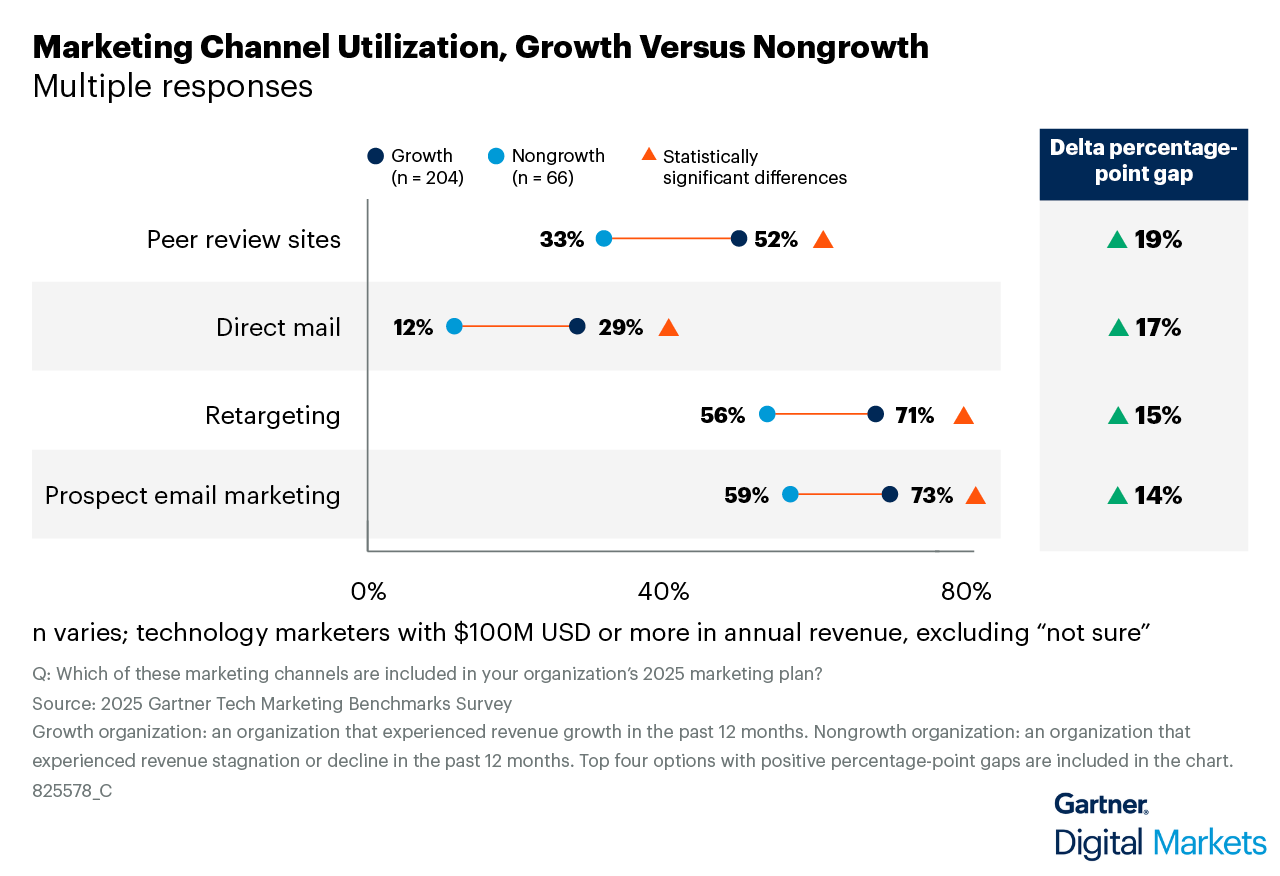

GenAI is reshaping organic reach and how buyers search for solutions. Marketing budgets are tight, with 59% of CMOs reporting they have insufficient budget to execute their strategy.[1] With the average B2B buying cycle spanning 4.6 months and crossing up to seven channels, the path to purchase is becoming highly complex.

Adapting to such seismic changes will offer a competitive edge. Resilient marketing teams are already leveraging technology and strategic know-how to become more efficient, scalable, and aligned with buyers' actual behavior.

In this article, we will unpack three trends currently shaping B2B marketing and how high-growth companies are meeting these expectations and preparing for the future. We’ll also explore how a multi-channel presence meets evolving buyer behavior.