Sourcing and procurement leaders: Move beyond cost management to leverage supplier capabilities for maximum advantage.

- Gartner client? Log in for personalized search results.

Key Strategies for Sourcing and Procurement Success

Procurement is transforming faster than ever. Don’t get left behind.

Traditional procurement workflows are no longer fit for purpose. New socioeconomic and environmental trends mean companies following traditional workflows are 26% more likely to overcomplicate their transformation projects versus those that have simplified sourcing and procurement processes.

These sourcing and procurement leaders enjoy a 42% increase in transformation success.

Download this report to:

Learn a simpler procurement process

Increase transformation success

Drive staff engagement

Sourcing and procurement leaders are investing in the future

Advancing digital capabilities, engaging teams and rightsizing supplier risk are key agenda items for sourcing and procurement organizations looking to improve and innovate operations.

GenAI in Procurement

Sustainable Procurement

Organizational Development

Performance Measurement

Supplier Risk

Understand GenAI trends, identify procurement use cases and deploy pilots

Traditional supply chain AI deals with analysis and automation, while generative AI (GenAI) technology is capable of producing new, insightful content like supplier risk assessments, category strategies and supplier scorecard evaluations. It’s little surprise then that 98% of executive leaders responding to a 2023 Gartner survey indicated they had or were making plans to utilize/experiment with GenAI.

Sourcing and procurement leaders, in particular, are exploring ways that GenAI can boost productivity and cost savings. They expect GenAI over the next 12 to 18 months to increase productivity by 21%, increase cost savings by 12% and improve revenue by 11%.

Productivity and cost savings are the primary benefits that sourcing and procurement leaders are seeking from their GenAI investments, but other value drivers include business agility, digital transformation, risk reduction, innovation, profitability and customer experience.

Potential GenAI use cases in sourcing and procurement span the chief procurement officer’s major objectives: engaging business partners; optimizing supplier partnerships; developing and managing talent; managing spend; managing supply risks; and managing the sourcing and procurement function.

The following are the top 5 GenAI use cases in sourcing and procurement today:

Sourcing/contract management. GenAI technology is capable of creating and analyzing contracts, suggesting contract clauses and simulating supplier negotiations.

Supply information discovery. GenAI can generate search rankings and alternate supplier recommendations.

Summarization of proposals. GenAI can summarize RFx responses, business cases and risk reports.

Supplier communications. GenAI can help sourcing and procurement teams with supplier onboarding, scorecards and performance management.

Strategy documents and policies. GenAI can create and/or update the sourcing and procurement analytics dashboard, process map and other essential documentation.

Use cases will surely evolve just like business needs, market dynamics and the technology itself. In fact, in just the last 12 months, sourcing and procurement leaders cite a 69% increase in the importance of data and technology competencies (e.g., dexterity, information navigation, data insight), putting in focus the capacity of GenAI to generate new job descriptions, new competency models and training programs.

Furthermore, Gartner analysts studying digital supply chain and technology transformation predict that:

By 2026, virtual assistants and chatbots will be used by 20% of businesses to handle internal and vendor interactions

Half of businesses by 2027 will support supplier contract negotiations using AI-enabled contract risk analysis and redlining tools

By 2029, 80% of human decisions will be augmented by GenAI

As such, to identify the right technology pilots, Gartner recommends that sourcing and procurement leaders prioritize GenAI use cases by business value and feasibility.

Business value includes efficiency gains, service improvement, cost savings and productivity gains. Measure candidate GenAI pilots on their potential to reduce cycle times, decrease errors, accelerate issue resolution, improve order status visibility, etc.

Feasibility factors span talent, cultural readiness, technology and data. Specifically, sourcing and procurement leaders must assess: the availability of talent to interface with GenAI technology; the organization’s risk tolerance for new technology; in-house versus third-party solutions; and the company’s approach to data governance and security.

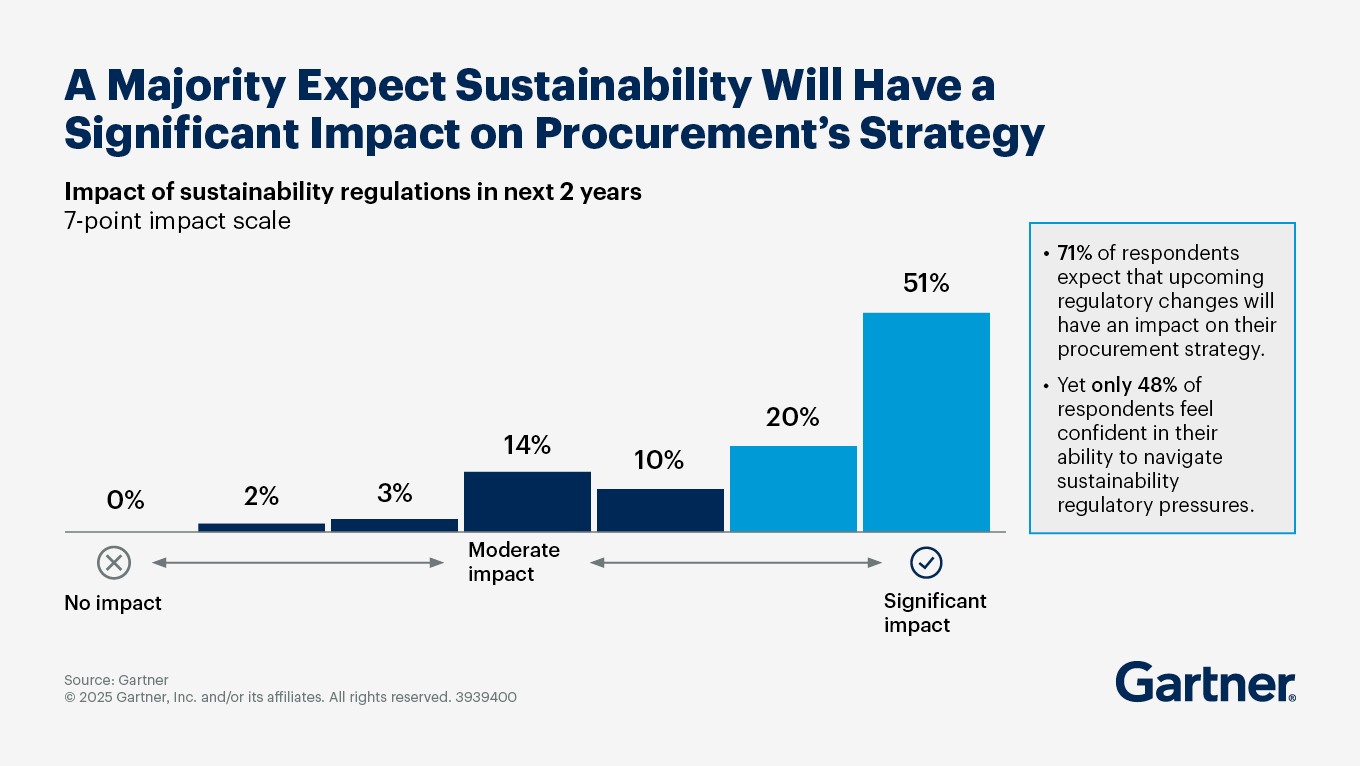

Ensure suppliers operate responsibly, and expand the use of diverse suppliers

To fully enable supply chain sustainability, you must embed sustainable procurement practices and supplier diversity metrics into the supplier relationship management strategy.

But 57% of sourcing and procurement executives rank performance measurement as a top challenge they face when engaging suppliers on sustainability. To measure supplier sustainability performance, Gartner experts recommend that sourcing and procurement executives do the following:

Embrace a holistic view of sustainability by accounting for environmental, social and governance (ESG) factors when assessing suppliers.

Apply an evidence-based approach, assessing suppliers’ commitment, transparency and progress on different sustainability topics.

Create standard definitions for each sustainability metric: greenhouse gas (GHG) emissions; renewable energy; energy efficiency; water usage; circularity; sustainable operations; DEI (diversity, equity and inclusion); human rights; employee relations; workplace health and safety; talent management; community engagement; sustainability governance; sustainability goals, targets and ambitions; sustainability reporting; public policy and regulations; ethics; sustainable sourcing and procurement; and sustainable products and services.

Delivering on sustainable procurement metrics is just as tough, with 83% of sourcing and procurement executives saying the pressure has increased or significantly increased in the span of just a few months. Organizations leading in sustainable procurement are more likely to incentivize suppliers to support sustainable procurement goals, outpacing followers in usage of structural, financial, partnership and recognition incentives. To advance sustainable procurement goals, Gartner experts recommend that sourcing and procurement executives take the following actions:

Implement the structural changes to category strategy that will improve supplier buying practices.

Help suppliers overcome barriers to improvement by offering financial incentives such as supply chain financing and longer-term contracts.

Partner with suppliers to improve their capabilities, and publicly recognize their performance improvements.

Meanwhile, to advance supplier diversity programs, ensure that supplier diversity metrics align to corporate goals and values. Supplier diversity programs are focused on supporting organizations that are greater than 51% owned and managed by an underrepresented group, and while many sourcing and procurement executives have established supplier diversity commitments, competing priorities and a lack of resources often leave their diversity goals unfulfilled. Our study of the highest-performing supplier diversity programs reveals that they are:

317% more likely to provide scholarships or aid programs

156% more likely to host a supplier diversity day

114% more likely to create a global program

107% more likely to create an ambassador program

Design your procurement organization to align to company priorities

Historically, the sourcing and procurement organization has been focused on achieving cost savings through careful balancing of cost with quality and delivery metrics. But increasingly it is responsible for an expanded set of priorities, including risk mitigation, innovation, sustainability and DEI (diversity, equity and inclusion). And in the current environment, procurement transformation success strategies are key agenda items.

This broader scope is challenging, especially considering the lack of sourcing and procurement talent available to tackle all the work. Now is the time for sourcing and procurement leaders to strengthen team capabilities and prioritize long-term development.

Sourcing and procurement leaders are responding by building staff competencies. According to our Procurement Competencies Survey, more than 75% of sourcing and procurement leaders have implemented or are on track to implement access to external courses and internal interactive training for their teams.

Competency planning and proficiency is an essential aspect of organizational development — so is org design. Our study of supply chain organization design and talent finds that 82% of companies are making moderate to significant organizational structure changes over the next 12 months. To get ahead, sourcing and procurement leaders are asking, “How do I optimize the design of the procurement organization with competing priorities and constant change?”

Gartner advises that sourcing and procurement leaders focus on the following three activities to optimize procurement org design:

Benchmark reporting lines and span of control. According to our Budget Benchmarking, 38% of chief procurement officers report to the company’s chief financial officer; 20% to the chief supply chain officer; and 19% to the head of operations. The CPO at the highest-performing companies surveyed directly manages eight staff members. This span of control decreases to six staff members at average-performing companies, and to four staff members at the lowest-performing companies.

Identify the ideal level of centralization. Through our Procurement Organization Structure Survey, we’ve studied trends in centralized, decentralized and center-led structures for over two decades. Center-led structures were the most popular up to 2017, when survey data revealed that just as many procurement orgs were centralizing as were leading from the center. But this year’s data reveals that center-led structures are making a comeback — probably due to increased supply chain disruption — with 51% of survey respondents citing center-led structures versus 39% citing centralized structures.

Align value drivers against org design decisions and capability investments. To achieve efficiency/speed, an activity-based structure is effective; to achieve total value/savings, a category-based structure. But org design doesn’t stop at the org chart: Sourcing and procurement leaders must also identify structural deficiencies and ensure that operating models and/or governance are set up to solve for them.

It’s critical that sourcing and procurement leaders determine the correct level of centralization for their organizations. More centralization means increased leverage/economies of scale; standardization of data, tools and governance; and strategic alignment to senior executives. But centralizing too much risks response time, supplier relationship management and relevance of procurement policies.

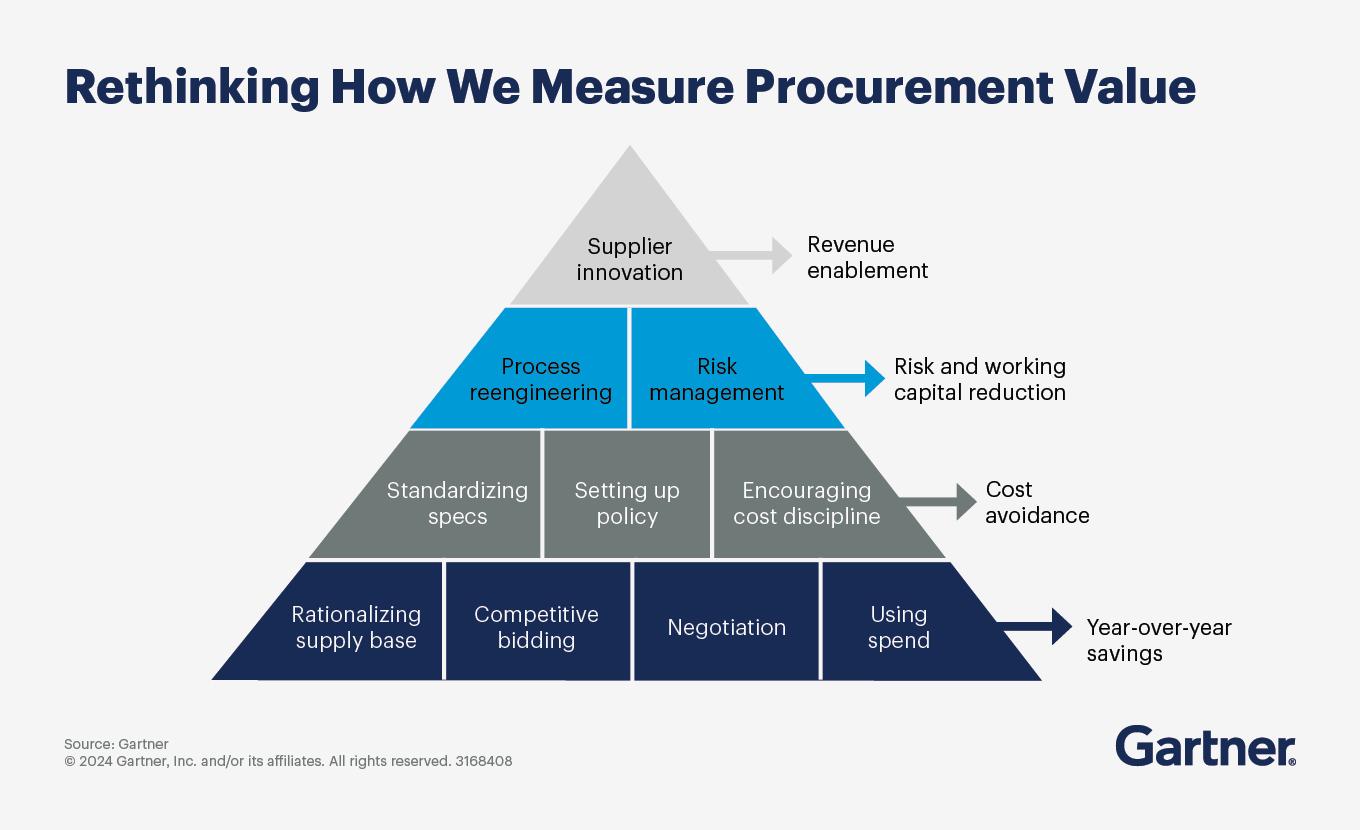

Demonstrate procurement value via savings and strategic performance metrics

Gartner’s Procurement Competencies Survey reveals that senior executives at only 41% of companies see the sourcing and procurement organization as an operational partner. Even worse, just 3% of companies regard it as a thought leader.

Using savings-oriented dashboards to communicate the chief procurement officer’s leadership vision perpetuates business partners’ misperception of sourcing and procurement as merely a savings function. Chief procurement officers must develop compelling dashboards that holistically communicate their function’s strategic value proposition.

Start by understanding business partners and their sourcing priorities. Then define strategic performance metrics for sourcing and procurement and showcase high-value contributions.

Metrics that matter to the CEO, CFO and board include:

Competitive advantage (e.g., price performance versus best in class by category)

Revenue “enabled” by procurement activity

Year-over-year procurement savings contribution to the bottom line (earnings per share [EPS], cash flow, economic value added [EVA], etc.)

Meanwhile, stakeholders in other functions or within business units want to see returns on strategic partnership — e.g., frequency of procurement’s engagement with internal customers; savings ROI; savings generated by key productivity initiatives. Don’t waste your time reporting on compliance with existing efforts.

It’s also important to select, track and report the right metrics for sourcing and procurement staff as well as suppliers. For sourcing and procurement staff, go beyond process measurements (like purchase orders per buyer) and include supply continuity, leadership bench strength and other metrics that reinforce discipline and development. Suppliers, too, benefit from less-transactional metrics — e.g., supplier innovations implemented, supplier diversity spend, supplier satisfaction (of us as a customer).

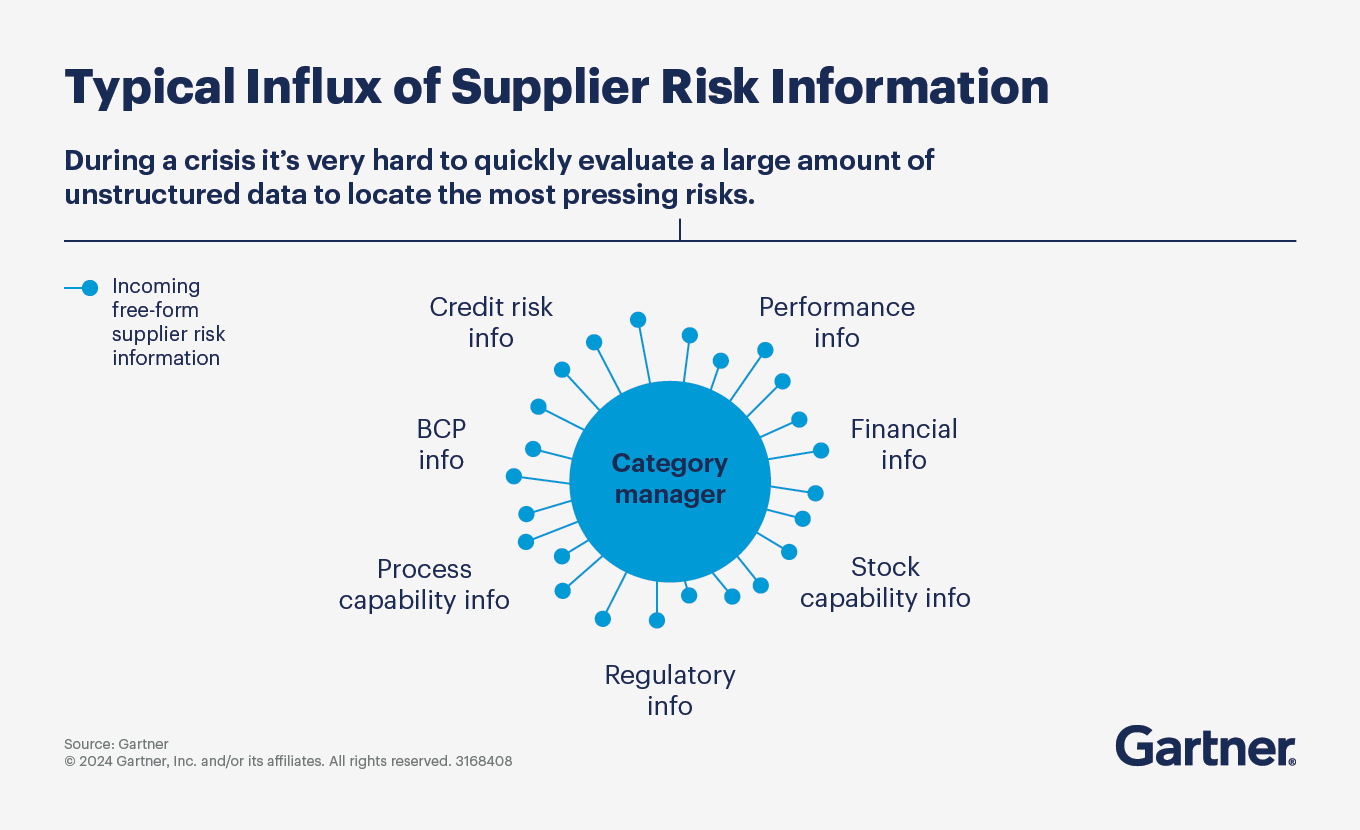

Evaluate and manage supplier risk to protect against potential business disasters

Supply chain risk management enables companies to thrive despite uncertainty and complexity in the business environment. Supplier risks present a unique threat to sourcing and procurement effectiveness and run the gamut from geopolitical issues to extreme weather events, to cyberattacks and more.

Inadequate supplier risk analysis creates disruption and financial losses that can impede business continuity. Best practice is to proactively establish clear risk thresholds, deep visibility of the supply base, risk response plans and technology support.

Supplier risk management enables sourcing and procurement teams to predict dilemmas and prepare appropriate solutions for their suppliers. Target those suppliers that pose the greatest risk to the enterprise from an insolvency and supply disruption standpoint.

There are methods to reduce risk with suppliers pre- and post-contract. During strategic sourcing, conduct risk-to-serve conversations with critical stakeholders. Risk-to-serve conversations should uncover how adding a supplier will affect your supply chain surface area and your exposure to high-impact risk events. Then monitor for post-award risk. Best practice is to equip business partners with the knowledge gained in due diligence, from the initial supplier risk profile to clauses in the contract terms.

During a crisis, supplier risk dashboards can hinder more than help risk response if the supplier rolls are too lengthy and the data is voluminous, lagged and unstructured. Sourcing and procurement leaders should prioritize crisis-ready risk mitigation dashboards — ones that limit the breadth and complexity of information category managers must analyze, thus making it easier to more quickly and accurately evaluate supplier risks to identify which suppliers truly present an immediate risk to the organization.

On an ongoing basis, review your supplier risk management performance. Assess whether the most pressing supplier risks are effectively documented in the risk library and update risk ownership accordingly. Establish a cadence with business partners to revisit due diligence and ensure it maps back to critical organization risks and helps uncover critical supplier risk information. Finally, ensure that business-led risk monitoring processes are followed throughout the supplier relationship and are not excessively concentrated during due diligence and recertification alone.

Webinars on sourcing and procurement

Attend a Conference

Join Gartner experts and your peers to accelerate growth

Gather alongside your peers in San Diego to gain insight on emerging trends, receive one-on-one guidance from a Gartner expert and create a strategy to tackle your priorities head-on.

Gartner Procurement Conference

San Diego, CA

Client stories on sourcing and procurement

See more stories of how Gartner clients achieve success on gartner.com

FAQ on sourcing and procurement

What are components of a successful procurement strategy?

Business disruption like increased competition, aggressive pricing, rapidly changing new technologies and new regulations challenge procurement operations. The key components of an effective procurement strategy are optimizing supply chain costs while balancing the reliability of supply; supporting social and corporate responsibilities; and mitigating risks.

How does procurement impact overall business performance?

It’s impossible to overstate the importance of procurement in supply chain management. Strategic sourcing enables organizations to leverage their consolidated purchasing power to find the best possible value in the marketplace. Not only does the procurement function govern corporate purchasing decisions, but it also conducts vendor evaluation and selection, competitive bidding and contract negotiation. Effective sourcing strategies enable organizations to reduce costs and maximize value.

What are the challenges in sourcing and procurement?

There is a lack of discipline and consistency in the sourcing and procurement process, specifically on cost management and business value creation through category strategies, supplier performance management, and collaboration with strategic supply partners. Best practices in procurement process management are designing for simplicity, thinking of users as the process’s customers and maintaining processes to keep them simple.

Can improving the procurement process benefit the organization?

According to the 2023 Gartner Procurement Functional Transformation Survey, organizations that implement steps to streamline procurement operations experience a 42% increase in procurement transformation success over those that don’t. Gartner advises procurement leaders to clarify ambiguous tasks and friction points in the procurement process, regularly solicit and act upon staff experience and continuously monitor and review process effectiveness.

What steps can we take to improve supplier relationships?

Analyze three primary types of supplier information for insight on how to improve supplier relationships:

Relationship dynamics. Focus on differences between how the procurement function and the supplier each view the relationship.

Key individuals. Assess how key account managers influence their company’s view of the relationship.

Organizational structure. Identify how the supplier’s organizational structure creates “hidden” incentives/disincentives for working with the procurement function.

Drive stronger performance on your mission-critical priorities.