LONDON, UK, September 11, 2025

- Gartner client? Log in for personalized search results.

Gartner CFO & Finance Executive Conference, London 2025: Day 2 Highlights

It’s not too late to join the conference

Overview

We are bringing you news and highlights from the Gartner CFO & Finance Executive Conference, taking place this week in London. Below is a collection of key announcements and insights coming out of the conference.

On Day 2 of the conference, we are highlighting emerging trends in the finance technology market, succeeding as a new CFO, and how finance can get the digital talent it needs. Be sure to check this page throughout the day for updates.

Key Announcements

2025 Emerging Trends in the Finance Technology Market

Presented by Marcus Marion, Senior Director, Analyst, Gartner

In this session, Marcus Marion, Senior Director, Analyst at Gartner, shared the top 5 finance technologies in 2025, and the formula for ensuring the tech roadmap is optimized for impact.

Key Takeaways

The two most important things finance must get right in order to optimize the tech roadmap and drive real impact are having well defined organizational needs and having a strong knowledge of the finance technology landscape.

The top five finance technologies for 2025 are enterprise resource planning (ERP), financial planning software, business process automation (BPA), source to pay vs. accounts payable, and customer resource management (CRM).

Technologies that enable speed and AI-augmented process transformation will dominate investment in 2025 and 2026.

CFOs should explore new technology avenues to understand what’s available and formulate targeted questions to evaluate what’s best for the organization.

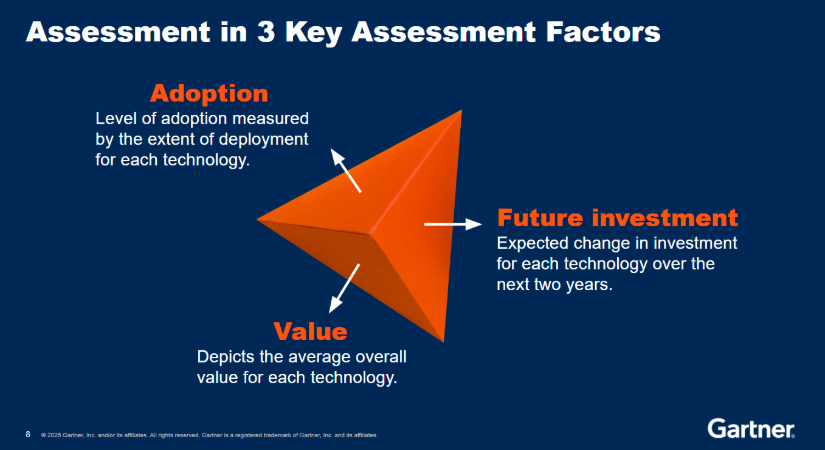

- CFOs need to plan a roadmap to understand adoption, value and future investment which will then help prioritize and plan a cadence of initiatives.

Journalists can receive additional information and/or request an interview with the Gartner expert by contacting Rob van der Meulen at rob.vandermeulen@gartner.com

Succeeding as a New CFO

Presented by Dennis Gannon, Vice President Analyst, Gartner

When new CFOs take the helm, they should aim to quickly establish priorities around two main sets of objectives: enterprise performance and finance function. In this session, Dennis Gannon, Vice President Analyst at Gartner, shared how the most successful executive transitions were twice as likely to have a formal transition plan in place and a template for putting it into action.

Key Takeaways

- Outgoing CFO tenure reached a five-year low of 5.6 years in the fourth quarter of 2024, with new CFOs taking the helm at a time of great technological change and opportunity.

Today’s CFO role often extends well beyond traditional finance. New-to-role CFOs should be strategic about this, clarifying the current and desired extent of the role with company leadership.

Building strong C-suite and business leader relationships is key to a new CFO’s success. They should prioritize teaming up with the CIO to lead digital strategy, fostering forward-looking discussions with business leaders that focus on risk and performance drivers, and engage with the head of sales to understand and support their engagement with customers.

New CFOs should mitigate common barriers to early wins by applying finance leadership practices to their own time: explicitly announcing and discussing personal focus areas, zero-basing their calendar to remove low value uses of time, putting time aside for focused sprints to maximise personal impact, and using calendar postaudits to create a learning loop on time expenditure.

Journalists can receive additional information and/or request an interview with the Gartner expert by contacting Rob van der Meulen at rob.vandermeulen@gartner.com

How to Get the Digital Talent Finance Needs

Presented by Mallory Barg Bulman, Senior Director Analyst, Gartner

As finance rapidly evolves into a more technology-driven function, leaders face the challenge of building teams with the digital skills required for the future. In this session, Mallory Barg Bulman, Senior Director Analyst at Gartner, explored how finance organizations can identify, attract, and develop the digital talent needed to stay competitive and drive transformation.

Key Takeaways

Gartner estimates that by 2027, about half of finance talent will need to be digital, requiring a major shift in workforce skills and staffing.

Upskilling both core and digital finance talent is essential in a competitive labor market, with a focus on low- and no-code technologies.

Finance leaders should first strive to find and develop hidden “citizen digital talent” because it has the dual benefit of filling talent gaps at a lower cost than hiring, as well as providing a development path for existing employees that can boost engagement and retention.

When internal talent development can’t meet digital objectives, and hiring is required, strong job descriptions for digital roles should highlight innovation, business impact, technology, and development opportunities.

Attrition of digital finance employees can be high, so retaining them requires creating a sense of belonging. Often they can feel misaligned with the function’s purpose.

Journalists can receive additional information and/or request an interview with the Gartner expert by contacting Rob van der Meulen at rob.vandermeulen@gartner.com

It’s not too late to join the conference

That's a wrap on this year's Gartner CFO & Finance Executive Conference. See you next year!

About Gartner

Gartner (NYSE: IT) delivers actionable, objective business and technology insights that drive smarter decisions and stronger performance on an organization’s mission-critical priorities. To learn more, visit gartner.com.