Establish a clear vision for how finance AI will transform your function.

- Gartner client? Log in for personalized search results.

AI in finance is now mainstream

Generative AI (GenAI) technologies are becoming more and more accessible, accelerating AI investment plans. Gartner research reveals that, on average, enterprises that have deployed at least one AI use case are exploring an additional 10 AI initiatives, and 56% of finance functions plan to increase their AI investments by at least 10% in the next two years.

This raises an important question: At what point does AI investment become excessive? Only 46% of CFOs say they’ve had explicit conversations with their finance leadership teams about how ambitious they should be with AI in the next one to two years. Before substantially increasing investments, CFOs and their leadership teams need a firm grasp and a clear vision of what drives success with AI in finance and beyond.

As CFOs boost investments in finance AI, an informed strategy is essential

Leading organizations overcome the challenges of finance AI adoption for effective transformation with the following success strategies.

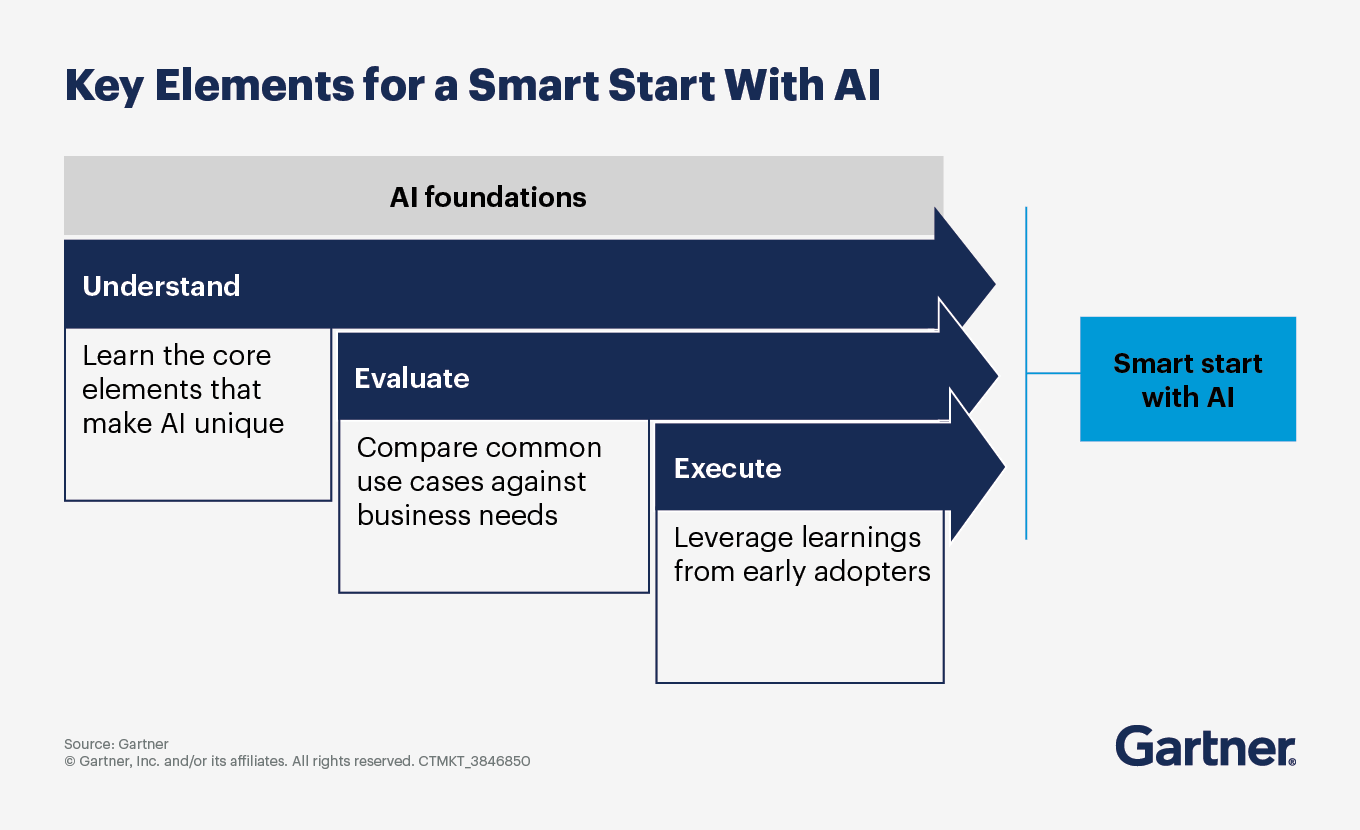

Learn what makes AI solutions for finance unique and compelling

At its core, AI is a computer program or machine’s ability to learn from data at scale and then think, judge and act upon that data like humans do. While other technologies, like robotics, can replicate human action, AI replicates complex, nuanced knowledge work and thinking tasks. It does so using a variety of techniques, including machine learning, natural language modeling and rule-based learning.

Finance AI has made significant progress of late, but there is still room for growth. AI-based forecast models can evaluate data on multiple business drivers to project future revenue. Compared to a human analyst evaluating the same drivers in a spreadsheet, AI can process and analyze data faster and at much higher volumes. The depth of AI’s analysis is constrained only by the data available, the training from its designers and the directions of its users.

View AI applications in finance through the lens of business needs

New use cases for AI in finance are continually emerging as the technology develops. The costs and benefits vary depending on the organization’s context and needs. For example, while one organization might gain needed insights into its cash forecasting by applying AI, an organization with fairly automated cash forecasting might not experience the same gains.

When choosing which finance AI use cases to pursue, evaluate the options that make the most sense for your organization. Assess the data sources aligned to a specific business problem before layering in the appropriate AI technique, and prioritize high-impact use cases based on intended outcomes, feasibility and scalability.

Make the most of lessons learned from early adopters of AI in finance

AI’s humanlike ability to make decisions often clashes with a conservative finance culture that relies on personal reviews to assure data accuracy. Organizations that make the most progress on AI take an intentional approach to building it.

To make fast progress on AI implementation and avoid common early pitfalls, apply the lessons learned from peer organizations. Organizations that succeed with AI in finance focus on training citizen data scientists, cataloging data assets and positioning AI as a co-worker. Make AI easier to adopt by making changes that leverage AI’s capabilities but also keep people in the loop where they are needed and where they perform well. Using AI to help employees perform better fosters acceptance, boosts job satisfaction and improves performance without driving fear that AI will take jobs away.

AI in finance FAQs

What is AI in finance?

AI in finance refers to the application of artificial intelligence technologies to enhance financial processes and decision making. It includes tasks like automating routine operations, analyzing large datasets for insights, predicting market trends, managing risks and personalizing customer experiences. By leveraging AI, financial institutions can improve efficiency, accuracy and strategic planning, ultimately driving innovation and better financial outcomes.

What are the key benefits of AI for financial forecasting and predictive analytics?

AI improves the finance function’s ability to predict, analyze and uncover important patterns from unstructured data, and thereby automate work, make informed decisions, compute large quantities of information (including unstructured data) and avoid risk.

How can CFOs prepare their teams for finance AI adoption?

It’s critical to create a culture that embraces and trusts AI. Progressive CFOs position finance for AI success by implementing the AI-forward framework — a structured approach to adopting AI in finance. The framework includes the following components:

Developing an organizational AI competency

Defining business drivers and automating the collection, correction and distribution of data

Purchasing software platforms with embedded AI finance features

Championing AI initiatives and communicating AI’s benefits

What should CFOs consider when implementing AI in finance?

Unlike automation software that can do simple, rote tasks, AI performs tasks that historically could only be handled by humans. This positions AI as more of a co-worker than other technologies. But despite AI’s capabilities, finance has unique responsibilities — such as validating the integrity of financial statements — that can’t be delegated to an algorithm.

When building AI-driven processes in finance, CFOs should consider how to design solutions with total transparency so that responsible humans can remain fully informed and accountable.

How important are data quality and data governance for successful AI adoption in finance?

Data is an essential asset for training algorithms to accurately answer questions. Large volumes of higher-accuracy data help to build highly effective and reliable AI models. AI-forward teams prioritize defining business drivers, as well as automating the collection, correction and distribution of data.

Attend a Conference

Join Gartner experts and your peers to accelerate growth

Gather alongside your peers in National Harbor to gain insight on emerging trends, receive one-on-one guidance from a Gartner expert and create a strategy to tackle your priorities head-on.

Gartner Finance Symposium/Xpo™

National Harbor, MD

Drive stronger performance on your mission-critical priorities.