Amita Jain

Amita Jain covers B2B content creation and strategy to help businesses reach their marketing goals. She received her master’s degree from King’s College London, U.K. Exploring the world of art and reading fiction are some of her usual happy distractions outside of work. Connect with Amita on LinkedIn.

___________________________________________________________________________________________________________________

Survey Methodologies

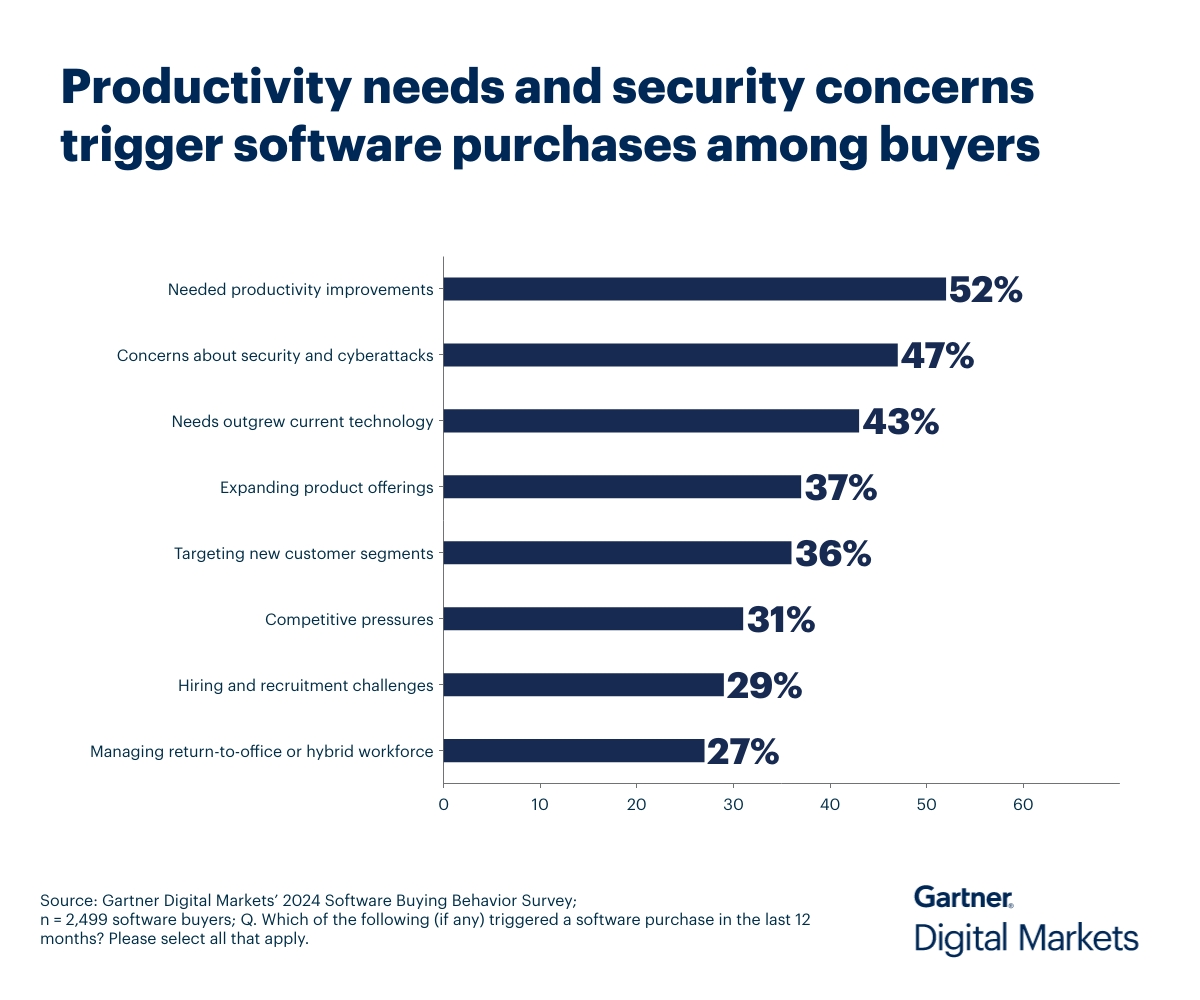

Gartner Digital Markets’ 2024 Software Buying Behavior Survey was conducted to understand the makeup, triggers, budgets, and challenges of software buying teams at global businesses across industries and sizes. We sought to uncover the software types these buyers are adopting, their evaluation methods, and what factors convince them to make a purchase, from vendor reputation and sales team interactions to content materials and user reviews.

The survey was conducted online in August and September 2023 among 2,499 respondents from the U.S., U.K., Canada, Australia, France, India, Germany, Brazil, and Japan, with businesses across industries, employing between 5-10,000 or more workers, and reporting up to $1 billion in annual revenue. Respondents were screened to ensure involvement in software purchasing decisions.

Gartner Digital Markets’ 2024 Tech Trends Survey was designed to understand the timeline, organizational challenges, adoption & budget, vendor research behaviors, ROI expectations, satisfaction levels for software buyers, and how they relate to buyers’ remorse.

The survey was conducted online in July 2023 among 3,484 respondents from the U.S., U.K., Canada, Australia, France, India, Germany, Brazil, and Japan, with businesses across industries and company sizes (5 or more employees). Respondents were screened to ensure involvement in software purchasing decisions.