Technology is key to financial transformation and efficiency in core finance activities. CFOs: Know the landscape.

- Gartner client? Log in for personalized search results.

Finance Technology: Strategic Insights and Roadmap for CFOs

Finance technology is complex, and CFOs need a tech roadmap

CFOs are navigating a wide array of finance technologies, including AI-driven ERP systems and intelligent automation applications.

Use the Gartner Finance Technology Bullseye to assess current tech and strategize around future innovations, leveraging insights from 380+ peers. Explore:

Four finance technology domains

Adoption levels and perceived value

A quick list of key technologies critical to finance organizations

What CFOs need to know about finance technology

Understand the finance technology trends that are transforming the finance function.

Finance Technology Trends

Finance Technology Roadmap

AI in Finance

Robotics in Finance

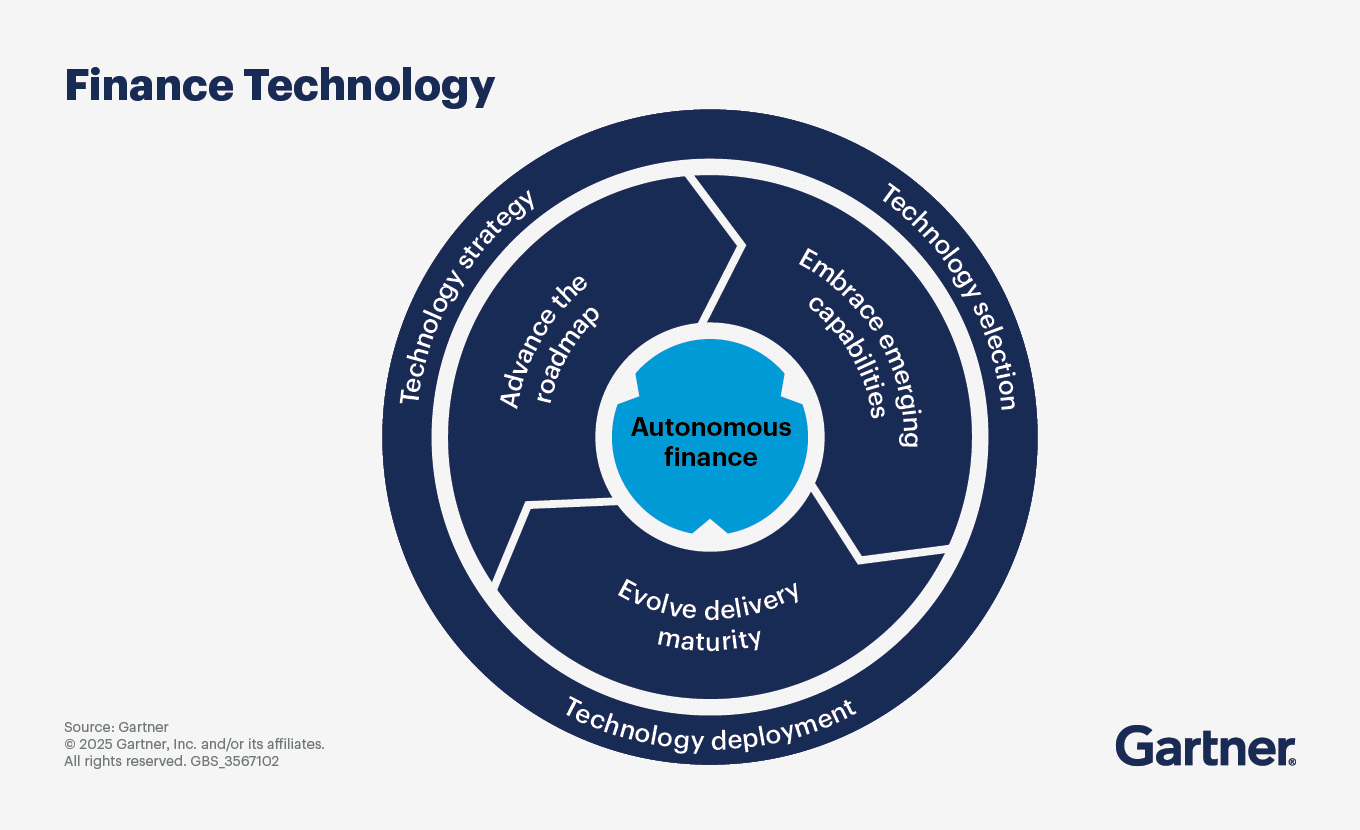

Innovation in finance technology puts autonomous finance goals in close reach

Emerging technologies bring substantial automation — and even true autonomous finance — tantalizingly close. But while the vast majority of CFOs agree they are accountable for realizing the value of digital finance technology investments, only 39% rate themselves proficient at it.

Nevertheless, technology lies at the heart of CFO efforts in enabling financial transformation activities, budgeting and forecasting. Technology solutions are also in demand to efficiently carry out a range of day-to-day functional activities in areas such as:

Financial planning and analysis

Core finance

Financial close

Contract and document management

Materials management

Vendor management

To make finance technology decisions that will drive value, CFOs will increasingly need to collaborate and partner with their CIO to expand technology skills, roles and processes within the finance team. They may even need a new role: head of finance information technology (IT).

Do CFOs need a head of finance IT?

As CFOs navigate the evolving role of finance technology, three signs indicate the need for a dedicated head of finance IT.

Sign No. 1 — You don’t have a documented finance technology roadmap

Lack of a documented finance technology roadmap can hinder digital success. Only 37% of CFOs currently have a clear strategy in place. Developing and executing this roadmap require time, focus and stakeholder engagement. If the roadmap has been neglected for over three months, establishing a head of finance IT becomes crucial.

Sign No. 2 — You have a roadmap but execution is slow

A roadmap is not enough if execution is slow. As decisions pile up, a backlog forms and progress stalls. While a finance transformation lead may temporarily handle this, the breadth of responsibilities will eventually demand a dedicated role. A well-empowered finance IT leader can expedite execution by making timely decisions and holding the CFO accountable for major choices.

Sign No. 3 — Finance and corporate IT collaboration is lacking

Finance and corporate IT collaboration is essential for successful finance technology investments. A head of finance IT can advocate for finance technology priorities and improve collaboration with corporate IT. The more friction that exists between finance and IT, the more beneficial a named head of finance IT becomes.

Whether the finance team has a dedicated IT leader or not, CFOs need to be educated about the finance technology market’s current state and future evolution.

Also seek out vendors that can deliver new, differentiated capabilities, and then co-lead digital delivery with IT to accelerate the path toward autonomous finance. Begin with these questions:

How should we assess the best opportunities for our organization across the finance technology landscape?

What technologies and vendors should we use to automate core finance and accounting processes?

How should we mature our capability to deliver and manage finance technology investments?

What role should finance play in shaping a successful ERP deployment?

How should we establish an artificial intelligence/machine learning oversight approach that won’t stifle experimentation?

Make the most of finance technology opportunities with a proven process

The growth of new finance technology capabilities has far outpaced most companies’ limited budgets. This puts pressure on finance teams to clarify and communicate a multiyear vision for their tech ecosystem.

A purposeful technology roadmap that includes well-defined opportunities and implementation timelines sets the finance function up to drive efficiency and effective decision making. Follow this five-step process to create your finance technology roadmap:

Step 1: Prepare to build the roadmap

Lay the groundwork by documenting the key participants from finance, IT and procurement and creating a finance technology roadmap “tiger team.” This team documents the project’s objectives and expected outcomes and how they align with the goals of both the finance function and the broader organization. The team also inventories the existing technology capabilities (see image) and maps them to key finance processes to define the current state of finance digitalization in the organization.

Step 2: Identify opportunities

Using the technology capabilities inventory, the tiger team assesses the effectiveness of the organization’s current finance technology capabilities to identify systems in need of upgrading, as well as capability gaps the organization needs to fill. The team also looks externally at the market for finance technology to identify emerging capabilities in which finance should consider investing. With that information in hand, the team engages the finance function and IT leadership to create a full technology opportunities list informed by functional needs and in-house IT priorities.

Step 3: Select technologies for investment

The full list of finance technology opportunities will be longer than the organization can pursue at one time. In this step, the tiger team evaluates and prioritizes opportunities using a standardized set of value criteria, success factors, risks and inhibitors to calculate their relative business value. Then the team can use Gartner BuySmart™ to validate the prioritized list against external market parameters and best practices.

Step 4: Create and communicate the roadmap

Set timelines for implementing the final set of prioritized finance technologies. Assign stakeholders who will be accountable for each technology project. Document key elements of the process and the ultimate roadmap, and share it with constituents in finance, IT and the broader organization.

Step 5: Monitor progress against the roadmap

Even with a roadmap in hand, the process is not over. Finance teams continue to monitor progress toward realizing the existing finance technology roadmap, while also monitoring the current state of technology in the organization and the emerging technology market to identify systems ripe for retirement and adoption.

Avoid hurdles, drive faster results and achieve significant returns using AI in finance

Interest and expectations for artificial intelligence (AI) are rising, and finance’s investment in AI is expected to increase by an average of over 21% year over year.

The value of AI in finance comes from improving the finance function’s ability to predict, analyze and uncover important patterns from unstructured data, and thereby automate work, make informed decisions, compute large quantities of information (including unstructured data) and avoid risk.

As you think about how to invest in AI finance technologies, start by considering how you will acquire AI. Following are four common acquisition methods:

Activating embedded AI capabilities in existing, implemented platforms — i.e., waiting for the platforms you currently use to incorporate AI

Buying prebuilt AI solutions — i.e., purchasing off-the-shelf tools from vendors

Leveraging external consultants to do a custom AI build

Building AI in-house using AI-skilled staff who could report through finance, IT or a corporate center of excellence

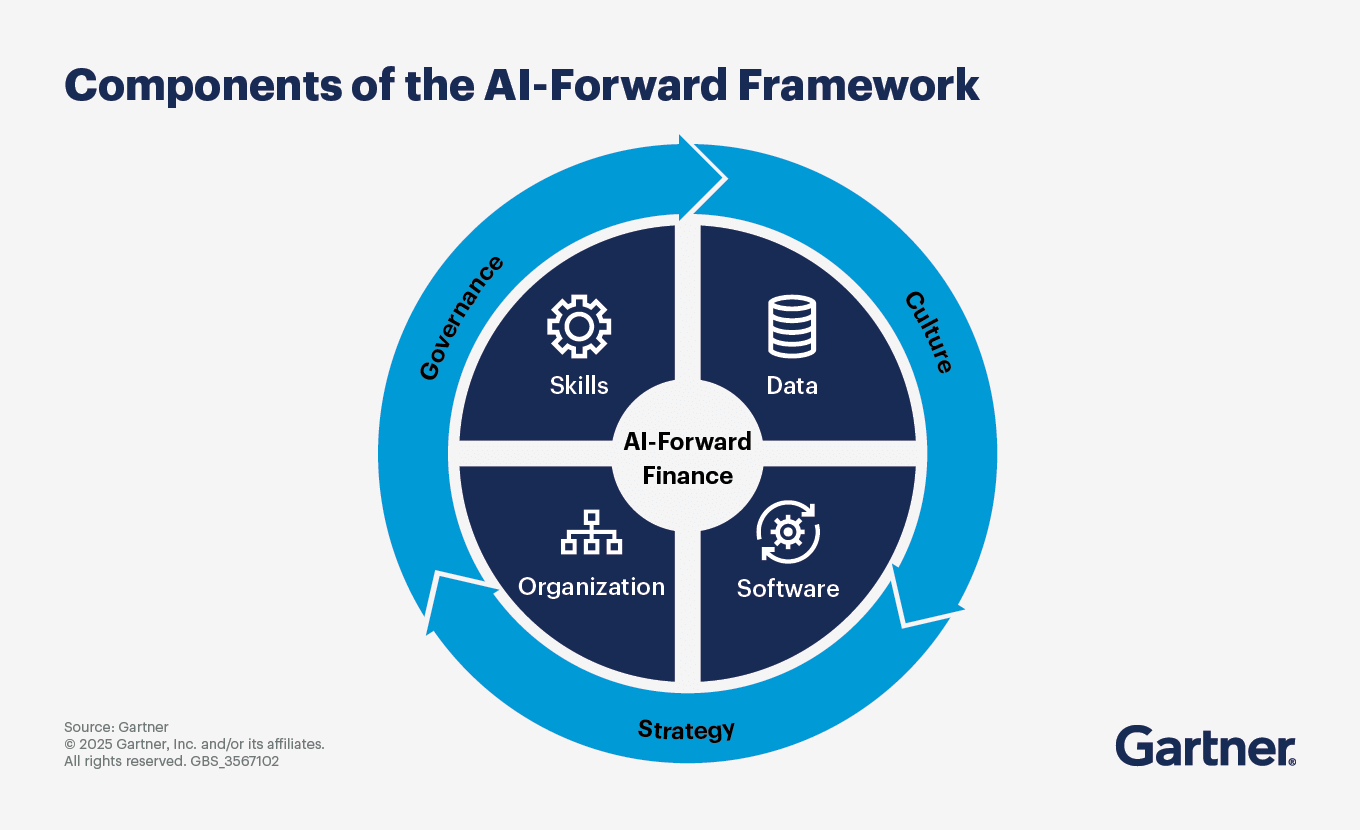

Once you’ve decided on an acquisition method, position finance for AI success by implementing our AI-Forward Framework. The framework consists of five components:

Skills. Developing an organizational AI competency is the only way finance can responsibly meet its obligation to validate the integrity of financial statements when using AI to automate transactions and make decisions. Accelerate your impact by hiring data scientists dedicated to finance — and then train existing staff in the basics of data science to establish a citizen data science competency.

Data. When using AI in finance, data is a critical asset. Large volumes of higher-accuracy data help build effective and reliable AI models. Prioritize defining business drivers and automating the collection, correction and distribution of data.

Software. Leading AI finance organizations are 71% more likely to purchase software platforms with embedded AI features. A growing number of vendors offer intelligent finance applications that natively use AI in common back-office processes like accounts receivable, accounts payable and audit.

Organization. In the future, an autonomous finance organization will require organizational changes that reflect the reliance on machines to do work, but today’s AI-forward organizations require only small, but meaningful, changes to the organizational structure. When CFOs champion AI efforts, they are nearly twice as likely to succeed than if the CFO takes a passive role. With the right executive support, team members are more likely to recognize AI as an organizational strategy and are more likely to embrace necessary changes.

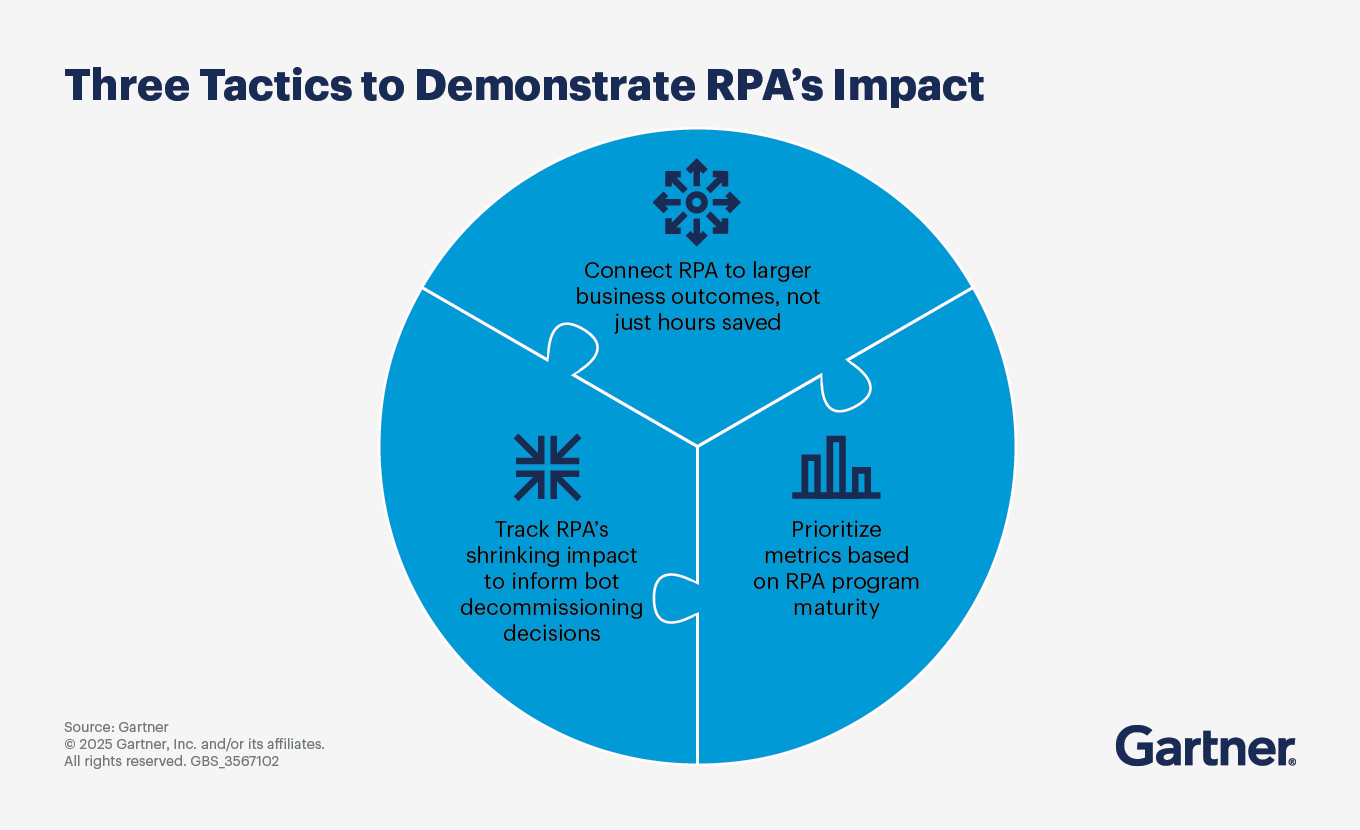

Gain efficiency across the function by using robotics

Enterprises have been using robotics in finance for years to automate simple, repetitive, judgment-free processes, improve speed and accuracy, and free up employees from mundane tasks.

Robotic process automation (RPA) uses software scripts with if-then rules to execute defined processes leveraging structured data. RPA can have a huge impact on the finance function, as much of the work that finance teams do (e.g., building reports, making entries, comparing actuals with forecasts) follows clear process steps and a defined set of rules.

Programming a robot, or team of robots, to undertake this work can eliminate the risk of human error and, in many cases, complete the task in half the time it takes a human.

But RPA does have limits. RPA is designed for “doing” (task execution) and is therefore inappropriate for complex, dynamic processes that require analysis and judgment. Also, each RPA deployment is stand-alone, designed to automate a specific process and not scalable beyond its original use case.

Still, for most organizations, the use of RPA finance technologies is a cost-effective way to improve accuracy and increase productivity, which is central to finance’s long-term strategy. And unlike traditional finance IT solutions such as an ERP installation or upgrade, implementing RPA doesn’t require a “standardize then automate” approach. In fact, RPA can automate individual tasks or components within a process that make the overall process more efficient.

Attend a Conference

Join Gartner experts and your peers to accelerate growth

Gather alongside your peers in National Harbor to gain insight on emerging trends, receive one-on-one guidance from a Gartner expert and create a strategy to tackle your priorities head-on.

Gartner Finance Symposium/Xpo™

National Harbor, MD

FAQ on finance technology

What is finance technology?

Finance technology covers the full spectrum of applications that support the modern finance function — from traditional automated solutions to autonomous finance solutions whose capabilities include self-learning, self-correction and decision making.

What are some must-have finance technologies?

Technology is having a profound impact on the finance function. Some of the most compelling finance technologies include:

Cloud-native platforms

Composable applications

Hyperautomation

Decision intelligence

What are the benefits of AI and RPA in finance?

Among the many benefits of using artificial intelligence (AI) and robotic process automation (RPA) in finance is the ability to automate repetitive activities. RPA is a proven and ubiquitous tool for driving efficiencies and increasing productivity in the finance function. Complementing RPA with AI for finance takes automation to the next level, in which entire processes, not just tasks, are automated.

Drive stronger performance on your mission-critical priorities.