Drive better decisions and create sustainable growth across your organization with a proven finance business partnering approach.

- Gartner client? Log in for personalized search results.

Finance Business Partnering: Guide to Driving Business Growth

Transform your finance business partnering approach for better ROI

Despite years of in-person support, FP&A leaders still struggle to see a tangible return on their investment in finance business partnering teams. To truly unlock their potential, it’s time to shift to a proven model.

Download this guide to:

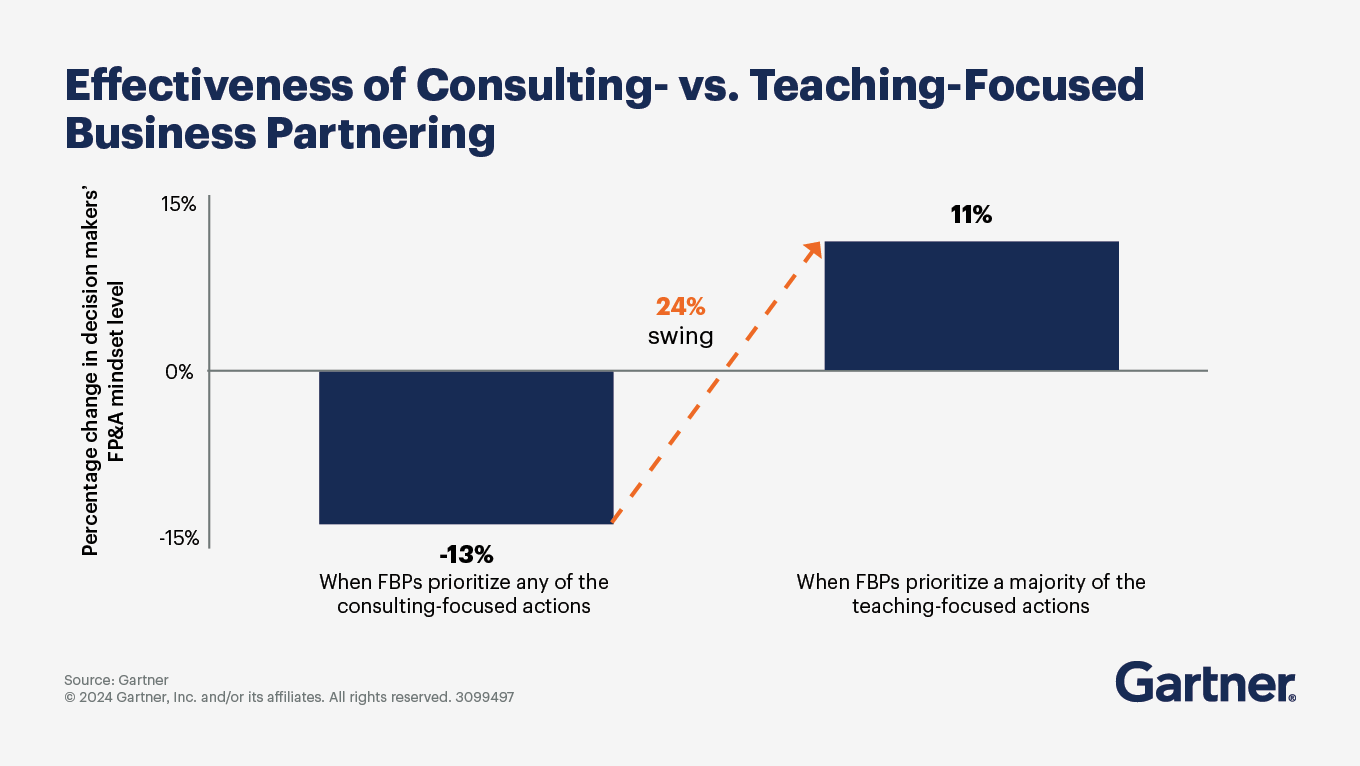

Discover how teaching-focused business partnering produces the best outcomes

Enhance decision-maker self-sufficiency

Scale FP&A influence across the enterprise

- Create a sustainable FP&A delivery model

Equip your finance business partnering team to succeed

As economic turbulence persists, traditional models of finance business partnering no longer apply. Ensure effective business decision support by reimagining the following.

Business Partner Reporting

Business Partner Skills

Business Partnering Impact

Enhance finance business partnering by aligning reporting to business strategy

As businesses and decisions become more complex, the demand for finance business partnering support and data is increasing. A finance business partner’s default response might be to add new reports with reworked metrics and KPIs. However, as workload and complexity grow, this approach can burden FP&A with extra work or overwhelm stakeholders with redundant information — neither of which is sustainable.

Instead, FP&A should focus on making its reports more actionable for finance business partners, rather than having FBPs create additional reports themselves. With enhanced FP&A reporting, you can free up finance business partners’ capacity and better align to FP&A leaders’ top priorities.

Rethink the way finance business partners deliver reporting by focusing on the following:

Align reporting to business strategy. Avoid redundancy and keep business leaders on track with objectives by building a driver map that links finance business partnering reports to the desired business outcome.

Lay out the “what?” Interview decision makers, making sure their needs are quantifiable, to define the report’s primary outcome.

Ask, “So what?” Unpack the enterprise’s key question or problem into a small set of drivers that influence it. Challenge stakeholders’ key assumptions to ensure reports and insights are relevant and aligned to organizational key goals.

End with the “Now what?” Translate strategy into actionable to-do’s for decision makers to mitigate, or solve previously identified issues.

Translate insights into measurable outcomes. Select and prioritize the right KPIs by pressure testing them against the outcomes they drive. Then deliver actionable insights that stakeholders can understand without a high level of financial savvy.

Simplify information delivery. Finance business partnering reports are most effective when they are direct and tailored to the specific business need. Segment KPIs and metrics by stakeholder seniority, consumption patterns and communication styles — and then customize data visualizations accordingly.

Validate and monitor key assumptions. Effective finance business partnering requires a continuous-improvement mindset. Conduct periodic reviews of report usage data, new information requests and KPIs — and make updates as strategy, business models or forecast variances evolve.

Foster the finance business partnering soft skills that drive digital success

Digital finance technologies have increased business expectations of the finance business partnering team. To meet these changed expectations, finance leaders tend to prioritize the development of hard skills such as coding to make the most of digital technologies. These hard skills are important — but they require soft skills to activate them.

To ensure the best use of digital finance technologies, develop the following soft skills in your finance business partnering team.

Communication. As machine-learning (ML)-driven analytical tools become more democratized, the business can generate insights independently by feeding operational and financial data to digital analytics technology. But the business also struggles to pull relevant insights from these technologies. Digital finance business partnering requires strong communication skills to distill complex financial concepts into business-centric terms.

Coach finance business partners on how to create a narrative that explains why a particular analytical approach was used and how it works. Emphasize the business context around the analytical approach and how it addresses the core business problem or aligns to business goals. Focus on answering the following:

Why a certain analytical approach was used

How it affects the output

Why it is relevant to a particular business problem

Logical reasoning. Business-led analyses tend to focus narrowly on the decision’s impact on the business alone, versus its broader financial and strategic implications. For example, an analysis through a cost and revenue lens would not take into account the impact on the organization’s working capital and liquidity. Finance business partnering can foster financially sound decisions by helping the business consider those broader implications and alternate scenarios.

Ensure FBPs have strong reasoning skills to create a logically sound train of arguments that are easy for the business to understand. To develop these skills, adopt a debate-style approach that empowers finance business partners to defend their assumptions and critically assess the business’s ML-based analyses and decisions. Focus on asking the following questions:

What information did you use to conduct your analysis?

What assumptions did you make? Why those assumptions?

How does your analysis change if assumptions change?

Adaptability. Although automation has improved data management capabilities, finance business partnering still requires dedicated time to deliver analyses at the speed of business needs.

To ensure that finance business partnering can accommodate real-time decision support, equip the team with tools that help them adapt quickly to upcoming requests and prioritize high-value support needs. Encourage finance business partners to source upcoming business challenges directly from frontline managers by asking:

Which operational decisions give you little time to react?

Which operational decisions are typically made based on “gut feel”?

Where do company policies such as pricing and spending fall short on serving business needs?

Overcome finance business partnering limitations to strengthen operating decisions

As organizations grow more complex, the volume of decisions business managers make is increasing, and so is the impact of those decisions on profitability.

A majority of business decision makers consider less than half of the broader financial implications of their operational decisions — and 22% of operational decision makers do not consider any financial implications, because sales volume is their primary motivation.

Financially unsound operational decisions cost the average company up to 3% of EBITDA. This impact on profitability only compounds over time.

Reverse this trend by shifting to a new finance business partnering model. While traditional finance business partnering follows a “business generalist” model, the approach has major limitations:

It isn’t scalable — In the current environment, the business generalist model requires more than 2,800 hours of finance business partnering to support all operational decisions within the decision window. That translates to finance business partners working 11-hour days, all year long, only in decision support mode.

Expertise is lacking — Operational decision makers make a wide range of decisions in multiple categories. The finance business partnering “generalist” goes wide but can only go so deep, preventing them from building applicable expertise for any specific decision.

It takes too long — Most operational decisions have a decision window of three days or fewer, and decision makers typically bring finance in at the last moment. This leaves little time for finance business partners to get the analysis right. If finance tries to iterate to improve its recommendation, it may miss the decision-making window altogether.

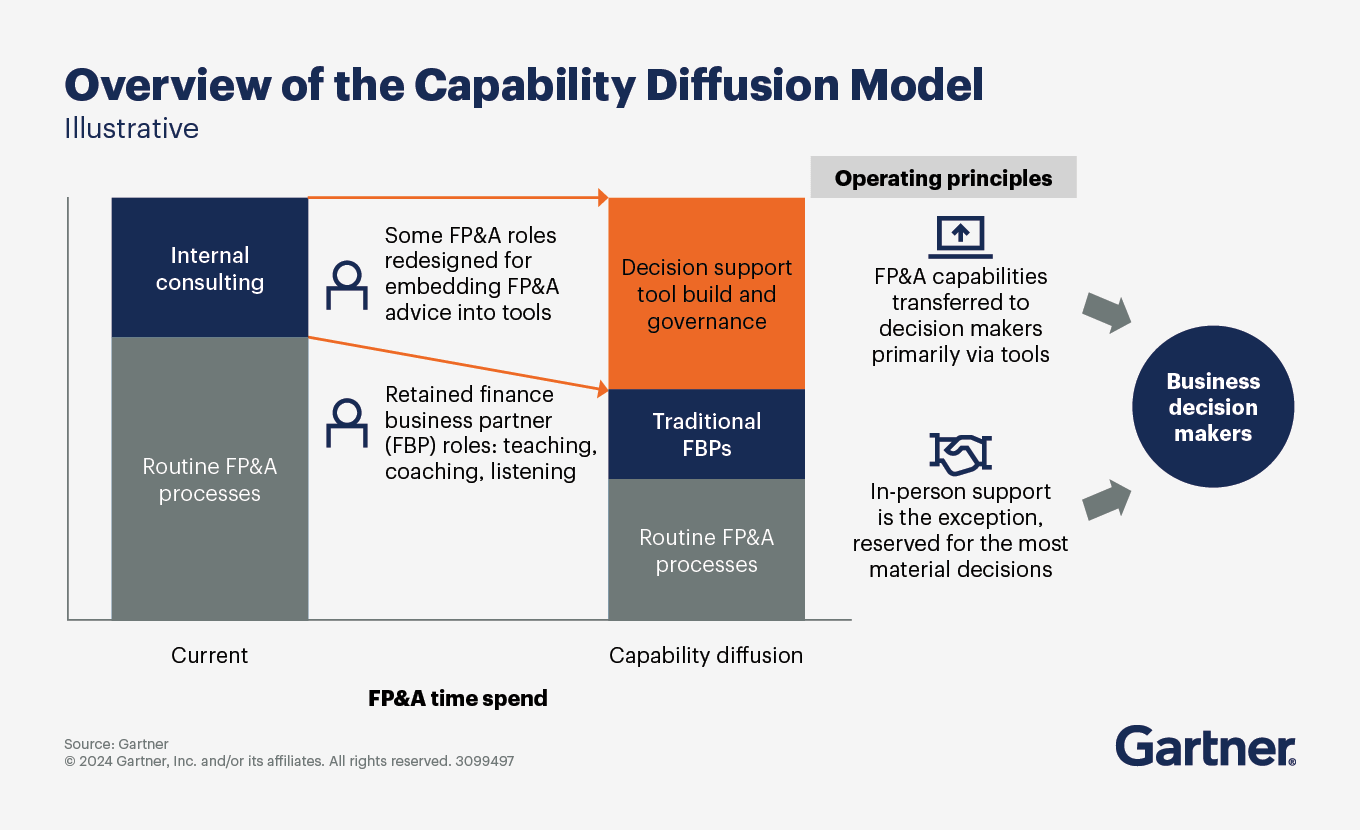

Replace traditional finance business partnering with a capability diffusion approach

The traditional FP&A model is struggling to keep up with the increasing complexity of decision-making. Enter the "capability diffusion" approach, which leverages technology to transform FP&A from a specialized finance team into an enterprise-wide capability. Here are some key takeaways on the benefits of this model:

- Expanded Reach: By embedding FP&A guidance into decision support tools, the capability diffusion model allows FP&A insights to reach a broader range of decision-makers. This means more decisions benefit from FP&A input without the need for additional personnel.

Increased self-sufficiency. With technology-enabled tools, decision makers can independently apply FP&A insights, reducing the need for constant hands-on support. This shift not only eases the demand on FP&A staff but also empowers business leaders to make more informed decisions.

Enhanced flexibility. By making in-person business partnering the exception rather than the rule, FP&A can focus its resources on the most critical and unique decisions, providing tailored support where it’s needed most.

Scalability. The model balances scale and customization, allowing FP&A to deliver high-quality insights consistently across the organization, even as complexity and demands grow.

Adopting capability diffusion enhances FP&A sustainability and effectiveness. Retained finance business partners should:

Embrace technology. Use digital tools for decision support.

Focus on teaching. Empower decision makers to use FP&A tools independently.

Build trust. Establish a finance “seal of approval” on digital tools.

Attend a Conference

Join Gartner experts and your peers to accelerate growth

Gather alongside your peers in National Harbor to gain insight on emerging trends, receive one-on-one guidance from a Gartner expert and create a strategy to tackle your priorities head-on.

Gartner Finance Symposium/Xpo™

National Harbor, MD

Related finance business partnering resources

Gartner clients: Log in for a complete suite of actionable insights and tools on finance business partnering.

FAQ on finance business partnering

What is finance business partnering?

Finance business partnering involves finance professionals working closely with other business units to provide financial insights and support strategic decision making. They translate financial data into actionable business strategies, improving financial performance and ensuring alignment with overall business goals. This role goes beyond traditional finance tasks, focusing on collaboration, proactive analysis and fostering a deeper understanding of financial impacts across the organization.

What are the challenges in implementing finance business partnering?

Challenges to implementing finance business partnering include:

Cultural resistance. Shifting from traditional finance roles to collaborative partnerships can meet with resistance.

Skill gaps. Finance professionals may lack the necessary business acumen and communication skills.

Resource constraints. Limited time and budget can hinder effective partnering.

Data silos. Inconsistent or inaccessible data can impede accurate analysis and insights.

How does finance business partnering contribute to business growth?

Finance business partnering drives business growth by providing strategic insights, improving financial decision making and aligning financial goals with business objectives. By translating financial data into actionable strategies, finance partners help optimize resource allocation, identify growth opportunities and mitigate risks, fostering a more agile and responsive business environment.

Drive stronger performance on your mission-critical priorities.