Accounting software enables controllers and accountants to process data faster while ensuring data accuracy. In fact, companies that digitized their accounting practices by using accounting technology saw a 75% reduction in financial errors.[1]

To streamline strategic accounting and financial management, organizations are actively searching for accounting software solutions on Gartner Digital Markets’ buyer destination sites—Capterra, GetApp, and Software Advice. But, with over 1,000 accounting products listed on these sites, how can sellers ensure they stand out and get their fair share of buyer attention?

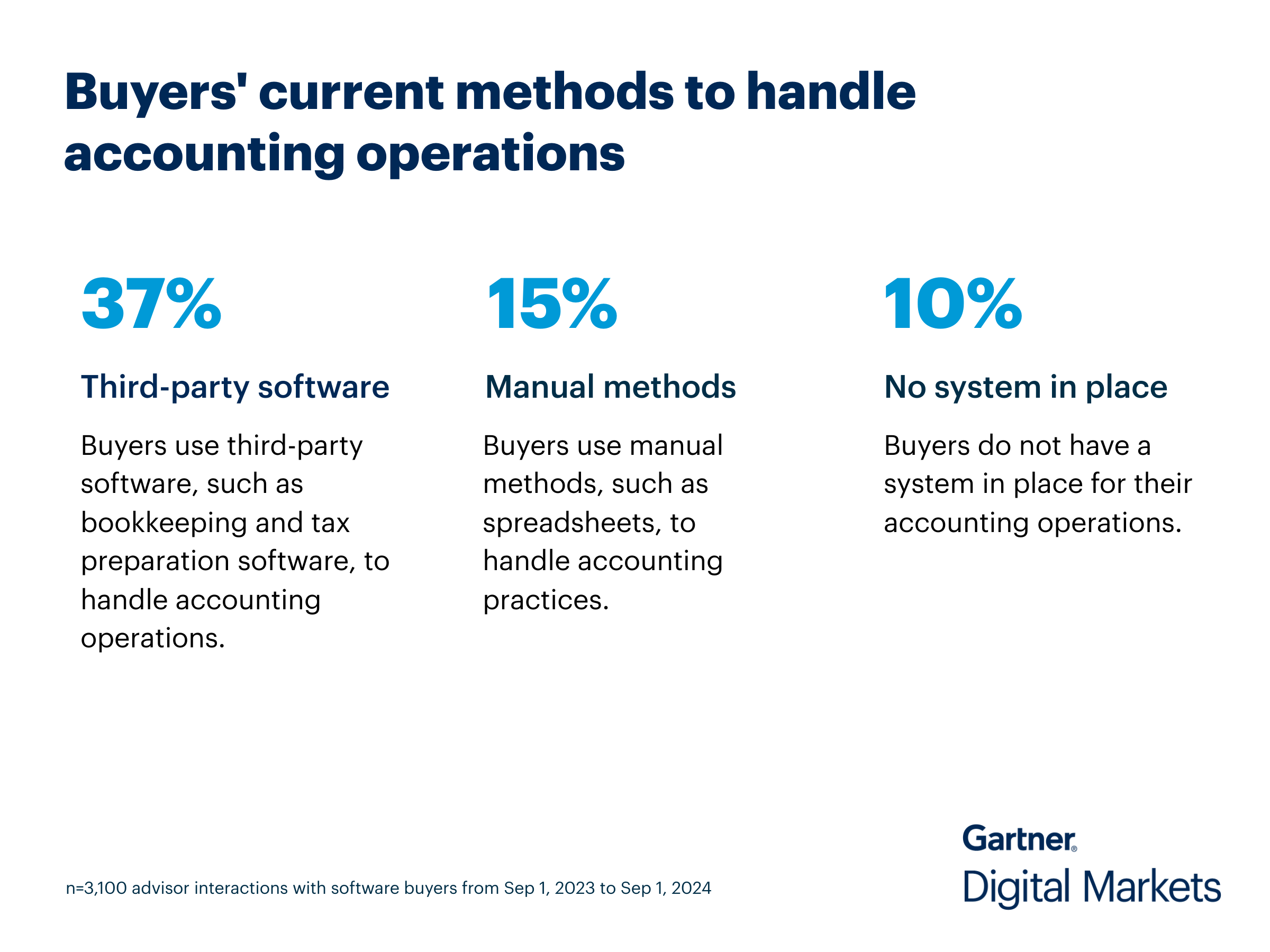

Each year, our software advisors speak with thousands of decision-makers evaluating new accounting software for their businesses.* We’ve mined those conversations for insights that you can use to fine-tune your messaging and create a unique positioning that speaks directly to the needs of accounting software buyers.