By Stan Aronow | January 09, 2026

Celebrating Our 2026 Power of the Profession Award Winners

February 20 2026

By Stan Aronow | January 09, 2026

Happy 2026, supply chain community! For several years, I’ve kicked off the year with predictions about global affairs and supply chain based on my interactions with Gartner’s COO/CSCO community. It’s time to place some bets and to grade how clear or cloudy my crystal ball was for 2025.

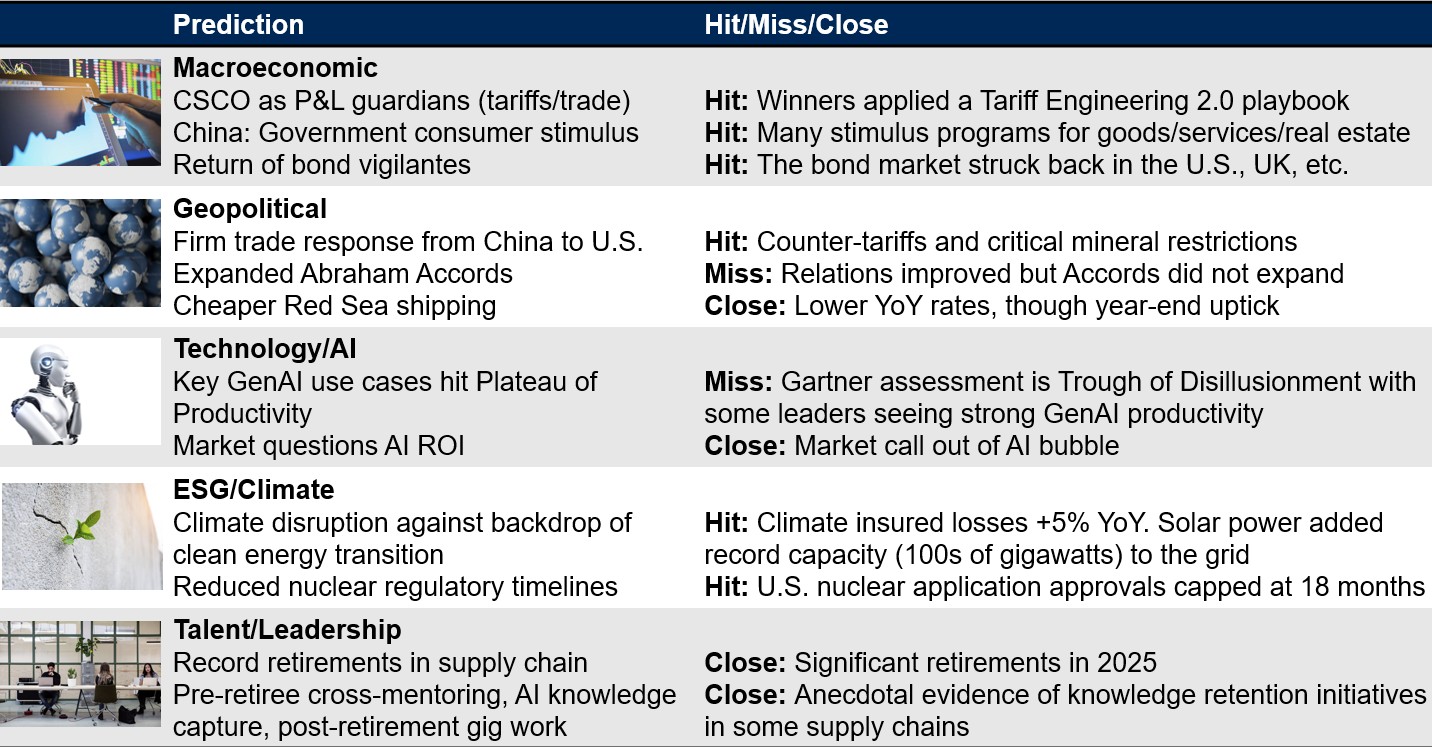

Let’s start with a comparison of last year’s predictions to actual events.

Here’s a rundown of the predictions in my Beyond Supply Chain 2025 Predictions blog:

Source: Gartner

On the macroeconomic front, we knew we were in for a roller coaster ride with impending tariffs. It was the shape of the track that was unclear. Winners kept their cars on the rails by applying portfolio thinking in their sourcing strategies. They also developed the means to dynamically route components and stage inventories based on total landed cost changes that fluctuated weekly (AKA tariff engineering 2.0).

Specific to China, I predicted that its government would finally step in with consumer stimulus after holding off for several years, despite a stagnant domestic market. By the end of the year, there were several programs that subsidized trade-ins for big-ticket purchases, incentivized services consumption (tourism, culture, healthcare) and relaxed real estate and auto purchase restrictions.

Finally, I saw a reemergence of bond vigilantes who discipline excessive government spending by demanding higher sovereign debt yields. The bond market was indeed a force to be reckoned with this year. The most prominent example was the sharp sell-off of US Treasury bonds in April that prompted the postponement of “Liberation Day” tariffs.

Geopolitically, I anticipated a firm response from China to U.S. tariff increases and technology restrictions. Throughout the year, China calmly matched escalating U.S. tariff pronouncements. Toward the end of formal trade negotiations, they shut down critical materials exports – an untenable situation for critical U.S. industries – which led to a final compromise that was more balanced between the two countries.

In the Middle East, I saw a potential expansion of the Abraham Accords between Israel and Saudi Arabia. While relations have improved over the year, barriers remain to this outcome. I also anticipated that reduced conflict in the region would lead to lower transport spot rates in the Red Sea shipping lane. Partial credit here as, by last autumn, rates slid back to late 2023 levels. They ticked up moderately at the end of the year, however, based on lingering disruptions and higher demand.

In the technology domain, I saw winning GenAI use cases hitting the Plateau of Productivity, using the parlance of Gartner’s Hype Cycle. We certainly heard this from the leading supply chains participating in our Lenovo and Unilever co-hosted Leaders in Action events, last September. However, evidence mounted that this might not be the case for the broader community (e.g., the widely publicized MIT study showing that 95% of GenAI pilots fail and Gartner’s general assessment that GenAI is headed toward the Trough of Disillusionment).

As far as the business of AI, I predicted the market would start questioning the payback of all the data center expansion planned for 2025. A mid-2025 Bain & Company report predicted an $800 billion annual revenue shortfall on these investments by 2030. U.S. equity markets, being the most exposed to AI investments, ended the year near record levels, so this story is a work in progress.

When it came to sustainability, I foresaw a race between market forces enabling clean energy transition and increasingly volatile climate conditions derived from legacy energy infrastructure. Global insured losses tied to climate disruption were expected to reach $145 billion in 2025, up 5% annually. At the same time, record levels of solar power (hundreds of gigawatts) were added to the global power grid last year.

The proliferation of AI data centers is accelerating energy demand well above long-term trends. I predicted a reduction in regulatory timeframes for new nuclear power facilities and mobile reactors to meet this growing need. This past May, a series of U.S. executive orders were issued to streamline the regulatory process, capping new reactor application approval time at 18 months. Previously, the process often took several years.

And finally, on the topic of leadership and talent, I predicted a record number of retirements in supply chain and proactive initiatives to retain the institutional knowledge of departing employees. While, as of the publication of this blog post, there is not a formal analysis of 2025 retirements in supply chain available, executive retirements in Gartner-led supply chain communities are running well into double-digit percentages of total for the year.

Anecdotally, our team is hearing from some companies using pre-retirement cross-mentoring and AI knowledge capture, as well as selective post-retirement consulting contracts to maintain tenured employee expertise.

At Gartner, we’re hard at work casting predictions about 2027 and beyond for everything from AI to logistics to key industry developments. Here is my early read on 2026, based on a view from the COO/CSCO community.

The geopolitical headlines of this brand-new year serve as a stark reminder that we’re, more broadly, moving into uncharted territory.

Many of us in supply chain have strengthened our “antifragility” muscles over the past several years and I’m confident that we’ll manage the twists and turns of 2026, even if there are a few jump-scares in the mix. At a minimum, no one will be complaining that our jobs in supply chain are boring this year. 😊

Wishing you and yours a happy and healthy year ahead!

Stan Aronow

VP Distinguished Advisor

artner Supply Chain

Stan.Aronow@gartner.com

Beyond Supply Chain

Subscribe on LinkedIn to receive the biweekly Beyond Supply Chain newsletter.

![[ALT TEXT]](https://emt.gartnerweb.com/ngw/globalassets/en/supply-chain/blog/beyond-supply-chain/images/bsc090126.jpg)