Validate, allocate and plan effectively with finance benchmarking insights that will support your finance transformation.

- Gartner client? Log in for personalized search results.

Finance Benchmarking: Achieve Profitable Business Growth

Optimize cost and drive greater value through finance benchmarking

Effective cost management starts with close examination of spend. The 2025 Gartner Budget and Headcount Changes report analyzes responses from over 300 CFOs and finance leaders revealing the continued importance of technology investments, as well as a measured approach to pay increases and higher budgets for growth-supporting functions.

Download the survey findings to:

Benchmark your organization’s budget allocations.

Compare budget priorities across enterprise and functional cost categories.

Justify budget reallocation within your organization.

Leverage finance benchmarking to set and meet your transformation goals

Over 75% of finance organizations are undergoing a major transformation, yet only 30% report successful outcomes. The following finance benchmarking insights can help enable a successful transformation.

Benchmark Progress

Benchmark Team Skills

Manage expectations around transformation with finance benchmarking

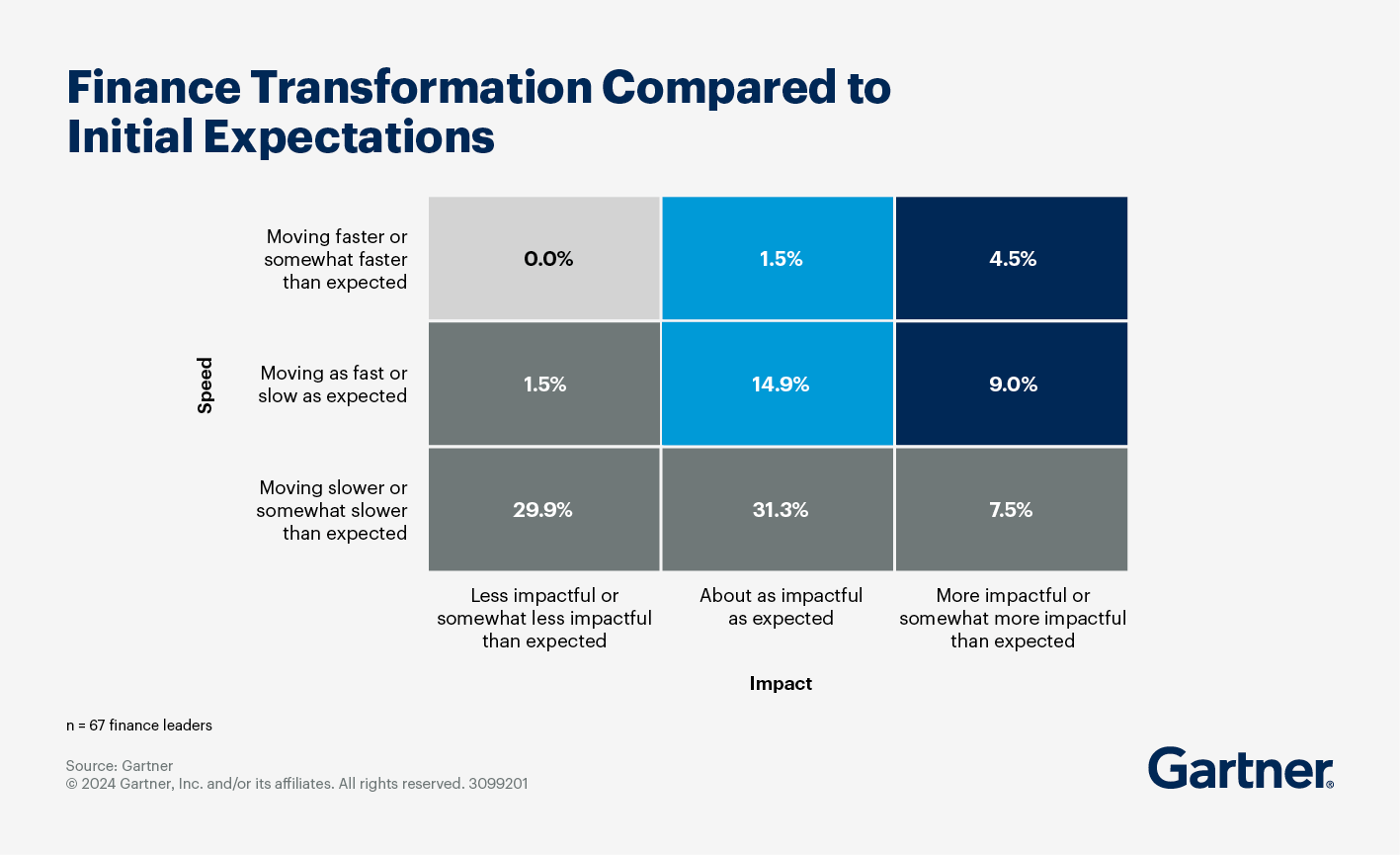

Speed and impact are two of the most important factors in assessing the progress and success of a transformation. Yet finance benchmarking data reveals the following challenges:

Only 13.5% of finance transformation leaders report a clearly successful transformation, in which finance transformation is more impactful than expected and moving as fast or faster than expected.

Only 16.4% report a moderately successful transformation, in which transformation efforts are about as impactful as expected and progressing as fast or faster than expected.

Just over 70% of respondents report that transformation is either less impactful or moving slower than expected.

Thirty percent say that transformation is both less impactful and moving slower than expected.

Overall, nearly 69% of finance transformation leaders report that their transformation is moving slower or somewhat slower than expected.

Overly ambitious transformation plans — finance benchmarking data reveals that, on average, organizations pursue five transformation workstreams at the same time. This results in the same pool of talent getting pulled into many projects at once, which creates resourcing and capacity challenges.

Lack of a strong governance mechanism affects leaders’ ability to make trade-offs between initiatives competing for the same resources. This strategy results in slow progress across many projects, rather than expected progress across fewer projects.

Dependency on central IT staff versus dedicated finance technology staff for implementation of technologies can often result in bottlenecks.

Absence of clearly defined success metrics — or failure to connect those metrics to broader organization priorities or personal performance objectives — can misalign priorities and lessen the impact of projects.

About 69% of finance leaders say their transformation initiatives deliver the expected impact.

This finance benchmarking insight implies that transformation initiatives can at a minimum deliver commonly expected benefits, such as cost savings, increased process efficiency, reduced manual effort and faster decision making.

Identify talent gaps and plan for future hiring through finance benchmarking

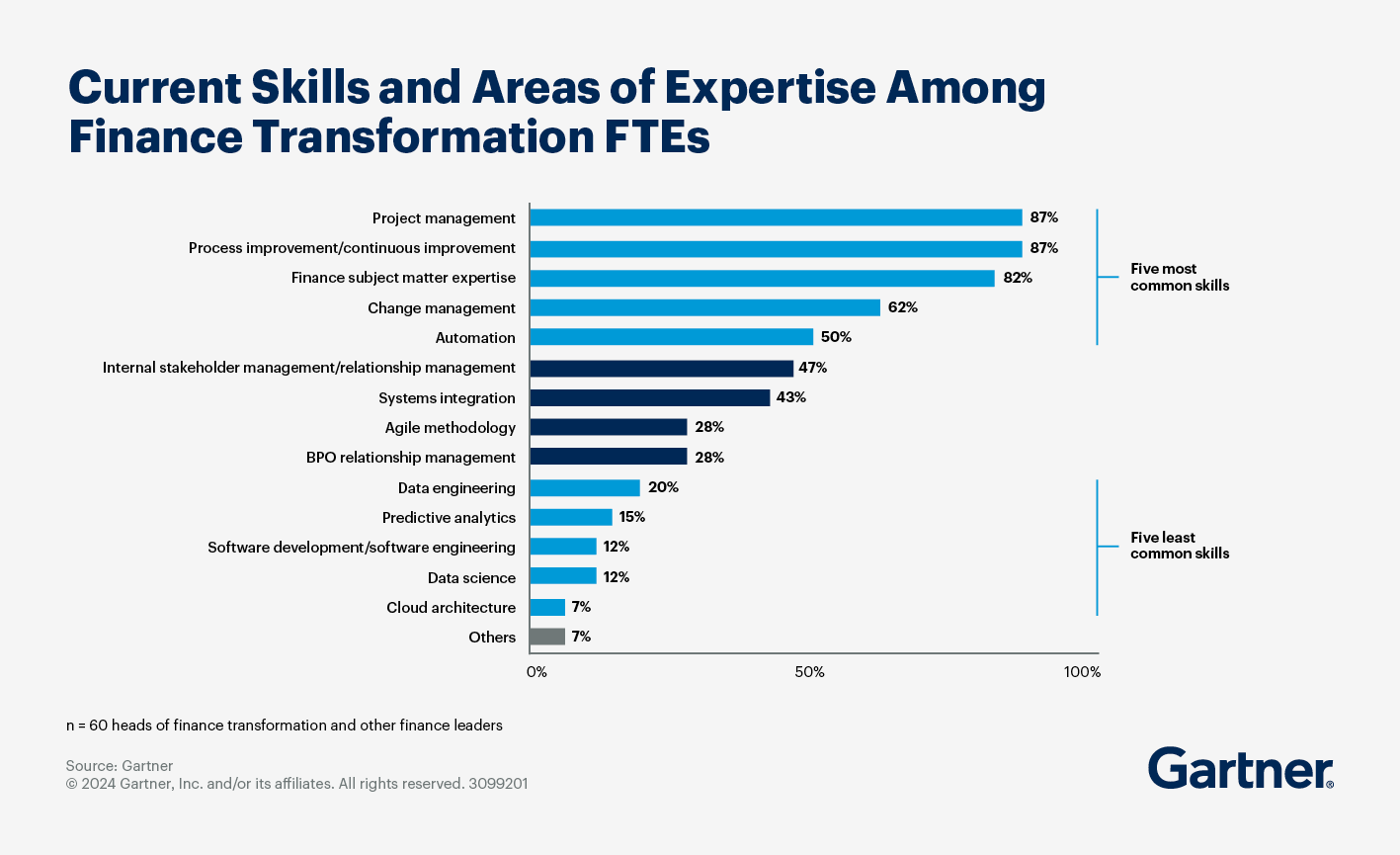

CFOs and their finance transformation teams are driving some of the organization’s biggest strategic objectives. The following finance benchmarking insights enable you to assess your transformation team’s composition and skills to determine where gaps exist and what skills to prioritize.

A typical finance transformation team has four full-time employees. A median of 10.5 employees work on finance transformation across the following categories: four full-time equivalent (FTE) employees, four to five part-time employees and two consultants or external employees. Larger organizations with revenue higher than $10 billion have more individuals working on their transformation teams than smaller organizations with revenue lower than $10 billion.

Project management and process improvement are the most common skills on finance transformation teams. The five most common skills among full-time transformation employees are project management, process improvement/continuous improvement, finance subject matter expertise, change management and automation. These five skills are also deemed most important for finance transformation.

Finance transformation teams lack highly technical skills. The five least common skills possessed by finance transformation teams are cloud architecture, data science, software development/software engineering, predictive analytics and data engineering. Even though these technical skills are becoming increasingly important, they tend to be less prevalent in finance transformation teams. This could be be due to several factors, including:

An increasingly competitive labor market, which makes hiring for these technical skills difficult

The presence of sufficient corporate IT support for transformation projects

The scope of current finance transformation focusing on foundational work where these technical skills are not yet needed

The presence of external consultants or vendors that bring technical expertise

In the near term, assess your transformation team’s skill needs by doing the following:

Gather “good-enough” skills data. Gather sufficient information to inform skill decisions today rather than wait for comprehensive skills data. This will enable you to remain nimble and keep up with changing skills and the organization’s needs.

Create a skills-sensing network where employees from various business areas contribute perspective about their needs. By combining your own expertise on talent with diverse internal feedback, you can more accurately assess your team’s skill needs.

Incorporate regular opportunities to course-correct. Commit to regular, consistent check-ins with an established skills-sensing network, such as representatives from across business units. This allows you to proactively identify changes in workforce needs and respond with agenda changes.

Attend a Conference

Join Gartner experts and your peers to accelerate growth

Gather alongside your peers in National Harbor to gain insight on emerging trends, receive one-on-one guidance from a Gartner expert and create a strategy to tackle your priorities head-on.

Gartner Finance Symposium/Xpo™

National Harbor, MD

Related finance benchmarking resources

Gartner clients: Log in for a complete suite of actionable insights and tools on finance benchmarking.

FAQ on finance benchmarking

What is finance benchmarking?

Finance benchmarking is the process of comparing your company's financial metrics against industry standards or best practices. It helps identify areas for improvement, optimize performance, and set realistic goals. By analyzing key indicators like revenue, expenses, and profitability, businesses can gain insights into their financial health and make informed decisions to stay competitive.

Why is finance benchmarking important?

Finance benchmarking does more than assess your finance function’s maturity; it positions finance to excel. Adopting best practices for finance benchmarking can help you understand how finance is contributing to overall strategy, identify gaps and chart a path toward optimal performance.

How can finance benchmarking support finance transformation?

As your organization moves toward autonomous finance, data-driven decision support is essential. By implementing finance benchmarking strategies along the transformation journey, you can validate budget, investment and resource decisions and better position the function to achieve transformation goals.

How can Gartner help with finance benchmarking?

Gartner offers best-in-class finance benchmarking tools and techniques for identifying and closing performance gaps, optimizing costs and evaluating effectiveness across the finance function. Gartner Digital Finance Score, a powerful diagnostic tool, equips you to benchmark your function’s maturity and establish your next steps in alignment with functional and business goals.

Drive stronger performance on your mission-critical priorities.