Create an actionable finance transformation roadmap that accelerates value realization.

- Gartner client? Log in for personalized search results.

Transform the finance function to maximize business profitability

Sixty-nine percent of finance transformation programs are progressing slower than projected, and 30% fail to deliver on expected benefits. The solution? A strategic and iterative finance transformation roadmap.

Use this guide to develop your finance transformation roadmap in four steps:

Define your transformation goals and vision.

Build a current-state baseline of finance capabilities.

Align your baseline with your future-state vision.

- Communicate plans, priorities and dependencies.

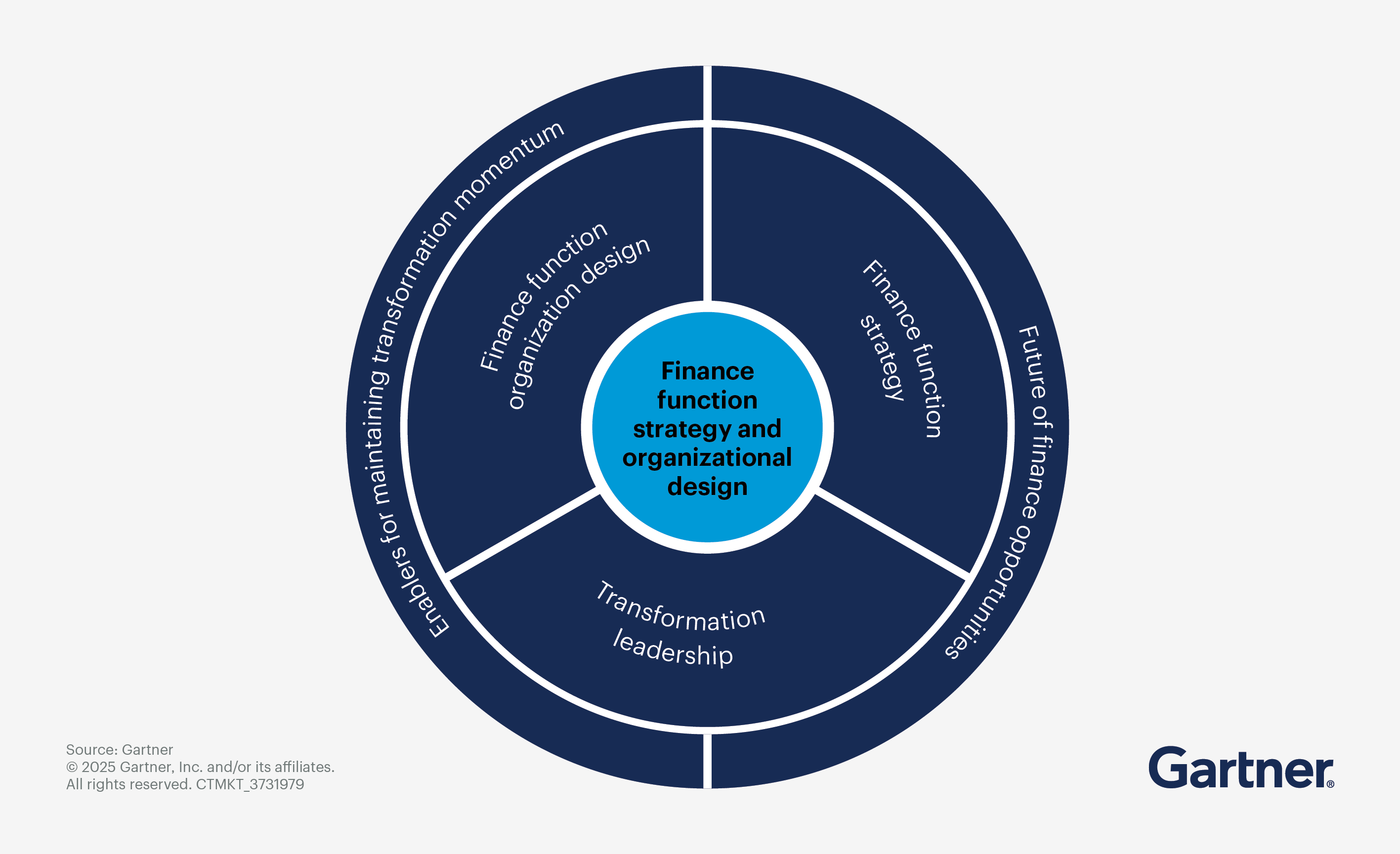

The key components of finance transformation

CFOs need a finance function that drives the enterprise’s strategic ambitions. To create more business impact, focus on fine-tuning your strategy, leadership, operating model, talent and/or technology.

Finance Strategy

Finance Leadership

Finance Operating Model

Finance Talent

Finance Technology

Optimize your finance transformation strategy by prioritizing effectively

When we examined how CFOs rank their most critical priorities, five themes emerged.

Theme 1: Data, metrics and analytics

Data, metrics and analytics is the top theme because of its outsized impact on all CFOs’ top priorities, including AI, and accuracy in budgeting and forecasting. In fact, 30% of finance leaders say data quality is a key inhibitor for low AI adoption in finance. CFOs must enhance data quality and governance, bridging financial and nonfinancial data to drive smarter decisions across the organization.

Theme 2: Efficient growth

CFOs are aiming for efficient growth by balancing cost objectives with investment in digital initiatives. Achieving sustainable top-line and bottom-line improvements is rare but rewarding, offering a shareholder return premium. CFOs must foster a cost-conscious culture while driving growth.

Theme 3: AI adoption in finance

AI usage in finance is becoming mainstream, doubling in the past year. CFOs are leveraging AI for automation and insights but struggle with quantifying investment and ROI. Intelligent process automation shows productivity gains, yet real costs are often underestimated significantly.

Theme 4: Time allocation and leadership capacity

CFOs face expanding responsibilities beyond finance, requiring better team leverage. Optimal time trade-offs can enhance organizational effectiveness. Delegation is challenging due to leadership gaps, complicating succession planning as CFOs scale into larger roles.

Theme 5: Sourcing and Retaining Digital Talent

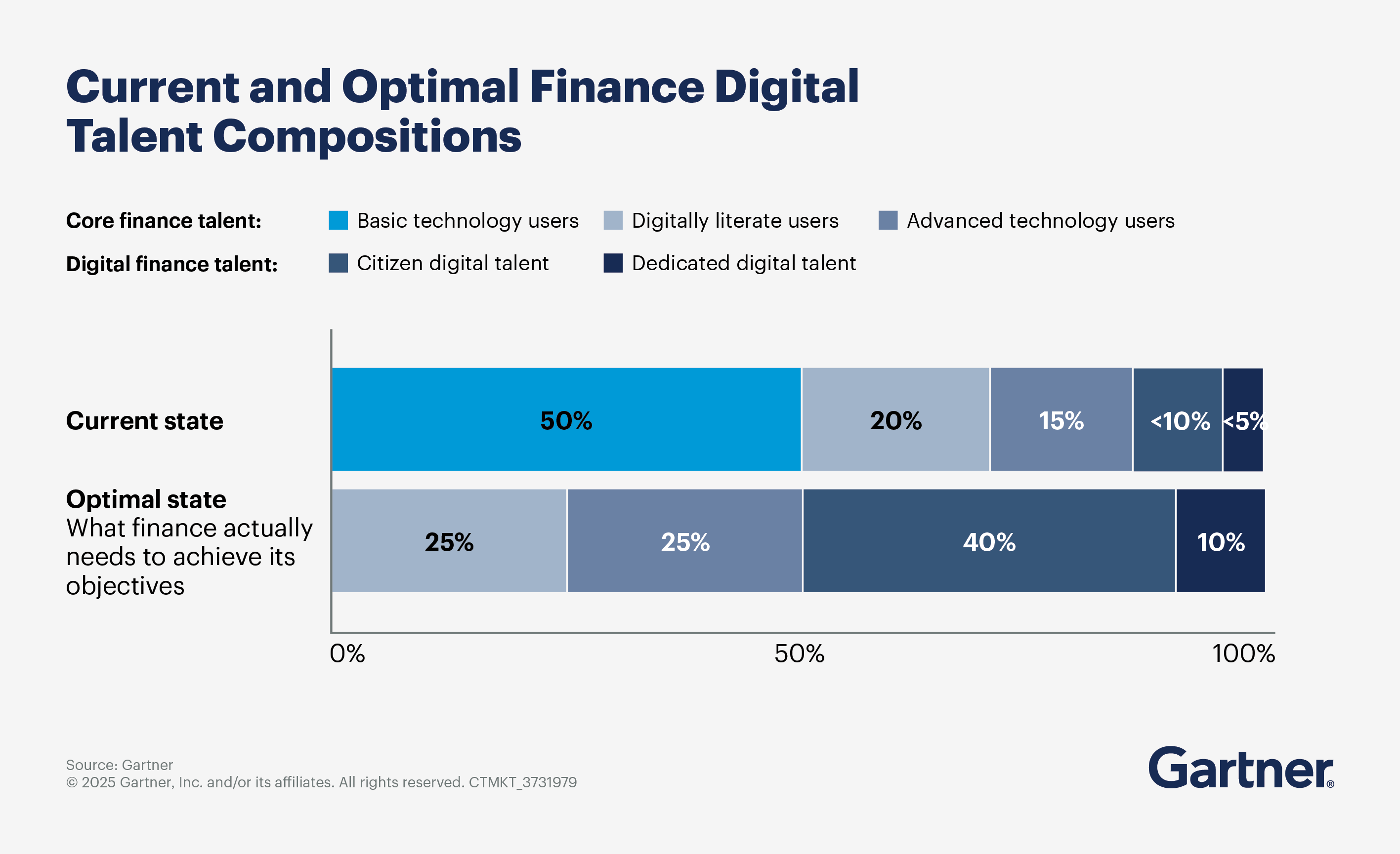

CFOs need more digital finance talent for transformation, facing challenges in sourcing and retention. However, digital talent is costly to replace and more likely to seek other opportunities. CFOs must upskill existing staff or recruit new talent, as they aim for half of finance employees to be digital by 2027.

Questions finance leaders are asking related to strategy include:

How do I go beyond my financial data management strategy to build an enterprise data strategy?

How can I find new opportunities to optimize cost?

How do I break the reliance on outdated decision-making inputs across the organization?

Speed time to value and maximize the impact of finance transformation efforts

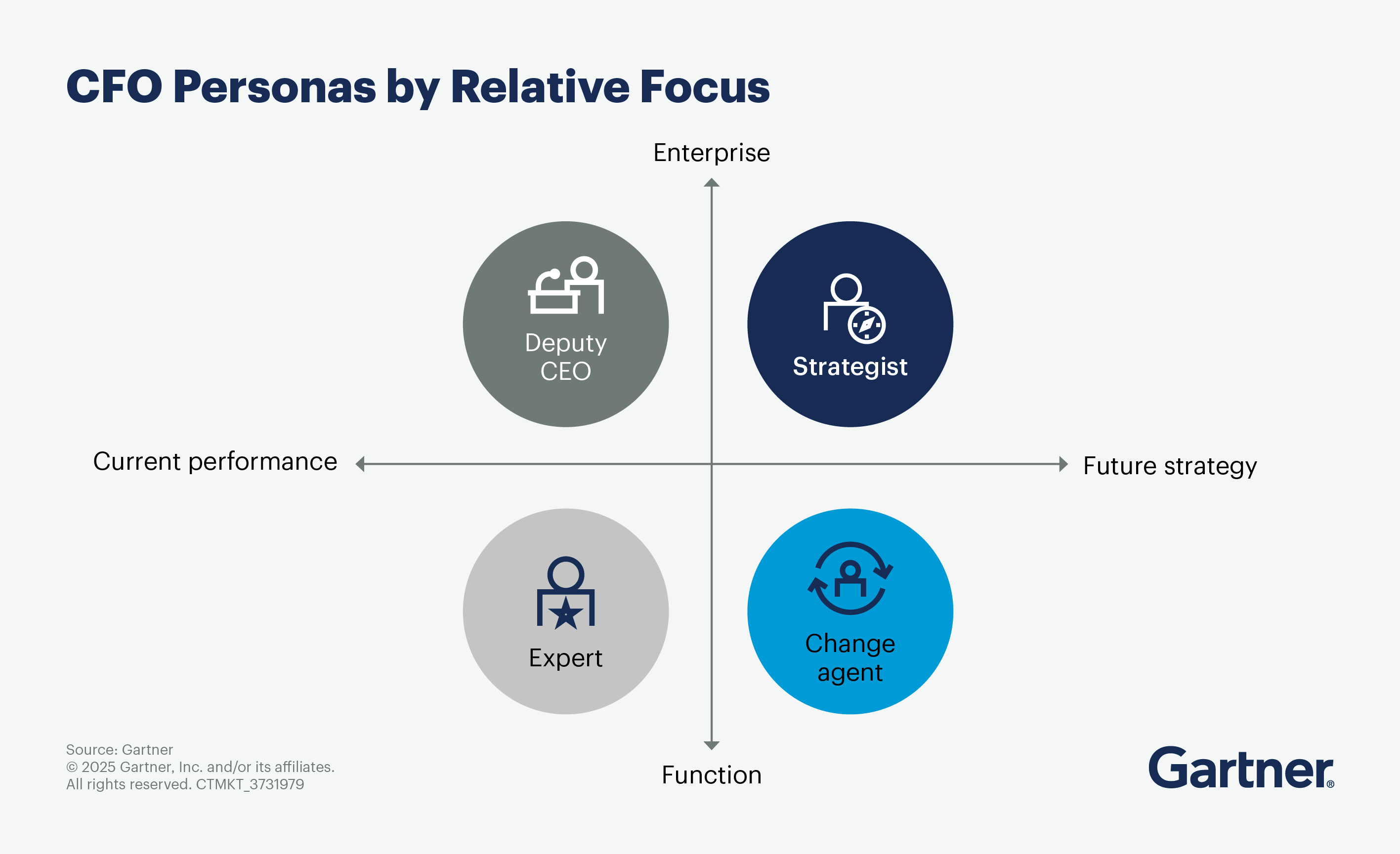

The role of CFO is rapidly evolving, with over 70% of CFOs now shouldering responsibilities beyond the realm of finance. Because of this, they require greater support from their finance leadership teams. However, 50% of CFOs state that their leadership teams need a significant or complete overhaul, complicating both delegation and succession planning.

How CFOs spend their time is critical to being effective. Different distributions of CFO time are best suited to different kinds of organizations, tenure and leadership teams. To maximize effectiveness in any one organization over the long term, a CFO will need to be able to flex between different personas by changing their time allocation and stakeholder orientation quickly as circumstances change.

Use the four personas to strategically calibrate time allocation, weighing trade-offs with an opportunity cost approach.

- The strategist: Strategist CFOs leverage enterprisewide visibility to align long-term objectives, making strategies understandable for all leaders. They emphasize future direction with a directive style, engaging with CEOs, boards and finance teams in growth contexts.

- The deputy CEO: Deputy CEO CFOs use their experience with leaders and the trust they’ve established to foster financial responsibility. They empower finance teams with minimal intervention, concentrating on current performance with a directive approach. They partner with investors, CEOs and boards in midsize companies.

- The change agent: Change agent CFOs use their visibility to guide organizations through change, addressing both process and human challenges. They focus on future direction with a participative style, working with finance teams and peers in struggling companies and large transformations.

- The expert: Expert CFOs understand enterprise value mechanics, shaping finance's decision support for better outcomes. They empathize with finance teams, targeting current performance with a participative method. They collaborate with business leaders and finance teams in value companies and regulated industries.

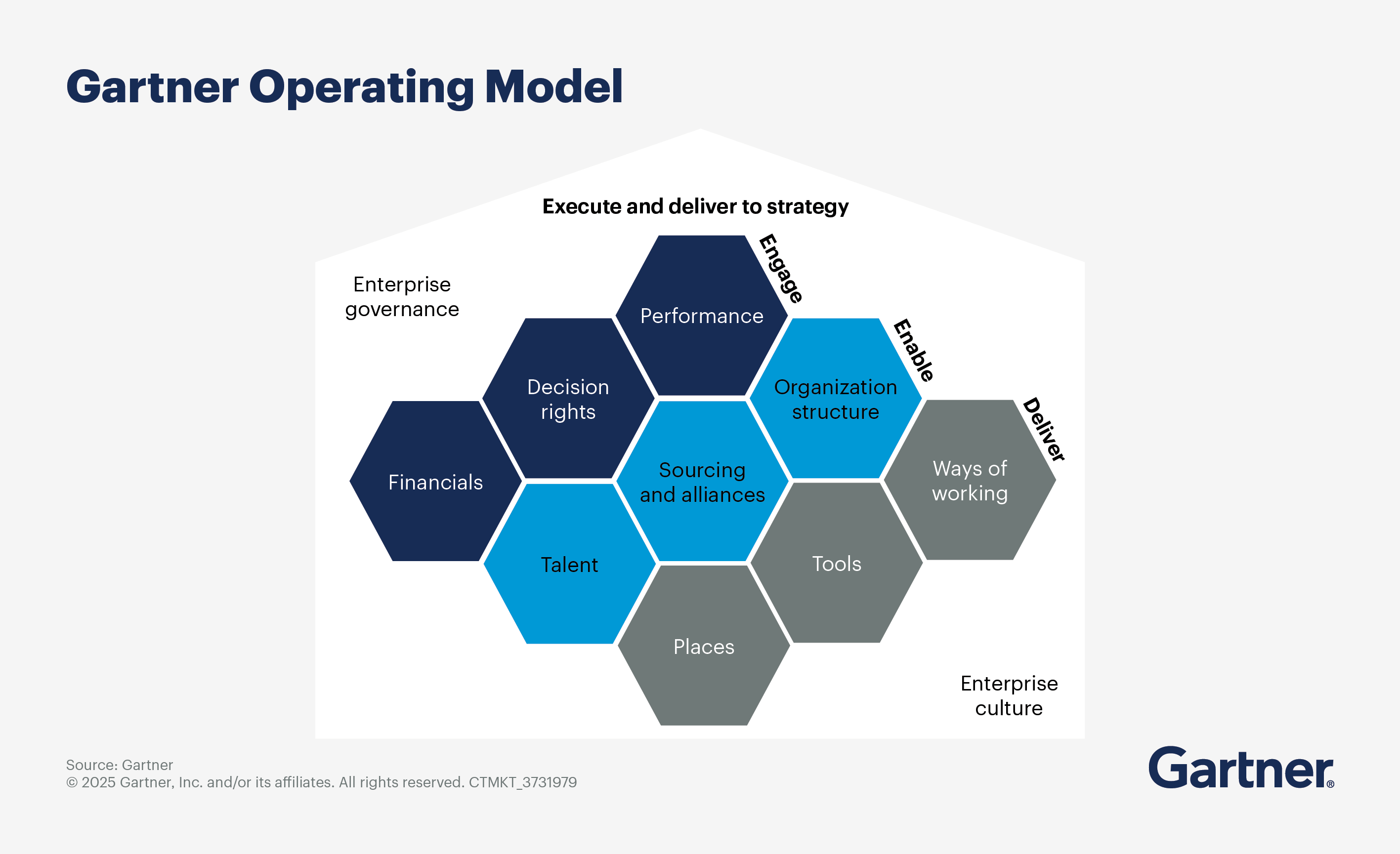

Is your current operational model built for autonomous finance?

Many finance transformation initiatives focus heavily on technology or organizational design, underinvesting in other operating model decisions. Prepare your finance leadership team to make decisions about the whole operating model for autonomous finance.

Because no two companies are alike, there is no single “right” operating model for autonomous finance. However, most firms should incorporate the following common general principles to move successfully toward autonomous finance.

Ways of working include more collaborative and transparent approaches to work, behaviors, informal workflows, team customs and the adoption of methods such as agile and lean.

Decision rights (held by key stakeholders) address who makes decisions, how decisions are made and how disputes are resolved.

Talent considerations include the competencies, skills and profiles needed to execute work in the operating model.

Organizational structure defines key roles, reporting relationships and collaborative networks involved in the finance transformation.

Tools include the assets, applications and functionalities that should (or should not) be used for teams to perform their responsibilities.

Financials include how finance transformation will be funded; how budgets will be allocated, planned and monitored; how costs will be recovered or priced; and how investment aligns to strategy.

Performance refers to the approach to performance management that will ensure the effective execution of strategy and ongoing operations.

Sourcing defines the approach to outsourcing and partnership with third-party service providers.

Alliances define the necessary partnerships and how to ensure they create value.

Places define the global locations of key people and assets.

Beyond these starting points, you may want to design your own operating model principles. As you do so, keep the following themes in mind:

Finance teams will work more like technology teams. Borrow from the best of how technology teams work to prepare for an environment where most teams have some responsibility for technology deployment, customization and ongoing management.

Machines will play a bigger role in decision making. While automation is already widely used for transactional tasks, machines will start to be more capable of judgment-based decisions and provide more prescriptive advice to humans (e.g., answering “Should we take Path A or Path B?”).

All teams will need more technology expertise. Keep in mind that technology expertise will be widely dispersed across the organization, not just confined to corporate IT or a finance IT team. At first, most teams will not need deep engineering or software development expertise, but that is likely to change over time.

Finance will start thinking more about “customer experience” and “user experience.” As finance delivers more of its insight and analysis via tools and technologies (as opposed to face to face), successful finance organizations will actively assess how stakeholders experience their interactions with finance and establish practices to continuously improve those experiences.

The comparative advantages of the corporate financial center will grow. Adopt or design principles that respond to the likelihood that the comparative advantages of the corporate finance center are likely to grow, while the comparative advantages of regional teams are likely to narrow, as technology and standardization progress

Address critical imbalances in digital finance talent

Finance needs more digital talent than ever, but today’s digital talent composition does not meet tomorrow’s demand. Currently, less than 15% of finance talent have digital capabilities, but soon, nearly half of the function will need those capabilities for finance to succeed.

Why the urgency? Finance teams that lack critical skills stand to miss out on seven key benefits of digitalization. The following list explains these benefits in order of importance and the skills that finance employees need to achieve them:

As digital technology helps streamline financial data, simplify core processes and reduce resource expenditures, productivity and efficiency improve. To reap this benefit, finance employees need an in-depth knowledge of internal finance processes, the ability to recognize opportunities to increase productivity and the ability to process mining skills.

Finance attains a high level of technical sophistication when dedicated digital talent and advanced technology users can accomplish complex tasks with a moderate to high level of technical acumen. To get there, finance talent must be able to analyze data and its nuances, learn new analytical approaches and tech skills, understand and troubleshoot finance technology systems and have knowledge of a programming language.

As efficiency, productivity and technical sophistication increase, finance employees gain increased capacity to take on more high-value analysis work, engage in strategic business partnering and customize systems. To do so, employees must be able to establish and maintain more advanced technological platforms and automate complex processes.

Digital technology helps finance identify problems and address them through tailored solutions — like modifying or constructing products in a way that aligns with stakeholders’ specific needs. To deliver these solutions, finance employees need advanced data analysis, management and interpretation skills and the ability to customize technology platforms.

Digital technology enables improved data security and management and increasingly sophisticated study of complex data, resulting in higher-quality data and analysis. To make the most of this benefit, finance employees must have advanced data analysis, management and interpretation skills, as well as effective business partnering skills.

Having a sufficient level of technical acumen gives finance greater independence from enterprise IT or vendor support. This requires an ability to automate complex processes, a knowledge of finance technology systems, and the technical acumen to deploy, customize and maintain technology.

Digitalization builds a common language between finance and IT, streamlining communication by using terminology that both finance and IT professionals understand. To achieve this benefit, finance employees need knowledge of finance technology systems and a programming language.

Accelerate AI’s impact on finance transformation

The AI technology adoption gap in finance is closing. Fifty-eight percent of finance functions are at least piloting AI tools, and 66% of finance leaders feel more optimistic about AI’s impact.

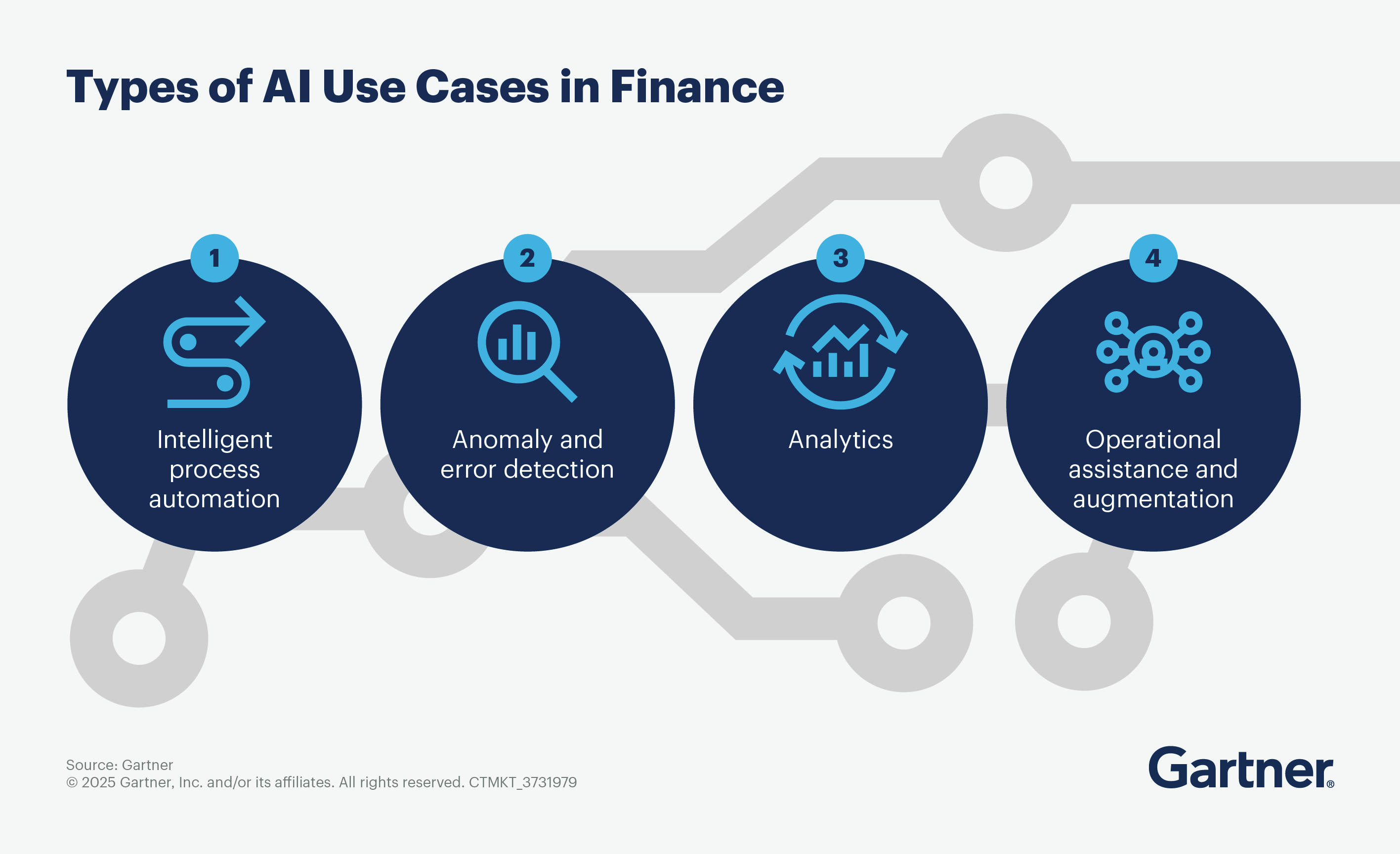

Four use cases continue to stand out for using AI in finance transformation.

Intelligent process automation: Leveraging the AI capabilities of existing automation tools (such as RPA) to enhance information processing.

Anomaly and error detection: AI-enabled identification and reporting of errors and outliers in large datasets such as internal claims, expenses and invoices.

Analytics: The creation of better financial forecasts and results analysis that can lead to improved decision making.

Operational assistance and augmentation: Emulation of human-judgment-based decisions in operations through AI and generative AI.

Although finance AI adoption is increasing, almost half of finance leaders currently using AI report that AI adoption went slower than anticipated. Only 11% report that the adoption went faster than anticipated.

Having the right talent and enterprise-level involvement in AI governance and management are key drivers of AI adoption success. Specifically, successful early adopters do the following:

Use data scientist talent. Early AI adopters of finance AI are over twice as likely to use data scientists within their finance function compared to non-AI adopters. These data scientists use their analytics and data management expertise to build and test AI models, prepare data for AI consumption and assist in the technical implementation of AI software.

Notably, only 33% of early AI adopters hired data science talent from external sources. The rest either trained citizen data science talent internally, leveraged data science talent from other parts of the organization or engaged third-party providers.

Get involved in enterprise-level AI efforts. Enterprise-level involvement can be a key jumping-off point for finance AI adoption. Sixty percent of finance AI users are engaged in enterprise-level AI governance efforts, compared to just 16% of finance AI nonusers.

Enterprise-level involvement provides early AI adopters’ teams with beneficial exposure to other functions and business lines further ahead in AI adoption. That exposure enables finance teams to more quickly learn what AI can do and how to implement it.

Attend a Conference

Join Gartner experts and your peers to accelerate growth

Gather alongside your peers in National Harbor to gain insight on emerging trends, receive one-on-one guidance from a Gartner expert and create a strategy to tackle your priorities head-on.

Gartner Finance Symposium/Xpo™

National Harbor, MD

Finance transformation FAQs

What is finance transformation?

Finance transformation describes strategic initiatives aimed at reenvisioning the finance function to align with the overall company strategy. Finance transformation may consist of restructuring and implementation of the finance operating model, accounting and finance organizations; accounting and finance processes; financial capabilities; and replatforming of finance and accounting systems. These changes can revolutionize the way an organization manages its financial function.

What are finance transformation best practices?

Successfully transforming the finance function includes the following key elements:

Evaluate, prioritize and scope activities in a finance transformation roadmap that focuses on differentiators of success.

Create a future-state design with best practices, case studies and tools to support your business case.

Implement strategies that create value for business partners.

Keep finance transformation projects on schedule, on budget and sustainable.

Why is financial transformation needed?

CFOs need a finance function that enables the strategic ambitions of the enterprise. For organizations today, those ambitions feature digitalization. CFOs must accelerate their finance transformation journey toward autonomous finance or risk falling behind. The business needs faster, more accurate data to make better decisions about everything from pricing and products to investor and customer sentiment.

What is the future of the finance function?

The future of the finance function is autonomous. Finance must transform into a digital operation to meet the needs of a digital business environment where activities need not be managed by humans or physically colocated.

As technologies evolve and data is democratized across the business, CFOs and finance transformation leaders must reimagine organizational structures, roles and the location of activities, as well as the balance of people and technology across finance.

How do we build an effective finance transformation roadmap?

Keep the following in mind to build an effective finance transformation roadmap:

Align finance strategy to the business by shifting focus away from historical spend and industry benchmarks and toward the right level of finance resources for your unique corporate strategy.

Prioritize services, markets and products that deliver the most business value.

Manage expectations. Rather than aiming to satisfy all stakeholders, shape customer expectations and force customers to focus on what they actually need.

Drive stronger performance on your mission-critical priorities.