Develop a successful B2B technology product plan using a four-step process.

- Gartner client? Log in for personalized search results.

Product Planning: Capture Market Opportunities and Meet Customer Needs

Identify the best path toward incorporating GenAI into your product portfolio

Technology providers are gravitating to four main approaches to delivering GenAI capabilities: foundation models, applications, enabling tools and custom services. This research helps product managers:

Map where, how and when to use each of the four approaches

Decide whether to embed GenAI in your core product, develop new offerings or do both

Mine the growing opportunities in the GenAI-enabling tool market

Address the custom solution development opportunity

Drive product success with a customer-centric product plan

Successful products start with identifying and understanding a target customer, sizing the market, evaluating competitors, and building a product strategy and roadmap informed by these insights.

Stay up-to-date on the AI vendor race with insights and guidance for technology and service providers competing within and across the layers of the modern AI tech stack.

Know the Customer

Size the Opportunity

Analyze the Competition

Create a Product Strategy

Ground your B2B technology product planning in knowledge about the customer

Successful product planning begins with a clear definition of who the customer is and what specific needs or objectives they have that the product will address. Knowing the customer from the outset has become more essential in recent years given the tendency of today’s technology buyer to self-educate and move closer to a decision before ever speaking with a salesperson.

To gain that customer knowledge, product managers must embrace new methods to collect and analyze user behavior and collaborate with prospects and customers to gather necessary insights. Focus on the following:

Define target customer segments

Segmenting the market will allow product managers to be more precise about who the customer is and what problems your product can solve. Segmentation is foundational to go-to-market (GTM) activities, such as market positioning and use case packaging. It is also key for identifying customers that can validate product roadmaps and inform expansion plans.

Capture VoC data

Companies that effectively discover and validate valuable customer and market problems set themselves up for greater product success. A holistic voice of the customer (VoC) program helps with that discovery, especially when it includes diverse sources of quantitative and qualitative data.

Today’s VoC systems are capable of capturing significant amounts of product usage data and customer feedback. Direct customer interactions, such as interviews and customer advisory boards (CABs), are also necessary to identify drivers of buyer and user behavior.

Establish a practice to mine and analyze both types of VoC data.

Create enterprise and individual personas

Leverage customer segment insights and VoC data to define the customer personas that will inform development, customer experience (CX) design and GTM strategy.

The first persona to create for B2B technology product planning describes the ideal customer — meaning, the target B2B company. An enterprise persona should include descriptors, such as firmographics, business situation and operating model. Product managers may also identify “acceptable” personas (whose circumstances include acceptable deviations) and unacceptable ones.

Next, product managers should create personas for important individual users. Examples can include a system administrator (power user) and business professional (less technical end user).

Though personas are a key input into technology product planning, they will get used as well in other areas of product management at later points in the product life cycle. Product managers should keep them updated as customer feedback, sales metrics and other input provide new insights.

Understand the size and appeal of the market you aim to serve

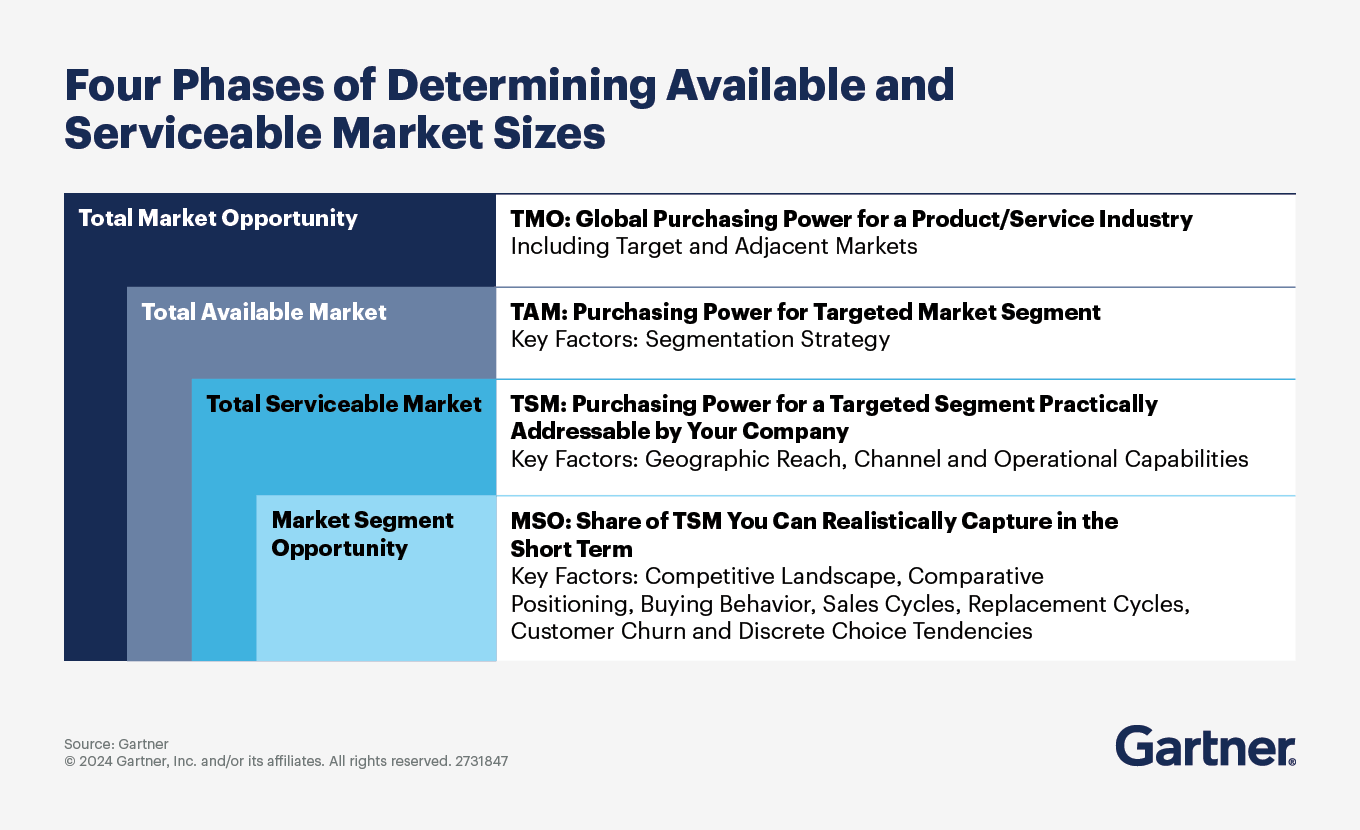

Sizing the market opportunity for a product is critical for creating investor pitch decks and executive business cases. To realistically size the market based on the target customer segments, embrace the following four phases.

Phase 1: Define the total market opportunity (TMO)

Leverage a combination of top-down and bottom-up modeling to define the market size and validate the opportunity. Top-down methodologies aggregate the sales revenue of competitors and industry analyst forecasts (such as Gartner’s IT spend forecasts) with data from government sources and industry associations.

Bottom-up analysis, in contrast, combines primary research, such as stakeholder interviews and sales pipeline analysis, with secondary research from third parties.

Product managers should also, in this phase, define the target customer by industry vertical, company size and/or number of users. Apply average per-customer annual revenue estimates to the refined customer base to generate an indicative annual revenue figure.

Phase 2: Define the TAM

Refining a TMO estimate into a total addressable market (TAM) requires product managers to define the segment of prospective buyers they want to pursue first. Identifying a TAM enables the product manager to focus on the specific needs of one set of customers. This selection should be based on:

Customer needs/market challenges

The competitive landscape

Common technology needs or trends

Macroeconomic trends and megatrends in a region or customer segment

Phase 3: Define the TSM

A total serviceable market (TSM) calculation reflects real-world factors influencing how the market will adopt the proposed product/service.

In this phase, the product manager should estimate how many customers within the targeted market are expected to buy. For emerging technologies, consider factors such as:

How long will it take to realize the business benefits of the technology?

How long will it take for the ease of use of the technology to become acceptable?

How long will it take for the price and total cost of ownership to become acceptable?

At what expected intervals will the organization need to expand the sales and marketing channels to stay ahead of demand?

Phase 4: Define the MSO

The market segment opportunity (MSO) represents what the organization can realistically achieve with its existing operations, marketing/sales channels and distribution structure.

To define the MSO, use survey techniques to answer:

How strong is the company’s brand among prospects?

How many existing companies replace their equivalent product/service each year?

What product/service improvements, ROI and speed of transition are necessary to persuade customers to replace their current product/service?

Do price elasticity and sensitivity trends favor the competition?

What are the key drivers of customer churn and switching?

How will the offering match up against the current pricing and revenue models of similar products?

What is a realistic time frame for cycles related to customer sales, onboarding and revenue recognition?

Determining MSO is often the most difficult phase because it forces the company to detail its strengths and weaknesses. Without honest and transparent internal assessment, an MSO calculation risks setting unrealistic expectations.

Leverage competitive findings to differentiate your product

Competitive intelligence allows product managers to steer product planning toward product strategies and function development with the greatest potential for impact. To analyze the competitive landscape, take steps to:

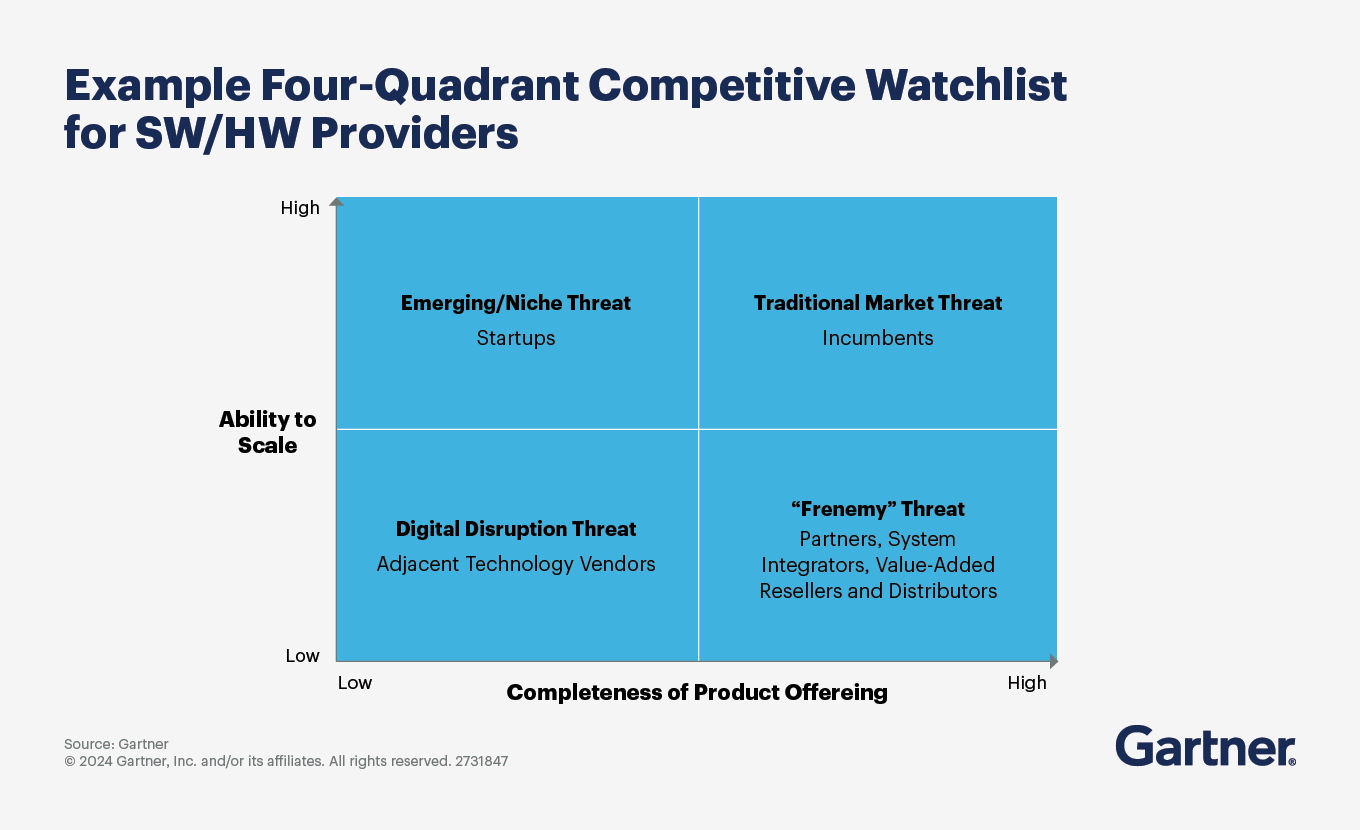

Identify direct and indirect competitors

Compile a list of direct (traditional) and indirect (nontraditional) competitors. Create a four-quadrant competitive watchlist aligned to a 2 x 2 matrix correlated to an x-axis (completeness of product offering) and y-axis (ability to scale).

Product managers should brainstorm with stakeholders from product marketing, sales and elsewhere to compile a comprehensive list of competitors. Map them in the four-quadrant competitive watchlist. Determine the leading competitors in each quadrant. Zero in on competitors with the greatest ability to take shares away from your product.

Assess each competitor’s product weaknesses

Begin by researching and extrapolating data from these sources:

Peer review sites, such as Gartner Peer Insights™, Capterra™ and Software Advice™

Social media, such as LinkedIn and Glassdoor

The competitor’s website, product technical specification documents and published financial reports

The competitor’s partner portal sites

Your engineering team’s product teardown of the weaknesses of your competitor’s product

Win/loss analysis

Interviews with new hires who came from the competition and can reveal information that is not under a nondisclosure agreement (NDA)

Interviews with trusted partners who have dealt with the competition in the past

Insights into pricing models, metrics or terms used

Incorporate competitive intelligence into product management decisions

Information on a competitor’s product often has a shelf life of about eight months or fewer. To best exploit the competitor’s weaknesses, product managers should incorporate competitive information throughout their product management activities.

In the context of B2B technology product planning, incorporate competitive intelligence early on, when evaluating the market for product investment opportunities. Seek consensus with product marketing and sales on ways to exploit the competitor. Embed the competitor’s product weaknesses into technology product planning documentation, including agile storyboards and VoC planning documents.

Combine the technology product planning elements into a product strategy

Combine the insights you have gained about the customer segments, the market and competitive intelligence, and use the Gartner Product Strategy Wheel Framework to create a customer-centric product strategy aligned with company objectives.

Include the following four core components:

Environmental and market factors. Include key trends in the industry, including your research on the focus customer segment and the competitive landscape, as well as technology opportunities.

Company factors. Include competencies that support product success, like technical skills or industry partnerships. Consider company constraints as well, including funding or financial targets.

Construct a vision for differentiation. Clearly articulate the unfilled needs the product aims to address and what is unique about the product from the customer’s perspective compared to the competition. This is the heart of the strategy and should be detailed enough to guide roadmap prioritization.

Strategic themes. List three to five themes that development roadmaps will align under. Capture how the company will realize its product vision, including aspects of product excellence critical to the vision.

Attend a Conference

Accelerate growth with Gartner conferences

Gain exclusive insights on the latest trends, receive one-on-one guidance from a Gartner expert, network with a community of your peers and leave ready to tackle your mission-critical priorities.

Frequently asked questions on product planning

What are the key elements of a product planning process?

Product planning lays the foundation for developing a product or offering. As a result, an effective product planning process includes the following activities:

Identify the target customer.

Understand the customer’s needs.

Assess and size the potential market and segment it.

Identify and evaluate competitors and their products.

What is the difference between product planning and product management?

Product planning establishes the basis for cross-functional teams to plan, develop and introduce products and services. It falls under the broader domain of product management, which includes conceiving, defining, delivering, monitoring, refining and retiring products and services to maximize business results.

Although product planning is a subdiscipline of product management, thorough product planning also enables effective management of a given product by ensuring from the outset that the organization has the right market and segment in mind when designing and developing it.

What is the most critical part of product planning?

Gartner surveys of product management leaders consistently find that they rank “understanding customer needs” among their top 3 most critical challenges.

Understanding the customer is becoming more complex in the context of B2B technology products, given the increased merging of hardware, software and services in a single offering.

Who the customer is and what their needs are can also involve a matrix of buyers and users, not a single persona. As a result, knowing the customer is both critical to product planning and requires a mix of data-driven customer analytics and design thinking.

Drive stronger performance on your mission-critical priorities.