Make B2B product life cycle decisions with a framework informed by data on product performance and customer satisfaction.

- Gartner client? Log in for personalized search results.

Optimize the Product Life Cycle With Data-Driven Decisions

Prioritize the customer value of new products

Product managers are under pressure to deliver new products, features and capabilities on time and within budget. Unfortunately, this focus often makes customer value and usability a secondary concern, resulting in releases that fail to make a difference for their customers.

Download this research and learn to:

- Focus on customer lifetime value and usability alongside time to market.

- Implement outcome-oriented measures such as postimplementation interviews and alpha/beta programs.

- Gain competitive advantage by prioritizing customer outcomes over internal outputs.

Remove the emotion from product life cycle decisions

Engage across functions to develop an objective and data-driven approach to decisions about maintaining, refreshing or retiring B2B technology products.

Know the Lifecycle Stage

Build a Decision Framework

Monitor Market Signals

Evolve and Retire

Understand where each product in your portfolio is in its life cycle

Making sound B2B technology product life cycle decisions starts with a complete view of the maturity levels of the products across your portfolio. Categorize each product or service into one of the following product life cycle stages:

Early stage, which spans from ideation to minimum marketable product

Middle stage, spanning from early release to self-sustaining

Late stage, ranging from late maturity to end-of-life products

A product’s age doesn’t necessarily determine its life cycle stage. Some products profitably meet the needs of customers for years. Others see initial enthusiasm but soon stagnate. To ensure a more informed categorization:

Monitor customer feedback using product analytics tools and voice-of-the-customer (VoC) processes to gather, analyze and prioritize the customer perspective.

Query the work management system to report the mix of work done on a given product or service. The work on an early-stage product will include significant experimentation, design and prototyping.

Interview product managers and business stakeholders. Ask them about transitions, transformations or disruptions underway in a product’s market that may not be apparent in the product roadmap or work plan.

Get a market assessment from product management. For products with significant internal or external competition, information on competitors or internal alternatives can inform the life cycle assessment.

Obtain the past three years of a product’s profit and loss (P&L). Nothing says declining product more than declining revenue and market share, even if the product is still generating profits and cash for the business.

Seek external data on customer demand, customer satisfaction, competitors’ product offerings and potential for market disruption to understand the broader context.

Use a data-driven approach with a defined standard of evidence to categorize the product life cycle. This removes the emotion and cuts short what might otherwise be long arguments. Standard metrics aligned with the product life cycle provide a common language that business and technology stakeholders can all align on. These data-based insights also help inform subsequent product management decisions, such as refining product strategy and product roadmaps, and deciding whether to maintain, refresh or retire a product.

Establish criteria for whether to maintain, refresh or retire a product

Expanding from the B2B technology product life cycle categorization exercise, product leaders can guide the development of a decision framework the organization can initiate when a product begins to underperform against planned expectations. The framework can guide decisions about whether to maintain, refresh or retire the product.

Maintain is to continue with the product in the current state.

Refresh calls for minor product changes, updates or some market repositioning, including pivots to rework the existing solution to address a new problem for a different user.

Retire begins the process of permanently withdrawing the product from the market.

A maintain-refresh-retire (MRR) decision-making framework enables objective decisions about what to do when a product appears to be faltering. It can overcome biases in decision making — for example, sales teams may want to maintain a product with a known value proposition and installed base even if maintenance costs exceed income, or engineering may allow excitement about new technologies to bias them toward a refresh, absent evidence that the new technology will improve customer outcomes.

The framework should be as clear and quantitative as possible. The organization must commit to using it to make data-driven product decisions instead of making gut calls. By doing so, everyone from the product leader to the stakeholder can eliminate impassioned appeals and reduce favoritism, while helping achieve consensus.

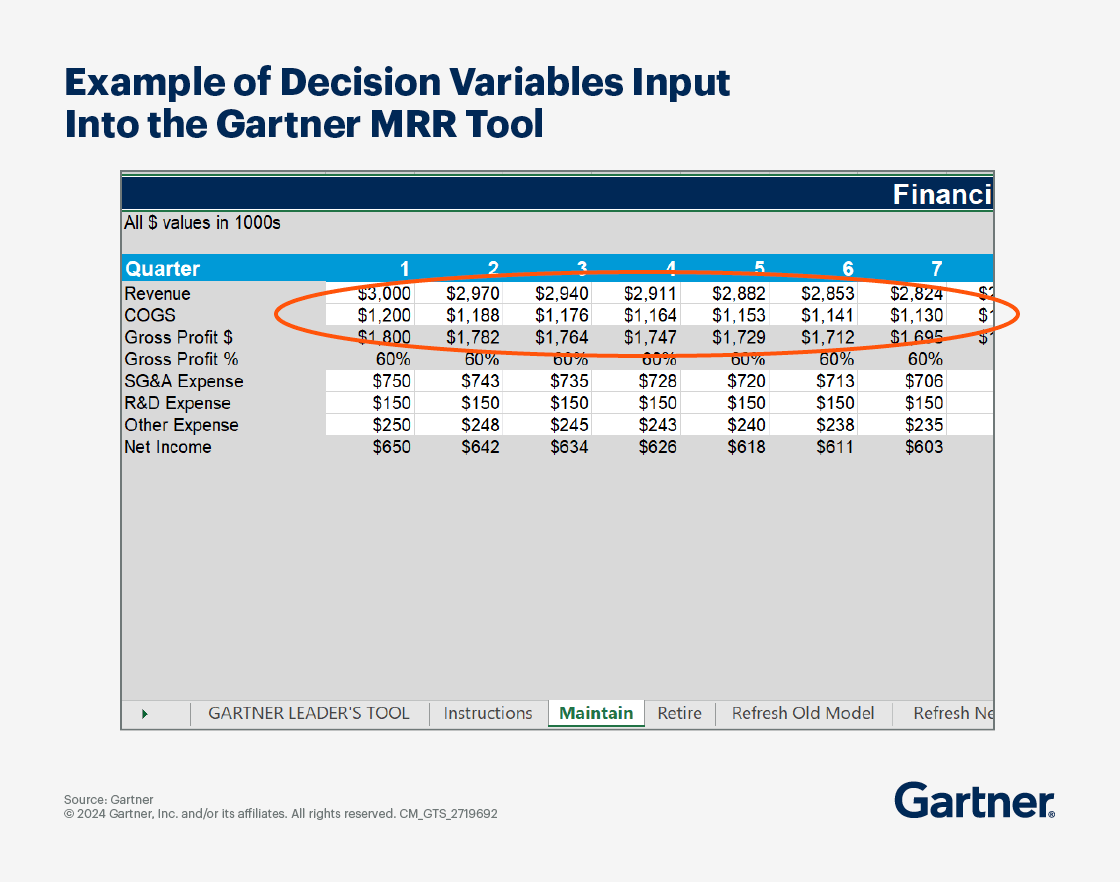

An effective MRR framework enables product managers to model the costs and benefits of each option to calculate their net present value (NPV) and evaluate them against each other and other projects. It should consider the costs that can be avoided and revenues that can be transferred. It should also consider various timing factors, such as how long it will take to retire a product or how long a refreshed product will overlap with earlier versions in the market. Variables required to calculate this decision may include:

Revenue and margin. What is the current situation, the potential for lost revenue from retiring the product or leaving it as/is, the potential incremental replacement revenue from a new or refreshed product, and the price change impact of a refreshed product?

R&D engineering/development costs. How much will it cost to support and maintain the current product, refresh it or develop a new product to solve that customer problem?

Additional costs to remarket. For a refreshed product, what will be the costs for marketing, training and providing channel support for a relaunch?

Less tangible factors may either preclude or force possible product life cycle options in the financial analysis. They include:

External supplier discontinuations or disruptions

Regulatory changes

Market/technology changes

Potential customer, reputational or political impact of discontinuation

Software usage analytics indicating reduced customer engagement

Once you have a theoretical agreement on an MRR framework, product managers can validate it by applying historical data related to past product life cycle decisions to see how the framework’s conclusions align with reality.

Know when to consider refreshing or retiring a product

The difference between a B2B technology product that enjoys a long and profitable life and one that quickly declines can depend on how the product leader responds to signals of change across the product life cycle. Knowing when it’s time to initiate an MRR evaluation for a product requires you to monitor market signals.

In the early stage of a product’s life cycle, product managers rely mostly on early customer feedback captured through product analytics tools and VoC processes. This offers key insights into how the product is addressing market demand.

As the product matures into its middle stage, product leaders have more — and more varied — information sources to monitor. They include financial and product performance metrics. By comparing current product revenue and margin against year-over-year historical figures, product managers can get early indications of underperformance. Performance metrics can even help identify specific areas of concern. For example, a decrease in gross margin accompanied by no increase in cost of goods sold can indicate downward price pressure, signaling the need to review competitor pricing.

Internal stakeholders who regularly interact with customers and prospects provide another source of information on product performance. So does direct contact with customers at trade shows, and during sales ride-alongs and VoC sessions.

None of these monitoring approaches is enough on its own to definitively identify a change in market conditions that will trigger an MRR review. In combination, they signal the need to investigate further or take action.

Effectively manage product evolution and retirement

Once product leaders have decided to refresh a product or retire it, they have options to ensure effective execution.

Evolving products for retention and growth

When evolving products to take advantage of new revenue growth opportunities, product managers have several strategies they can embrace, including:

Introducing a premium version with enhanced features, support or scalability

Creating a basic version with only the essential features to expand reach to smaller, cost-conscious customers and to counter low-cost competitors

Working with sales and marketing to expand into new geographies

Adding new integrations and APIs to address customers who are part of ecosystems

Expanding workflow integrations with other products in the portfolio to boost cross-sells

Addressing new use cases

Redesigning the product for an improved user experience

Introducing a free trial or “freemium” version

These strategies vary in terms of the required effort and investment. Use all the available customer, product and market data to assess and prioritize these approaches to maximize ROI.

Even as you are evolving a product to embrace new opportunities, it’s important to maintain or enhance the user experience. Analytics can help to detect features that are no longer being used and remove them, which can positively improve the user experience, customer lifetime value, time to value and quality.

Product managers must also include capacity during a refresh for upgrades to the underlying technology to remain secure, relevant and supportable. For example, evolving security standards are a frequent reason for required infrastructure upgrades. Product managers must not only deliver these upgrades but also provide any migration tools and plans to minimize customer impact. Though typically less frequent, new and changing regulatory requirements may also need to be addressed through a product refresh.

Act on end-of-life cycles

Every product will eventually need to be retired. When the MRR evaluation determines that a product has reached its end of life, product managers must work with product marketing and sales to manage the retirement with the same discipline afforded to a new product launch.

Maintain written internal and customer policies governing the entire process of product retirement from the cessation of sales to the end of support. These policies include the minimum time allocated to each stage of the end-of-life process so that customers and stakeholders have the opportunity to prepare for these events.

Attend a Conference

Accelerate growth with Gartner conferences

Gain exclusive insights on the latest trends, receive one-on-one guidance from a Gartner expert, network with a community of your peers and leave ready to tackle your mission-critical priorities.

Drive stronger performance on your mission-critical priorities.