By Stan Aronow | January 10, 2025

The Era of Supply Chain Reinvention

January 30 2026

By Stan Aronow | January 10, 2025

Welcome to 2025! As we roll into the new year, it’s time to place bets on what’s in store — for the world (more generally) and supply chain (more specifically).

Some of this is based on extrapolation of trends or anticipation of key events, but there are always wildcards. In our profession, we need to persistently tune into the risks that will disrupt today’s operations and the strategic threats that might cause us to preemptively change our network or operating models.

A good starting point is comparing last year’s predictions to actual events.

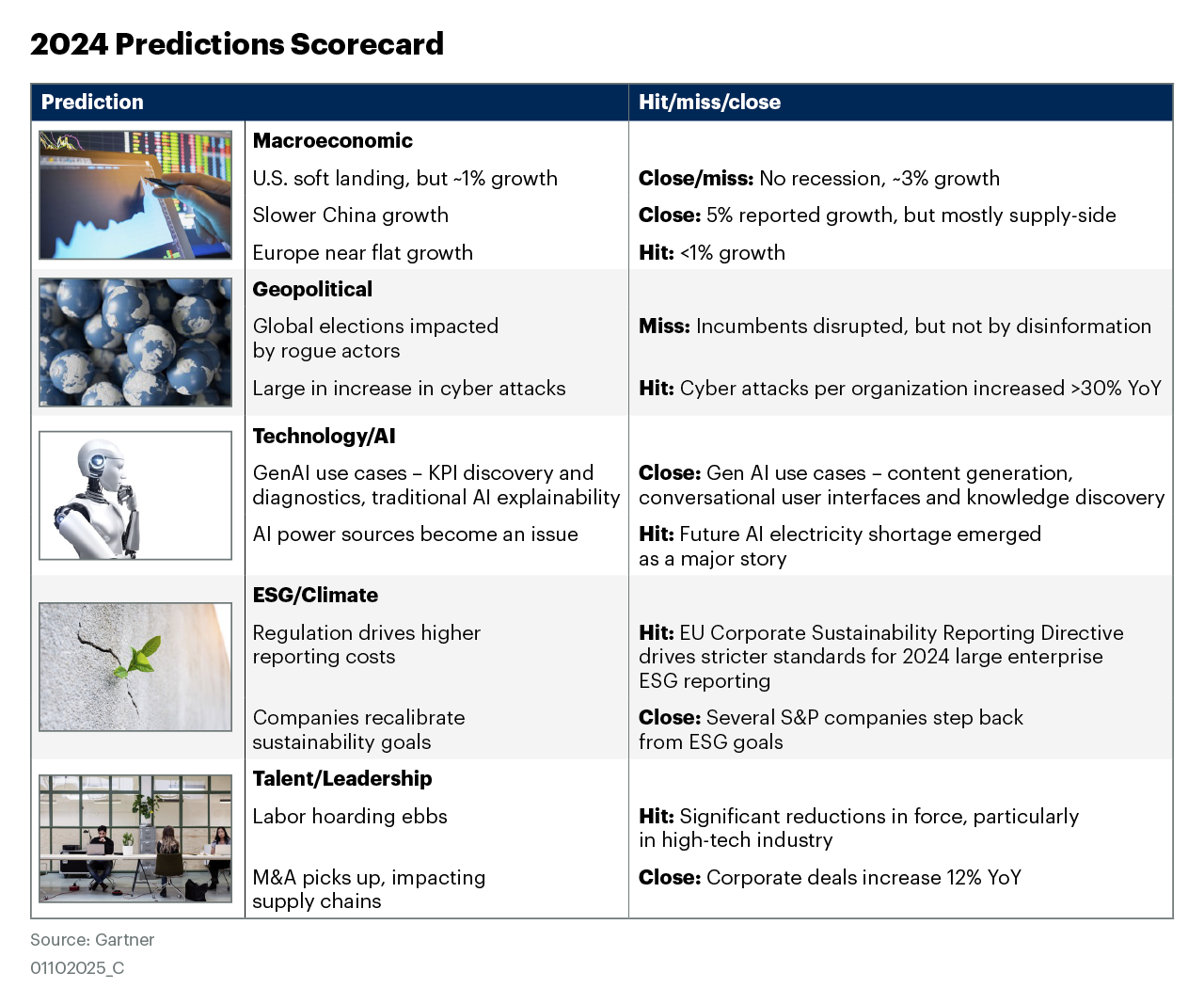

Here’s a rundown of the predictions in my Beyond Supply Chain 2024 Predictions blog:

On the macroeconomic front, I correctly called the U.S. avoiding recession, Europe’s flattish growth and a challenged Chinese economy. Ultimately, the U.S. economy and labor market fared better than most expected in 2024. China’s President Xi recently alluded to hitting his government’s 5% GDP growth target, but continued investment in industrial capacity and output were the main drivers. When coupled with tepid consumer demand, the result has been deflation in producer prices for the past two years.

Geopolitically, I highlighted the risk of rogue actors disrupting the largest election year in history – one representing more than 70 countries and nearly half the global population. While there were some instances of disinformation coming through social media channels, democracy generally worked in 2024. The result was that voters successfully registered their collective displeasure with incumbents. Of the G20 countries either holding elections or experiencing a more sudden change in leadership, two-thirds went to challenger parties. Cyber-disruption was more prevalent in the business world, with one measure of weekly attacks increasing more than 30% year-over-year.

In the technology domain, a Gartner report (subscription required) showed 80% of large enterprises were beginning to (or planning to) implement GenAI at the beginning of 2024. My best guesses for winning use cases at that time were in performance management and improved explainability of traditional AI applications. In addition to those areas, information summarization and knowledge management tools, alongside conversational agents for customer service and support, emerged as the most commonly used.

In last year’s predictions, I mentioned the enormous amount of power required to run all of these new applications. A Gartner Maverick report on this topic noted that, if forecasts hold, electricity demand for information and communications technologies will reach nearly two-thirds of total global supply by 2040!

When it came to sustainability, and ESG more generally, 2024 was a transition year. Regulations previously loaded in the pipeline, such as the EU’s Corporate Sustainability Reporting Directive, increased the cost of reporting for larger enterprises. At the same time, many companies quietly pulled back on ambitious emissions reduction or resource stewardship goals set in the early 2020s.

I also predicted the labor market moving back into equilibrium in 2024. Thankfully, the pendulum did not swing too far in the direction of weak labor markets, though some sectors, like high tech, saw significant layoffs. Finally, I saw corporate M&A as a potential disruptor for supply chains in 2024. Analysis by one investment firm showed corporate deal volume increasing 12% year-over-year, though 2025 may see a larger jump in activity.

It might feel strange to hear, but last year’s operating environment is likely the calmest and most predictable we’ll see for a while. Supply chain leaders that thoughtfully plan for a wide range of disruptive forces and events will fare best.

We should also remember the power of our community when it pools resources and advocates for our collective good. Powerful governments may set the opening frame for trade terms, but enough strong voices from the business community can shape the final outcome.

Wishing you and yours a happy and healthy year ahead!

Stan Aronow

VP Distinguished Advisor

Gartner Supply Chain

Stan.Aronow@gartner.com

Connect to your supply chain peer communities:

Beyond Supply Chain

Subscribe on LinkedIn to receive the biweekly Beyond Supply Chain newsletter.

![[ALT TEXT]](https://emt.gartnerweb.com/ngw/globalassets/en/supply-chain/blog/beyond-supply-chain/images/beyond-supply-chain-january-2025-predictions.jpg)