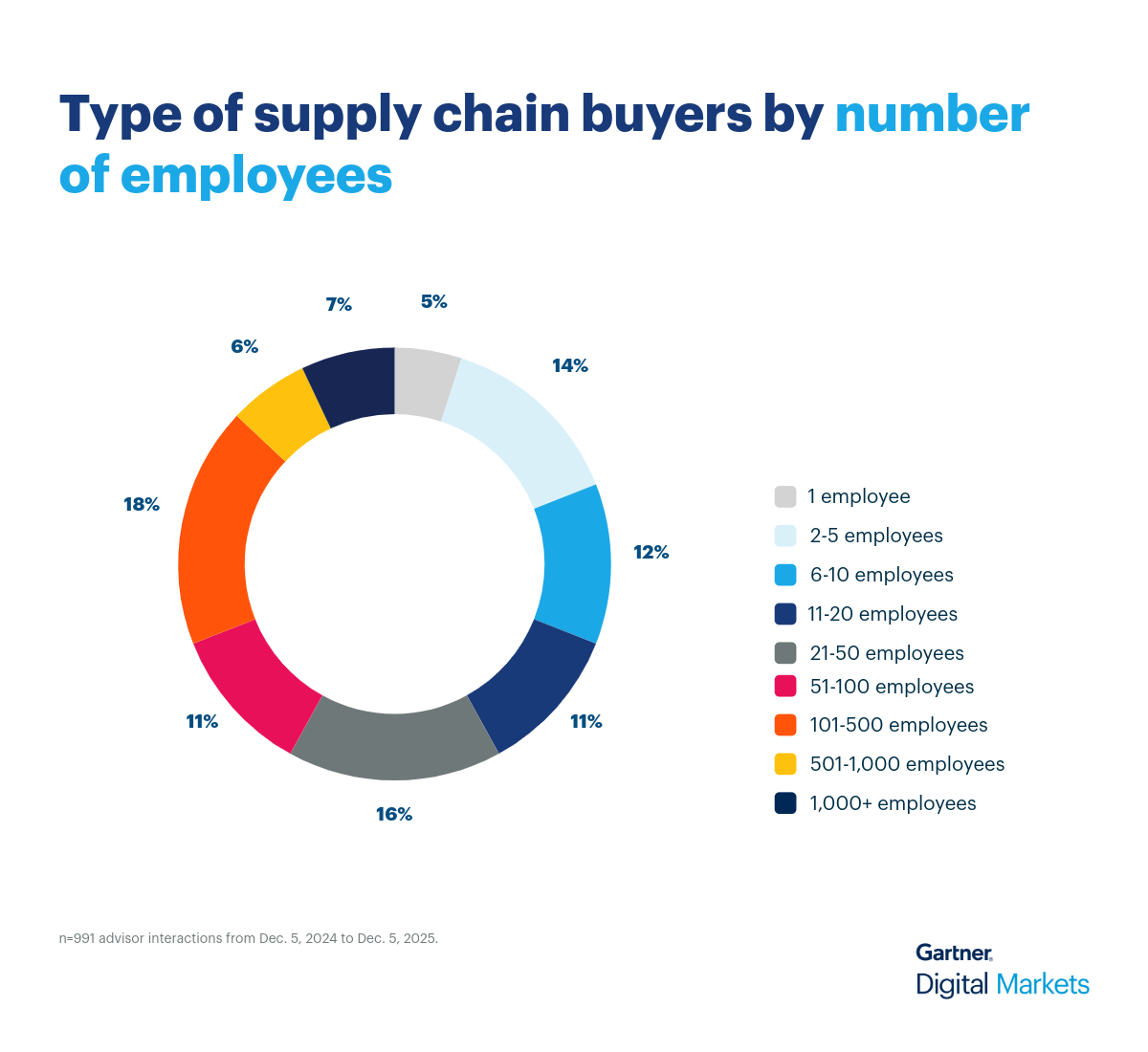

Our software advisors speak with thousands of buyers every year, qualifying them based on budget, authority, need, and timeline (BANT). We’ve analyzed these real buyer conversations to help vendors sharpen their messaging and position their supply chain management software to match what buyers are actually looking for.