New Gartner data: In the past 24 months, supplier collaboration skyrocketed in priority for 88% of procurement leaders.

- Gartner client? Log in for personalized search results.

Supplier Relationship Management Best Practices

Strategic supplier relationship management means aligning suppliers to value

Supplier segmentation is a foundational pillar of effective supplier relationship management (SRM), but only 35% of chief procurement officers have a working model for differentiating their most critical suppliers by value.

Download “4 Ways to Better Manage Your Complex Supply Base” for actionable insights on:

How to spot a strategic supplier

Key metrics on supplier value, criticality and revenue at risk

Supplier scorecard basics

Gain competitive advantage through your SRM strategy

Supplier relationship management (SRM) is the partnership between buyer and supplier to sustain and enhance supplier value. SRM is foundational to strategic collaboration with the supply base.

Scorecard vs. Strategy

Supplier Collaboration

Supplier Innovation

Supplier Quality

Strategic Partnership

Supplier relationship management is more than a scorecard — it’s a strategy

Sixty-two percent of companies practicing supplier relationship management (SRM) use supplier scorecards to measure supplier performance. It’s no surprise then that one of the most common SRM questions Gartner gets from procurement leaders is, “What metrics should we include on our supplier scorecard?”

Successful supplier scorecards enable clear and objective understanding of a supplier’s ability to deliver value against business priorities, as well as stakeholder support of supplier development strategies. But the best procurement organizations measure their most strategic suppliers on value-driven metrics that go beyond operational ones like cost, quality and service. They include SRM metrics related to category strategy, business partnership and supply chain resilience.

Some supplier scorecards fail to properly surface the value of suppliers by:

Measuring as many suppliers as possible

Using a one-size-fits-all approach to measure all suppliers

Failing to provide transparency into the supply base on performance measurement

Omitting the supplier’s feedback on changes the buying organization needs to make to fix problems that could adversely affect the supplier’s performance

To develop best-in-class supplier performance measurement, Gartner recommends procurement leaders use supplier segmentation as part of supplier relationship management to focus on suppliers most relevant to the business.

Strategic suppliers have the potential for joint value, innovation and collaboration, so supplier performance measurement should prioritize the supply chain sustainability metrics that drive continuous improvement. In contrast, operational excellence is key for nonstrategic but critical suppliers, so prioritize financial, risk and compliance metrics on the scorecard. There remains a lot of room to improve the breadth of supplier scorecards, as only 22% of procurement organizations report using supplier scorecards with both operational and nonoperational metrics.

It’s also important to incentivize suppliers to perform and provide feedback useful for uncovering performance improvement opportunities. Scoring must come with action. Top-scoring suppliers should be rewarded with visibility/recognition, revenue/margin growth and/or business development opportunities. Examples include:

Supplier awards

Peer benchmarking

Exclusivity

Co-branding

Staff training

Employee discounts

Underperforming suppliers, on the other hand, need clear consequences like loss of business volume and/or limited new business opportunities.

Supplier performance measurement should be managed in the spirit of continuous improvement, so voice-of-the-supplier and supplier satisfaction surveys serve as complements to supplier scorecards.

Implement a 4-step framework to create an effective supplier collaboration strategy

A majority of leading procurement organizations (62%) say strengthening relationships with their supply base is a top priority for supplier relationship management (SRM). The business case is clear: Supplier collaboration yields cost and quality improvements, higher engagement in sustainability initiatives and priority access to scarce capacity. Besides, squeezing supplier margins for cost savings is unsustainable. Plus, competition is fierce. The buying organization’s leverage is diminishing, and procurement teams across industries are under increasing pressure to deliver business value.

Operational collaboration is focused on reducing waste and increasing process efficiency via SRM, usually through dedicated technology systems (e.g., a supplier portal wherein you can manage purchase order submission, shipping, invoicing and materials forecasting).

Strategic collaboration, on the other hand, is about generating additive value beyond what was originally defined in the supplier contract. This type of SRM collaboration is not dependent on technology; common examples are quarterly business reviews, supplier summits and supplier satisfaction surveys.

Through hundreds of client interactions, Gartner has identified the four key steps to implementing an effective supplier collaboration strategy as part of the overall SRM approach.

Step 1: Strategy design. With an ever-growing number of supply partners and continuous pressure to reduce costs, procurement leaders often rush to launch supplier collaboration initiatives without recognizing that strategic planning is a crucial first step. This phase begins with clearly articulating the goals of supplier collaboration, identifying key stakeholders required to support the initiative and kick-starting the supplier segmentation process.

Step 2: Stakeholder alignment. Managing the supply chain organization is a key consideration for procurement teams focused on supplier collaboration, since you can’t effectively drive supplier collaboration without stakeholder support and resources. Involving stakeholders early and often in the design and execution of the supplier collaboration strategy can help secure critical mind share when multiple projects and limited resources make it difficult to get their attention. In the stakeholder alignment phase, secure stakeholder support, assign accountability and finalize supplier segmentation.

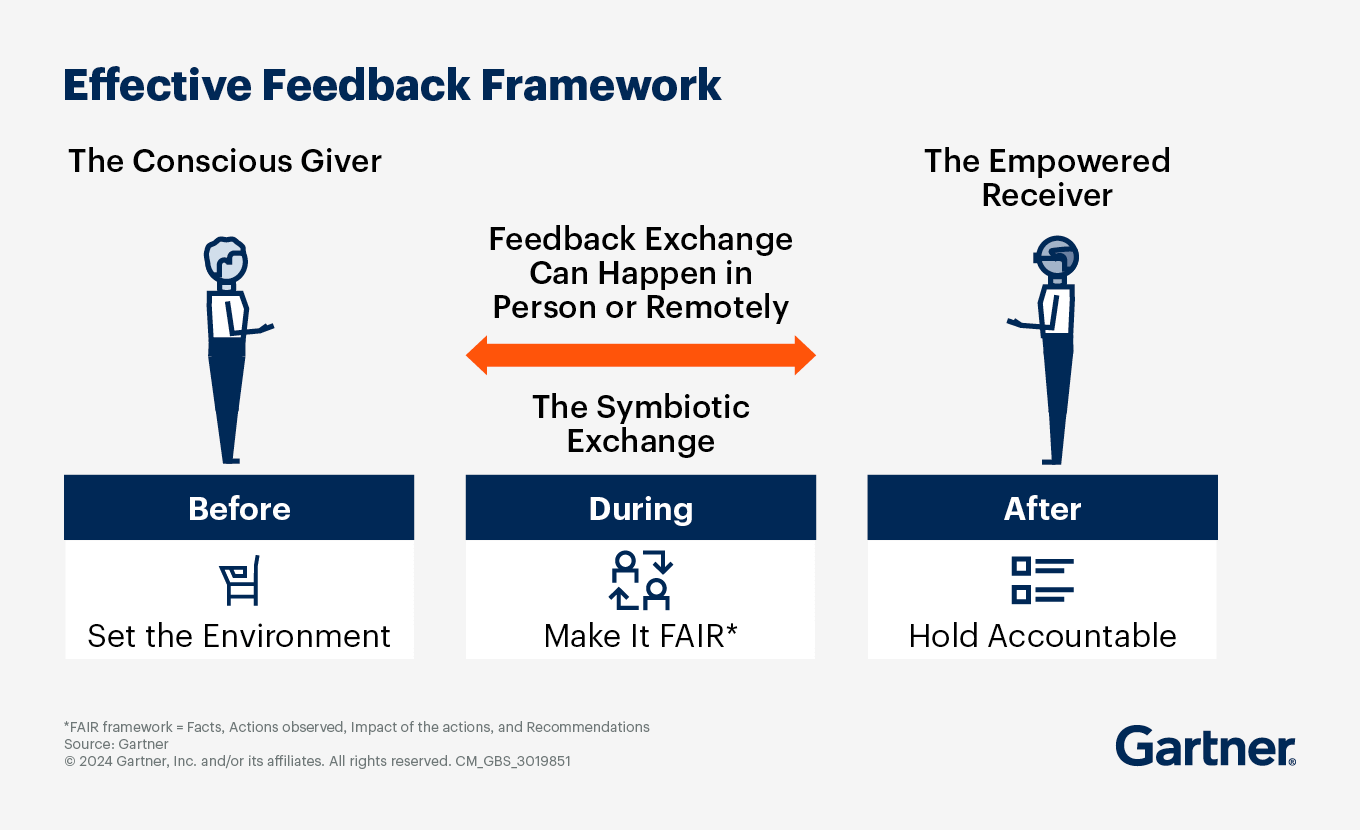

Step 3: Strategic supplier communication and launch. In this phase, communicate to strategic suppliers the objective for increased supplier collaboration (including that the buying organization will make changes to address supplier feedback) as well as the metrics that will be used to track performance. Gartner data shows that supplier reluctance and skepticism is the top challenge procurement leaders encounter when seeking to increase supplier collaboration, making transparency essential to the success of supplier relationship management.

Step 4: Strategy governance and scale. It’s typical to focus on establishing stronger partnerships with your strategic suppliers, and while this is a good first step, there is significant value to be gained from deploying other mechanisms to increase collaboration with the broader supplier base. In this phase, establish the guidelines of quarterly review meetings with strategic suppliers as well as the guidelines for supplier summits, supplier feedback surveys and supplier advisory councils.

2 ways proven to drive more supplier innovation value

Supply chain disruption underscores the need for supplier innovation in your supplier relationship management (SRM) strategy. A Gartner survey of 100 global procurement leaders revealed that 89% are under pressure to deepen supplier relationships because of supply shortages; 80% because of supply chain weaknesses exposed by the COVID-19 pandemic; 74% because of logistics challenges; and 63% because of inflation.

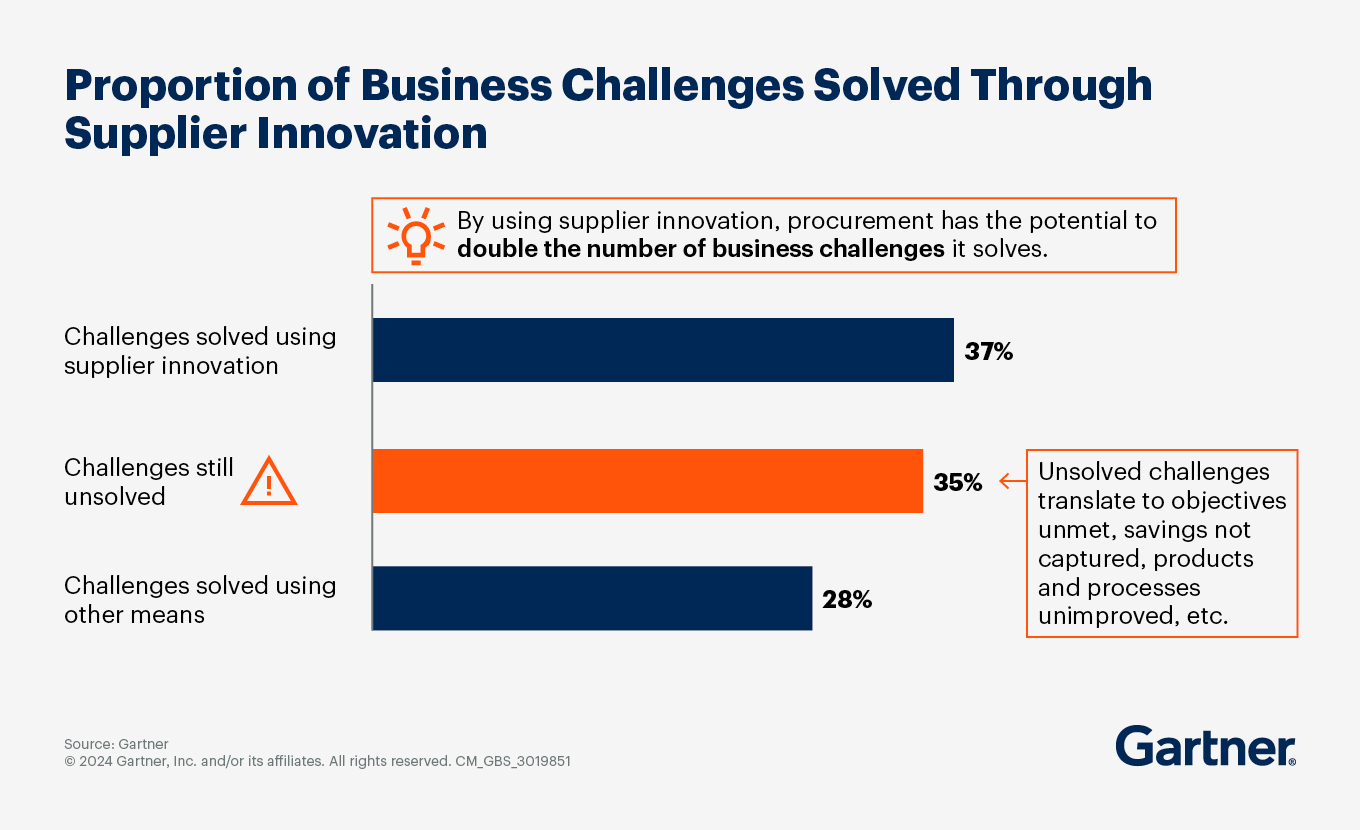

Supplier innovation has the potential to yield many benefits for the future supply chain, including cost reduction or avoidance, new product or service creation, process improvement, product or service improvement, risk mitigation, growth, and ESG achievement. But it’s hard to gather a high volume of quality ideas and select the best ideas to present to the business. Thus today’s SRM teams fail to capture the majority of potential supplier innovation value.

How do the best SRM teams — what Gartner calls “Innovation Champions” — successfully capture supplier innovation value? By prioritizing the idea-gathering and evaluation phases of the supplier innovation process. The supplier innovation process comprises seven phases: Challenge definition, idea gathering, idea evaluation, idea selection, innovation development, innovation implementation and innovation measurement.

In the idea-gathering phase, SRM leaders invest considerably more in these three actions than do typical organizations:

Provide a technology platform to suppliers to submit innovation ideas.

Host supplier innovation events in which suppliers present their ideas.

Ensure suppliers are up to date on challenges the buying organization is looking to solve.

Furthermore, in the idea-evaluation phase, the best SRM teams apply more structure than their peers when it comes to who reviews ideas, what they review and how they review.

Innovation Champions assign clear accountability to each reviewer and determine the decision mechanism in advance.

They pre-identify the metrics reviewers will use to evaluate each idea.

They also maintain a steering committee responsible for idea evaluation.

Steering committees and supplier innovation events, in particular, help Innovation Champions drive 59% and 39% more supplier innovation, respectively — but only when leveraged consistently.

Focus on governance, metrics and talent to improve supplier quality

Supplier quality is an important pillar of the CPO leadership vision. Faced with material constraints, global inflation and unstable demand, many procurement organizations have begun diversifying their network of suppliers.

But this has led to increased risk and contributed to a rise in quality defects. Actively managing a higher number of suppliers strains procurement staff who are already stretched thin and threatens the effectiveness and efficiency of supply chain management.

As CPOs work to improve supplier quality performance, they are focusing the supplier relationship management (SRM) strategy on these three main areas:

Establishing a robust supplier governance foundation

Measuring and monitoring supplier quality performance to prevent these defects

Hiring and retaining supplier quality management talent

Supplier quality governance. There are four core phases of a supplier quality management process: first, establishing supplier management strategy, and second, qualifying new suppliers, both of which are one-time activities; third, monitoring supplier performance, which is ongoing and at different cadences depending on supplier segmentation; and fourth, improving underperforming or excessively risky suppliers, which is ad hoc.

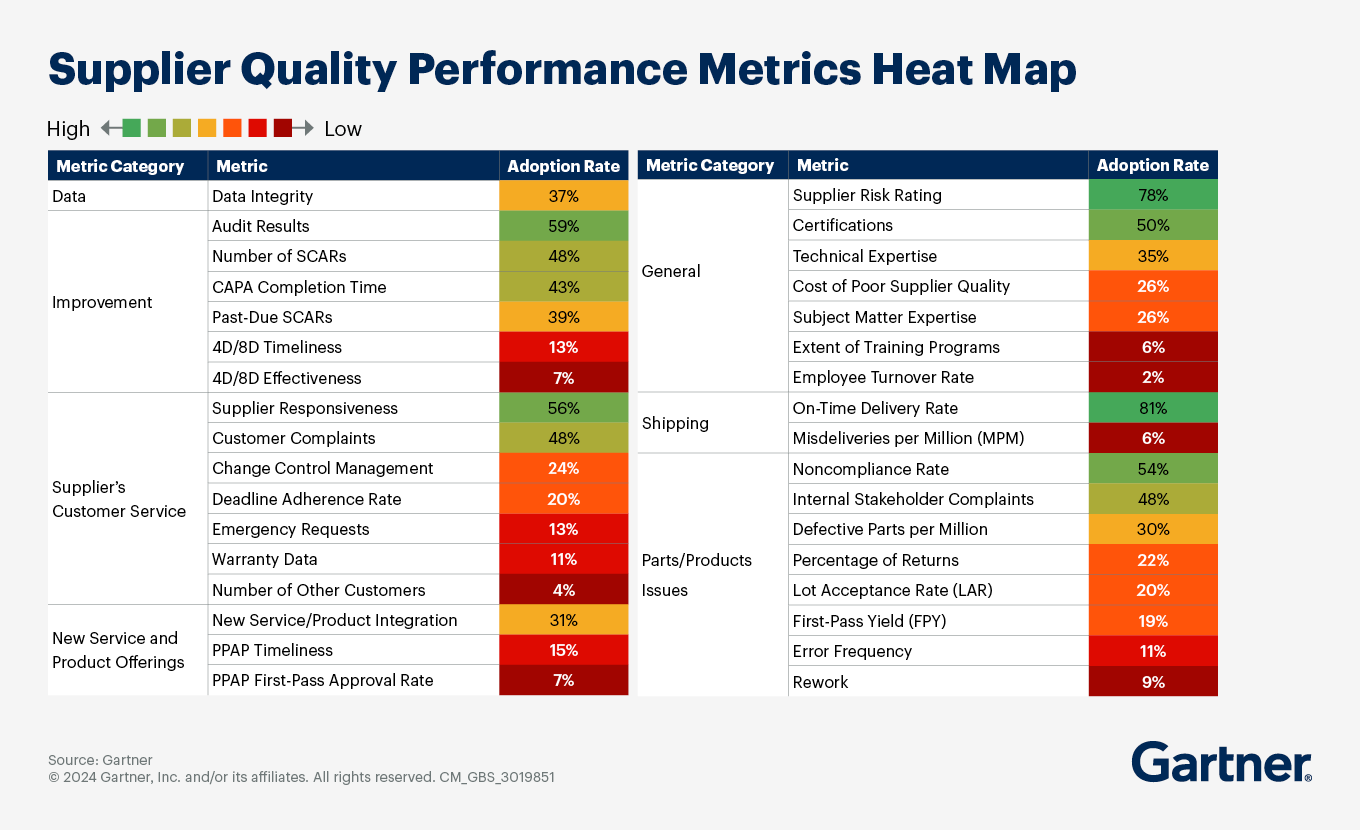

Supplier quality performance management and metrics. According to the 2023 Gartner Supplier Quality Management Survey, the most common challenge cited in improving supplier performance is that supplier quality metrics are more focused on fixing problems than on anticipating them. We recommend incorporating the top 10 leading supplier quality indicators in your supplier scorecard to anticipate poor-quality supplier performance: supplier responsiveness, certifications, corrective and preventive action (CAPA) completion time, technical expertise, new service/product integration, subject matter expertise, change control management, error frequency, extent of training programs and employee turnover rate.

Supplier quality talent. The CPO must partner with key stakeholders across the business to establish a cross-functional team, whose objective is the adoption and success of the supplier collaboration strategy. Four roles are key to this cross-functional team: the SRM steering committee, which sets supplier goals and priorities; the SRM strategy group, which defines segmentation criteria and supplier engagement activities and tracks the benefits of the SRM strategy; SRM leaders, who drive consistency with strategic suppliers; and the SRM core team, which executes the predefined agenda with strategic suppliers. There are also four key skills that supplier quality talent needs to partner effectively with suppliers and become trusted advisors: empathy, persuasion, conflict management and adaptability.

3 keys to partnering with strategic suppliers amid supply chain disruption

Strategic supplier relationships have been put to the test in recent years amid an increasingly disruptive environment. As businesses continue to navigate challenges like recessionary economics and capacity constraints, it is increasingly important to reinforce supplier relationship management (SRM) best practices with the most strategic suppliers. To do this, the CPO community must prioritize three things: exhibiting customer-of-choice behaviors; creating an open feedback loop; and redefining value measurement.

A “customer of choice” is typically defined as a buying organization that consistently receives competitive preference for scarce resources across a critical mass of suppliers within its supply base. To be a customer of choice, a procurement organization must demonstrate trustworthiness with its strategic suppliers, especially when faced with supply chain risk. For example: Provide performance feedback; spend time at supplier sites; recognize and reward supplier success; and respect supplier margins.

To determine whether your company is perceived as a customer of choice by suppliers, begin by answering the following questions:

Do we share our business strategy and growth plans with strategic suppliers?

Do we acknowledge strategic suppliers when they go the extra mile for us?

Are we willing to invest and accept some risk and cost with this strategic supplier?

Do we invite strategic supplier contributions to innovation early in the process?

Also important is creating an open feedback loop to ensure transparency with the supplier. CPOs need to understand how shifts in customer demands, the regulatory environment, the labor market, and materials price and availability are impacting their most important suppliers. Risks of not doing this include suppliers making trade-offs on a customer’s behalf, supplier solvency issues and the supplier being unable to supply a good or service.

Ask yourself, “What are the major concerns the strategic supplier is facing for its business?” and “What risks is the strategic supplier facing that could impact me as a customer?” Then establish solutions (like shortened payment terms) or develop collaborative plans (like negotiating better prices with Tier 2 suppliers).

Finally, redefine value measurement to continually gain buy-in for the resources allocated to strategic supplier relationships. A Gartner Supplier Relationship Management Survey found that most procurement organizations are overfocusing on the financial performance of their strategic suppliers at the expense of stronger supplier collaboration. However, in times of inflation, financial benefit is no longer a good indicator of success since the buying organization is facing cost pressure just like its suppliers. Indeed, supplier collaboration is most urgent amid supply chain disruption.

Assess your strategic suppliers on metrics that drive success through times of disruption. For example: “How did the supplier help us get access to scarce capacity?”; “What intelligence did the supplier provide that forecasted potential disruptions?”; and “How did the supplier help us reduce risk within the multitier supply base?”

How Danone Maintains Supply Chain Resilience Throughout Disruption

Apurva Gupta, Vice President Procurement at Danone, describes Gartner insight on the Antifragile Supply Chain and how he leverages expert guidance and networking opportunities to succeed in a volatile business environment.

Webinars on supplier relationship management

Attend a Conference

Experience Supply Chain conferences

With exclusive insights from Gartner experts on the latest trends, sessions curated for your role and unmatched peer networking, Gartner conferences help you accelerate your priorities.

Gartner Supply Chain Symposium/Xpo™

Orlando, FL

Client stories on supplier relationship management

See more stories of how Gartner clients achieve success on gartner.com

FAQ on supplier relationship management

What is supplier relationship management (SRM)?

Supplier relationship management (SRM) is a business initiative that many companies undertake to build mutually beneficial relationships with suppliers. Well-designed SRM programs help companies increase collaboration by identifying the right suppliers with whom to partner. Top business drivers for implementing SRM include cost optimization; risk mitigation; top-line growth from supplier innovation; operational process improvements; and preferential treatment from suppliers as a customer of choice.

How does effective SRM benefit businesses?

Commonly cited benefits of SRM according to a Gartner survey of procurement leaders include: priority access to supplier capacity, materials and components when in short supply; improved cost management; service-level improvements; quality improvements; faster speed to market; joint risk mitigation strategies and reduced risk exposure; higher engagement on the sustainability agenda; and access to supplier ideas and innovation ahead of others.

What are best practices for managing supplier relationships?

Different supplier segments must be managed differently. For example, risk and gain sharing should always be used to engage strategic suppliers, seldom with critical suppliers and never with transactional suppliers. Strategic suppliers can access the buying organization’s product roadmap any time, while access for critical and transactional suppliers is limited/as needed. Contracting with strategic suppliers runs longer term than contracting with critical and transactional suppliers.

How do businesses measure the success of SRM initiatives?

To ensure that suppliers’ performance aligns with business goals, measure SRM against traditional operational metrics such as on-time delivery, quality and cost savings, as well as suppliers’ innovation capabilities, ability to support new product introductions and responsiveness. Incorporating these value-oriented metrics helps SRM initiatives move from being reactive, looking only at history, to being predictive and future-focused.

How do you align key stakeholders in your SRM efforts?

To align key stakeholders in your SRM efforts, Gartner advises assembling an SRM governance team whose job is to ensure consistency on supplier engagement and scale the supplier relationship management strategy. The SRM governance team is led out of the procurement organization but includes business partners who provide input on key SRM processes — e.g., supplier segmentation, strategic supplier account planning, quarterly business reviews, performance scorecards, supplier summits and awards.

Can tech solutions enhance SRM?

Supply chain digital transformation is useful to supplier relationship management. Automated supplier scorecards, specifically, extract more innovative ideas from suppliers at less cost. Scorecard automation yields other efficiencies, too:

Better leveraged supply bases. Scorecarding generates supplier performance insights that inform strategic sourcing.

More rationalized supply bases. Scorecarding minimizes risk when awarding business and builds deeper relationships with strategic suppliers.

Drive stronger performance on your mission-critical priorities.