Implement a forecasting process that provides transparency and credibility with these three steps.

- Gartner client? Log in for personalized search results.

Proactively manage and streamline cash-flow forecasting to increase profitability

A clear view of your organization’s true cash position provides insight into the company’s liquidity needs. Preparing short-term cash forecasts allows you to take timely, proactive measures and make more informed decisions about cash needs, since these forecasts provide advanced warning about future cash shortages or surpluses.

The importance of accurate cash forecasting becomes even more pronounced during times of economic uncertainty and volatility. When businesses face heightened risks and unpredictable financial landscapes, it is essential to have a clear understanding of cash-flow dynamics. By leveraging precise cash forecasts, your organization can navigate unexpected challenges with greater confidence and resilience.

See Gartner research in action at our finance conferences and events.

Make your short-term cash-flow process more efficient and valuable

To develop an accurate short-term forecast, combine the direct cash-flow method with the right level of business involvement on critical driver assumptions — along with weekly variance analysis and iteration.

Use the direct cash-flow model to drive improved cash management decisions

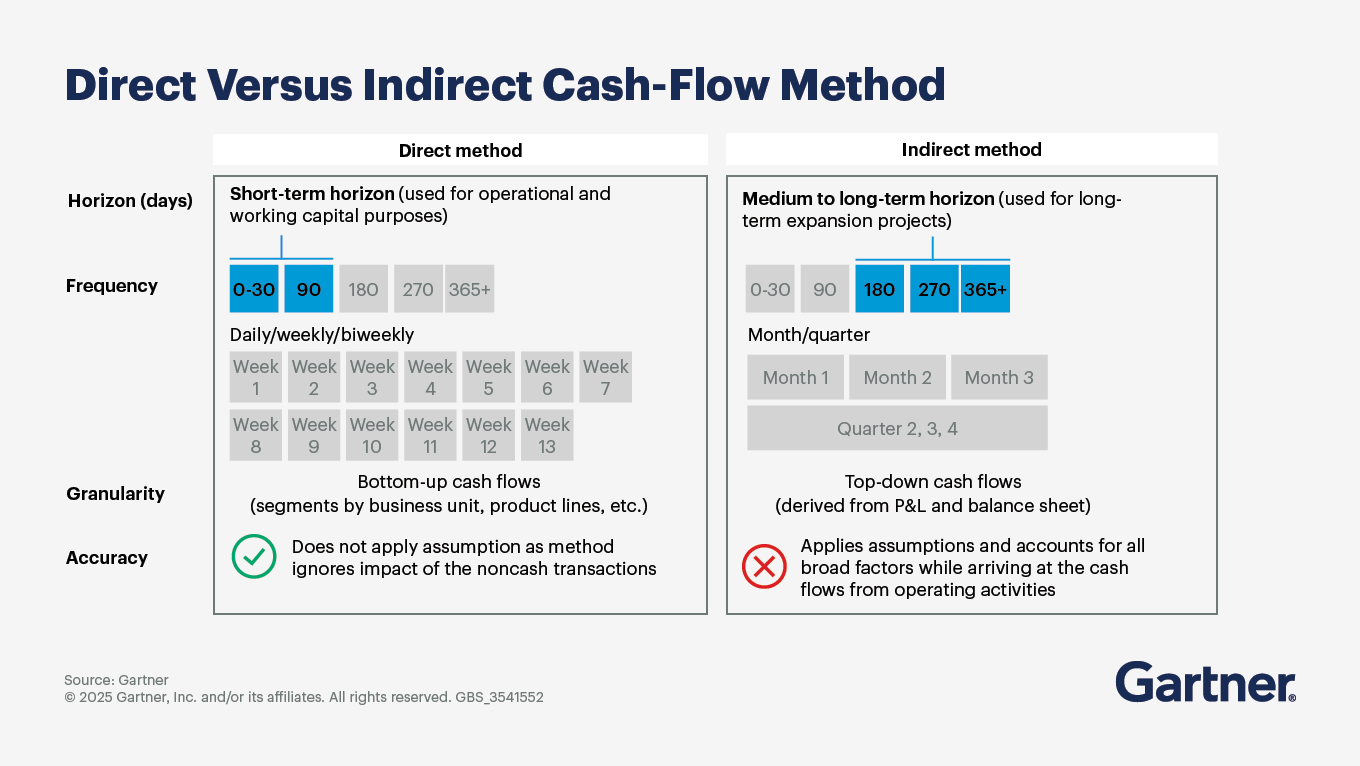

While the indirect cash-flow forecasting method is easier to implement than the direct method because the information is readily accessible through already-required financial reporting and accounting functions, it does not help organizations make timely short-term cash management decisions.

Financial planning and analysis (FP&A) leaders relying on indirect cash-flow methods may find themselves lacking the transparency and accuracy needed for effective short-term cash-flow management. The direct method, though perceived as complex, offers better cash-flow prediction, enhancing operational cash management.

Simplify the direct method by focusing on key liquidity drivers

Overcome the complexity and cumbersome nature of the direct-method cash forecast by involving the business and concentrating efforts on a limited set of liquidity drivers that have the greatest impact on short-term cash flow.

FP&A leaders can simplify the cash-forecasting process in a way that targets critical data by limiting the time spent on predictable assumptions — costs such as salaries, benefits, tax payments and fixed operating expenses that can be easily derived from general ledger data.

Involve business units in forecasting critical assumptions

Improve the cash-forecasting process and forecast accuracy by using range-based forecasts and building a weekly variance review of actuals against forecast numbers that identifies the key sources and causes of volatility.

Business input should mainly focus on unpredictable or nonrecurring events to improve the forecast for those items. Minimize the burden of the cash-flow forecast typically placed on the business units by emphasizing material drivers that affect short-term cash flows and enable strategic decisions.

Cash-flow forecasting FAQs

What mistakes do FP&A leaders make with cash-flow forecasting?

Many FP&A leaders rely on indirect methods that fail to provide the necessary accuracy for short-term cash-flow projection. It’s vital to use the direct method and involve business units to improve transparency and accuracy.

Should FP&A leaders avoid complexity in forecasting during uncertainty?

While complexity can be challenging, focusing on key liquidity drivers and involving business units can simplify the direct method and enhance short-term forecasting.

Are range-based forecasts important for improving accuracy?

Yes, range-based forecasts provide better insight into cash-flow impacts. Request range forecasts where historical variance and transaction values are high to improve accuracy.

Attend a Conference

Join Gartner experts and your peers to accelerate growth

Gather alongside your peers in National Harbor to gain insight on emerging trends, receive one-on-one guidance from a Gartner expert and create a strategy to tackle your priorities head-on.

Gartner Finance Symposium/Xpo™

National Harbor, MD

Drive stronger performance on your mission-critical priorities.