Prepare your finance function for a rapidly changing landscape shaped by 8 emerging forces.

- Gartner client? Log in for personalized search results.

Navigate the Future of Finance

By 2030, agentic AI will make at least 15% of daily decisions autonomously, and 70% of finance functions will use AI for real-time decision making, according to Gartner. Use the Future of Finance report to monitor emerging forces before they become mainstream disruptions and create a long-term vision that positions your finance function ahead of the curve.

Download the Future of Finance report to:

- Discover key challenges and opportunities for CFOs and finance teams

- Prepare your finance function for a new era of efficiency

- Future-proof your finance organization strategy

About Finance 2030: The Future of Finance

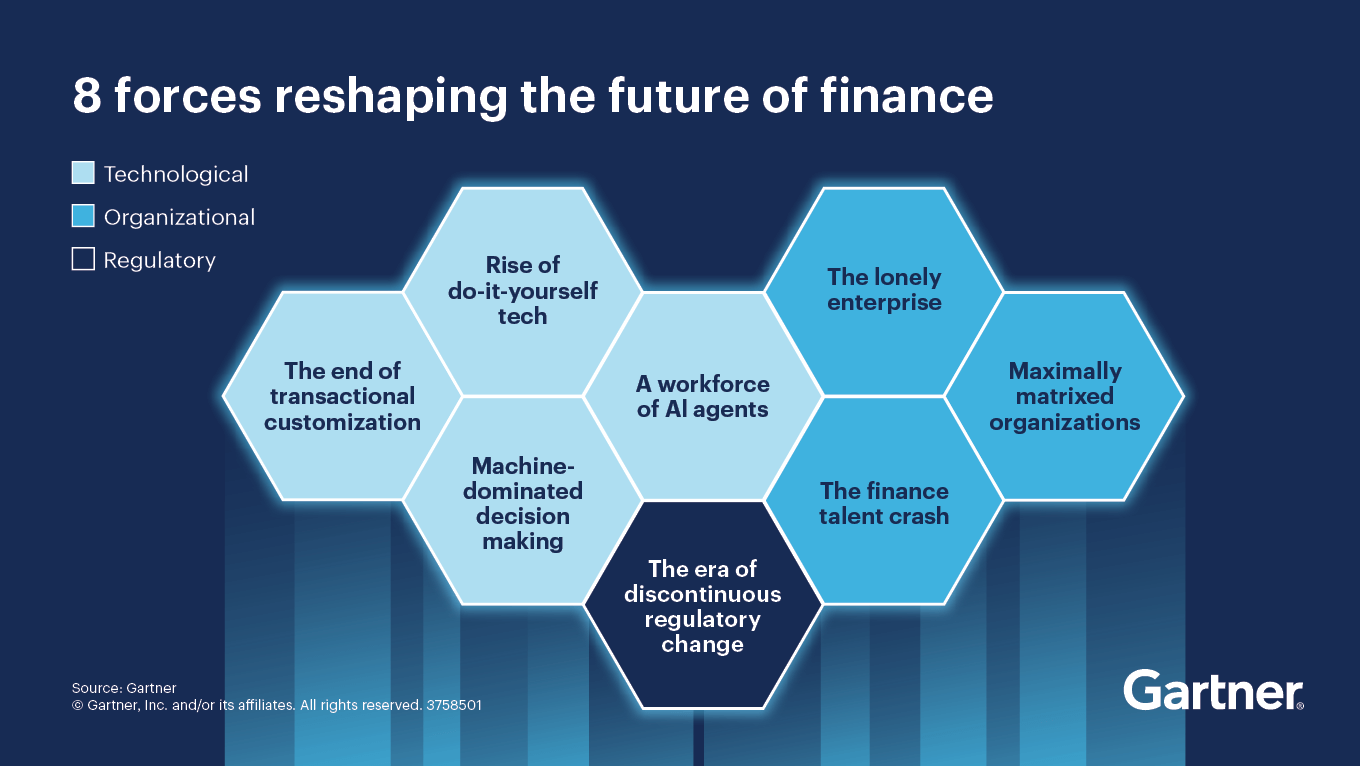

Finance stands on the cusp of a profound transformation. Over the next several years, eight technological, organizational, and regulatory forces will redefine the function, compelling CFOs to reimagine how they plan, strategize, decide, operate, and organize.

Technology—especially agentic AI—will drive efficiency and require a reassessment of finance’s role. Organizational complexity and new behaviors will reshape talent and team structures. Discontinuous regulatory change will challenge core activities like scenario planning, business partnering, and compliance.

CFOs can use this Gartner report to prepare their workforce for the future of finance and refresh long-range plans.

Future of Finance FAQs

How will AI reshape the finance function by 2030?

By 2030, artificial intelligence—particularly agentic AI—will revolutionize the finance function. Agentic AI refers to autonomous systems capable of executing tasks and making decisions with minimal human input. Gartner predicts that by 2030, at least 15% of day-to-day finance decisions will be made autonomously. This shift will dramatically alter how finance operates, with many routine and even complex decisions being delegated to machines. Finance professionals will transition from task execution roles to overseeing and coordinating AI agents. Organizational structures will flatten, potentially eliminating over half of current middle-management positions. The adoption of AI will also redefine vendor relationships, talent competencies, and the overall strategic role of finance within the enterprise.

What are the biggest talent challenges finance will face?

Finance is on the brink of a significant talent crisis. Between 2019 and 2021, approximately 300,000 accountants exited the industry, and in 2023, 82% of those leaving had more than six years of experience. This trend is expected to continue, leading to a shortage of experienced professionals, especially in core disciplines like accounting. As automation reduces traditional skill-building opportunities, finance teams will become smaller and more specialized. CFOs will need to pivot their hiring strategies toward technology-savvy talent and consider innovative solutions like encoding legacy knowledge into large language models. The future finance workforce will require a balanced mix of finance and technology expertise to maintain quality and continuity.

How will finance processes evolve by 2030?

Transactional finance processes are expected to become highly standardized by 2030. As best practices converge and vendors offer aligned products and services, most finance functions will adopt similar approaches to transactional tasks. This standardization will reduce costs, simplify technology selection, and eliminate many roles focused on customization. However, analytical processes will remain tailored to each organization’s unique needs, such as industry-specific metrics and strategic goals. Finance leaders must prepare their teams to shift focus from customization to oversight, ensuring data quality and AI effectiveness while managing resistance from stakeholders accustomed to personalized service.