The global importance of this region makes it near-impossible for businesses to avoid impact. CSCOs must leverage the resilience built in recent years.

- Gartner client? Log in for personalized search results.

Why CSCOs must act now on the Israel-Iran conflict

Despite attempts at a ceasefire between Israel and Iran, no chief supply chain officer (CSCO) can ignore what this — and other — geopolitical flashpoints could mean for their business.

Container traffic through the Suez Canal dropped by 50% following the November 2023 Red Sea crisis — a stark precedent for what’s unfolding now. With 30% of global container traffic historically passing through this corridor, the implications are massive. Gartner outlines three strategic imperatives for CSCOs.

3 strategic imperatives for CSCOs amid 2025 Middle East supply chain disruption

Today’s challenge isn’t just about rerouting shipments — it’s about preserving business continuity, protecting margins and maintaining customer trust.

Imperative No. 1: Assess exposure to global bottlenecks

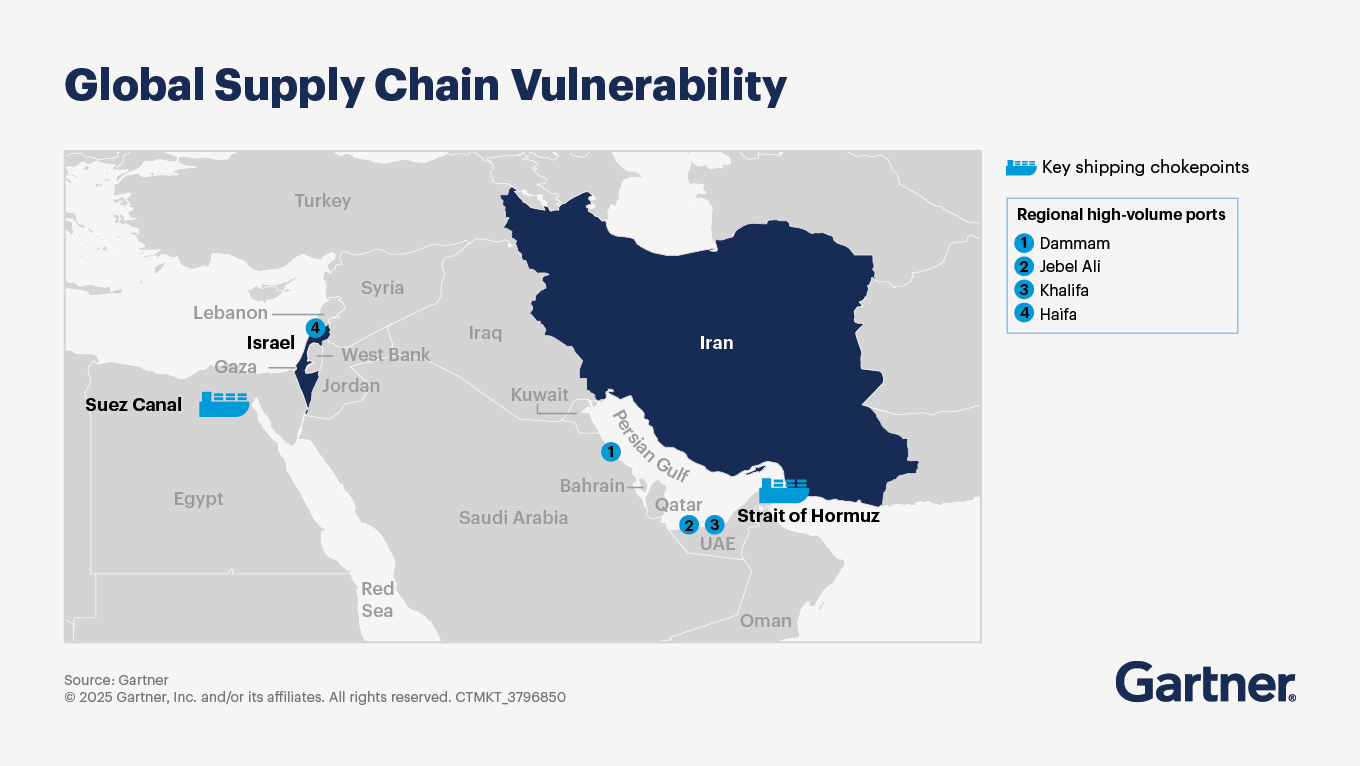

Gartner identifies four critical chokepoints: the Red Sea/Suez Canal, the Strait of Hormuz, regional high-volume ports (e.g., Jebel Ali, Haifa) and Eurasian railfreight. Each presents unique risks:

Red Sea/Suez Canal: APAC-to-Europe transit times could more than double.

Strait of Hormuz: Transit times may double or increase by up to 14 days.

Regional high-volume ports: Shipping costs could spike by 30% to 50%.

Eurasian railfreight: Railfreight delays of four to six weeks are likely due to demand surges.

What you may not know: Far East-to-Europe railfreight rose 9% YoY in early 2025, signaling a shift already underway.

Imperative No. 2: Prepare for cost volatility

Amid supply chain disruption, CSCOs must proactively brief CFOs on:

Fuel surcharges and marine insurance premiums, which have already risen 15% to 30%

Inventory holding costs, as “just-in-time” gives way to “just-in-case”

Technology investment gaps, especially in visibility and risk management tools

What you may not know: Underinvestment in supply chain tech has created more widespread vulnerabilities than many assume.

Imperative No. 3: Diversify sourcing and supplier networks

CSCOs must:

Reassess overreliance on Middle Eastern suppliers

Identify high-risk components and raw materials

Revalidate supplier risk management capabilities

What you may not know: According to the 2023 Gartner Future of Supply Chain Survey, two-thirds of supply chain leaders have invested in collaborative supplier relationships, but over 50% still face exposure due to geographic concentration.

The bottom line on responding to Middle East supply chain disruption

Gartner’s message is clear: Resilience is not a future goal — it’s a current necessity. The Israel-Iran conflict is a stress test for every supply chain strategy built since COVID-19. CSCOs who act now will not only mitigate supply chain risk but may also gain competitive advantage.

Attend a Conference

Experience Supply Chain conferences

With exclusive insights from Gartner experts on the latest trends, sessions curated for your role and unmatched peer networking, Gartner conferences help you accelerate your priorities.

Gartner Supply Chain Symposium/Xpo™

Orlando, FL

Drive stronger performance on your mission-critical priorities.