Only 7% of CFOs see high ROI from AI in finance functions, despite growing adoption. Closing the value gap is critical.

- Gartner client? Log in for personalized search results.

As AI integration becomes mainstream, CFOs are facing a reality check on ROI

Nearly three in five finance teams are piloting or fully implementing AI use cases — and two-thirds of CFOs say they’re more optimistic about AI’s value than a year ago. However, many CFOs also acknowledge a major gap between AI vision and reality: Only 7% of finance leaders see a high impact from their AI use cases. That, along with wildly inaccurate AI cost estimates and high overruns, could lead to abandonment of more than half of AI pilots over the next few years. To maximize AI’s potential, CFOs need concrete ways to effectively navigate the challenges and tap into AI’s full value.

See Gartner research in action at our finance conferences and events.

Close the gap between finance’s AI vision and reality

Maximizing AI’s value — both in finance and throughout the organization — requires a clear, compelling AI roadmap that supports credible use cases and ensures the proper controls are in place. Follow these five steps to close the value gap.

Pinpoint the highest-value finance AI use cases for your organization

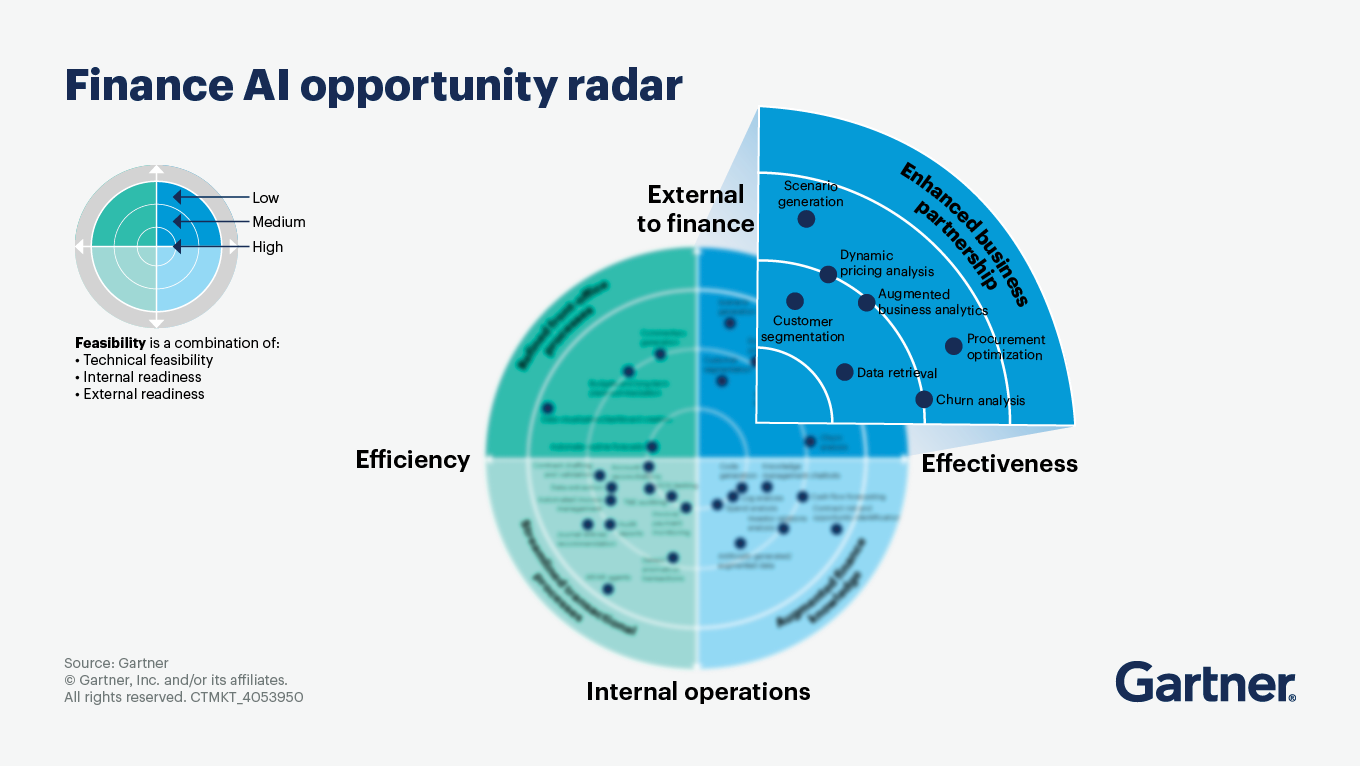

Successful AI implementation starts with a clearly defined business problem or objective. Don’t simply adopt what’s worked elsewhere or start from the latest technology. Instead, look for clear alignment between a use case’s scope and your organizational priorities, and then evaluate it against expected value and feasibility. The same use case can offer wildly different potential from one organization to the next. By tailoring AI opportunities to your company’s unique context, maturity, resource capabilities and goals, you’ll be more likely to achieve positive, impactful results from the pilots you select.

Prepare the finance team for AI implementation and adoption

Low data literacy and technical skills in finance are a major stumbling block for AI adoption. Unlock AI’s full value by amping up the finance team’s foundational data science and generative AI (GenAI) skills — such as basic Python, data wrangling and modeling, prompt engineering and GenAI code generation. At the same time, start developing citizen data scientists within the function, who blend technical proficiency and strong business acumen, instead of relying on professional data scientists who often lack functional context. Making this shift could address as much as 90% of finance’s AI opportunity.

Improving team skills will allow more finance staff to work alongside AI in shared roles, which boosts team efficiency and frees staff to focus on higher-value tasks. By 2029, Gartner predicts that one-third of finance staff will hold “shared jobs,” in which AI and a person are responsible for performing a single job role together.

Plan and define a clear AI build vs. buy strategy

The fastest starting point for AI value is to take advantage of embedded functionality in your existing software. Gartner insights reveal that 99% of finance teams intend to “buy” AI capabilities from third-party vendors — but 60% of finance buyers have experienced postpurchase regret from recent software purchases.

To go beyond vendor promises, architect your vendor engagements to ensure vendors fully understand your organizational processes and key functional capabilities. Explore a variety of vendors and use innovation-based metrics to evaluate performance.

When weighing a new purchase, keep in mind that a hybrid build-and-buy approach can strike the right balance between quick efficiency gains from prebuilt solutions and longer-term competitive advantage coming from strategic, customized capabilities. By 2028, 80% of finance organizations will employ a hybrid build-and-buy approach to GenAI to maximize performance and differentiated value.

Proactively manage AI cost and value

Balancing the cost of AI relative to value is inherently challenging, as organizations must continually determine if the increasing amounts going in are worth the payoff. In some organizations, initial AI project cost estimates have been off by as much as 500% to 1,000%, with ongoing costs proving especially volatile and fast-moving. Look closely at key drivers of cost volatility — for example, usage, varied vendor pricing, or data management demands for the AI model — and push for greater transparency in vendor pricing.

Proactive value management is key to delivering sustained ROI. Develop consistent methods for measuring and discussing AI’s value, a crucial step for evaluating use cases across the enterprise and accelerating funding for the most promising pilots. Enterprises that manage AI investments with a portfolio approach are more than twice as likely to reach mature levels of AI implementation.

Prioritize AI governance and risk mitigation without compromising progress

AI adoption introduces new and evolving risks related to data privacy, security, intellectual property and AI model performance (such as hallucinations and bias) that must be balanced against potential value in a sound AI strategy.

CFOs should champion an AI governance framework for finance and the enterprise that centers around data integrity, continuous model testing, and human oversight. Lean on your expertise and experience in financial oversight and risk management to take a phased approach that aligns with your organization’s current AI maturity while supporting an accelerated value strategy.

Finance AI FAQs

What actions should CFOs take when considering a major AI investment?

Before substantially increasing their organizations’ AI investment within or beyond finance, CFOs should focus on three areas: learning what makes an AI solution unique and compelling, comparing common use cases against business needs, and leveraging lessons learned from early adopters.

What are some challenges CFOs face in optimizing AI value?

One major challenge to AI adoption in finance is talent-related. AI implementation requires a wide set of skills and associated roles, many of which are new to the finance function. Having limited experience with “what good looks like,” finance leaders and managers face a steep learning curve and don’t always know how to develop their teams’ AI skills.

Data quality is another challenge for CFOs in optimizing AI value. Some organizations delay AI exploration because they believe their data must be perfect first, but that mindset often becomes an excuse that stalls progress. Rather than waiting for ideal conditions, leading organizations use AI to improve data quality and accessibility, making faster gains with data that’s imperfect but sufficient. Ensure data is AI-ready by categorizing and contextualizing it along with aligning data readiness with the right AI technique.

Attend a Conference

Join Gartner experts and your peers to accelerate growth

Gather alongside your peers in National Harbor to gain insight on emerging trends, receive one-on-one guidance from a Gartner expert and create a strategy to tackle your priorities head-on.

Gartner Finance Symposium/Xpo™

National Harbor, MD

Drive stronger performance on your mission-critical priorities.