Non-executive board members have high expectations of tech investments, yet some misunderstand how these investments can maximize shareholder value.

- Gartner client? Log in for personalized search results.

Maximizing shareholder value requires tech, yet boards overlook the real ways it delivers

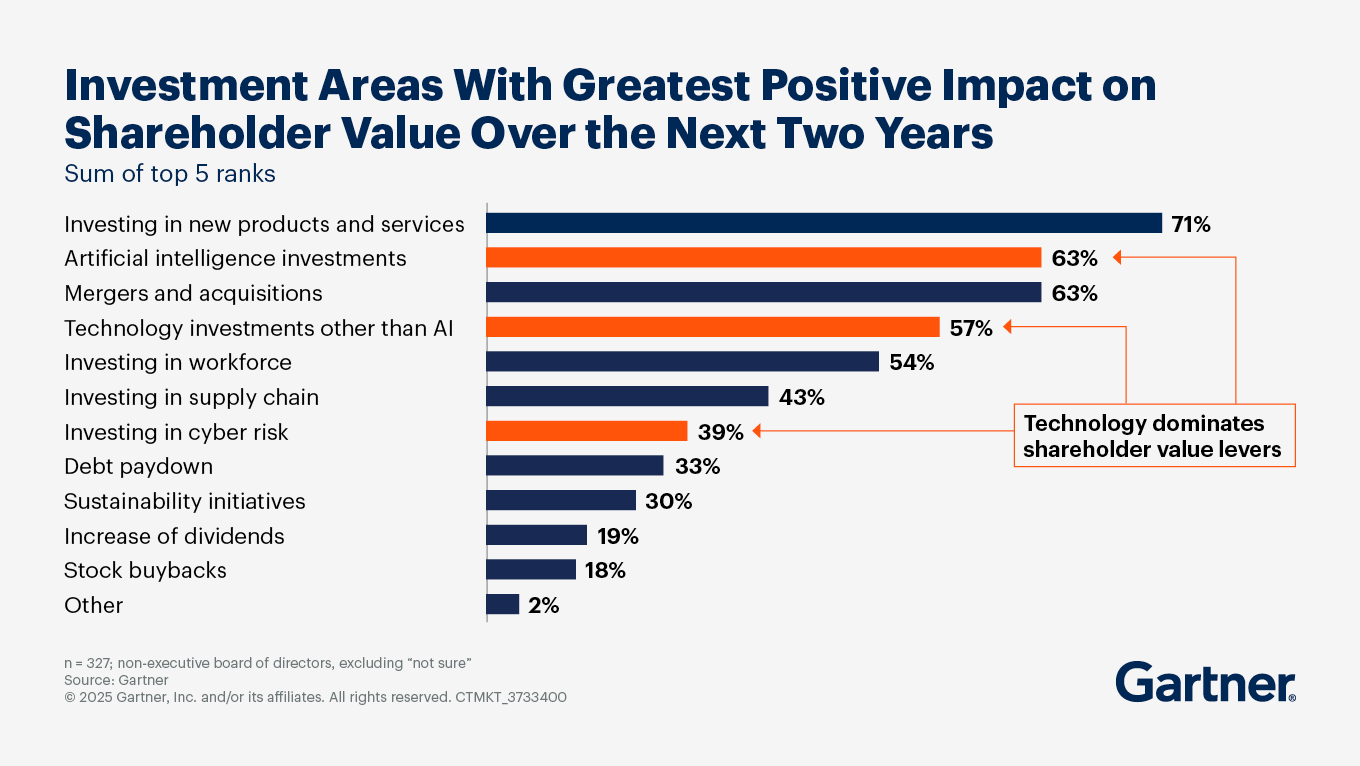

Technology is expected to continue to be a powerful source of shareholder value through 2026. According to the Gartner 2025 Board of Directors Survey, 63% and 57% of non-executive directors (NEDs) believe investments in AI and non-AI technology, respectively, will deliver value, and 37% are pinning their hopes on investments in cybersecurity.

While it is no surprise that NEDs have high expectations for technology, take note: Some overestimate or underestimate the exact source of value key technologies bring to the business.

Boards’ techno-optimism leans on executives to make the right calls to maximize shareholder value

When it comes to AI, non-AI tech and cybersecurity, important nuances could make the difference between boosting shareholder value and simply meeting expectations.

Despite optimism about AI, organizations struggle with ROI

It is challenging to realize value from AI investments. Though some studies have documented AI’s positive impact on worker productivity among certain segments (such as in call centers), those gains often dissipate at the team and organizational level. AI productivity gains also only translate into increased value if employees redeploy the time saved toward value-adding activities. Many do not — although it’s not their fault. Two-thirds of CEOs say their business/operating model is not designed to compete in an AI-driven world.

Furthermore, NED optimism over AI may not account for potential negative impacts of the technology, which few organizations have tackled. For example, only 7% of heads of enterprise risk management (ERM) have fully accounted for risk interdependencies from AI.

Non-AI technologies deliver as much shareholder value as AI

Robotic process automation (RPA), digital twin and blockchain are delivering as much value to businesses as AI is. The potential upside of combining these technologies — applications include geospatial analytics, Internet of Things (IoT) and blockchain for supply chain management — is even greater.

Yet some organizations are allowing the hype over AI to pull attention and resources away from non-AI technologies or technology combinations that have as much or more potential.

Cybersecurity does not just protect sources of value — it also creates it

The primary purpose of cybersecurity is to protect an organization from attacks, damage or unauthorized access. NEDs believe this is becoming more difficult, with 98% suggesting that cyberthreats will grow in the next two years and 93% saying cyber risk is a threat to shareholder value.

Yet cybersecurity can also generate shareholder value by protecting cost optimization and revenue — something NEDs are less aware of. For example, as executive leaders turn to AI to reduce costs, cybersecurity can lend support by protecting large language models (LLMs) and data or organizational IP from unauthorized access and tampering. Cybersecurity also supports M&A by protecting data and systems before, during and after a transaction.

Nearly all investments that drive shareholder value involve tech

Though AI, non-AI tech and cybersecurity investments explicitly emphasize technology, many other sources of shareholder value in 2025 imply a technology element. The largest share of NEDs — 71% — say investments in new products and services will deliver the most shareholder value in the next two years, while 63% say mergers and acquisitions will be key. Technology plays a growing role in both areas.

In the case of product and service investments, technology may be part of the product or service itself. Even if it isn’t, technology will likely play a role in product development or go-to-market execution. Similarly, mergers and acquisitions may stem from the desire to acquire technology resources or talent, and technology often facilitates pre-acquisition due diligence and post-acquisition integration.

Are you a CIO or IT leader at a midsize enterprise?

See how your peers are navigating AI adoption, vendor decisions and evolving business demands — with tools tailored to your role:

Explore our resources for midsize enterprises

Check out a curated list of Gartner’s most popular research being utilized by your peers

Maximizing shareholder value FAQs

What is meant by shareholder value?

Shareholder value refers to the return on investment in the form of dividends or capital gains that the owners of a company’s stock receive when its share price increases. That value usually rises based on actual revenue and profit growth, and in anticipation of future revenue and profit growth as a result of smart, high-potential investments.

What are the main strategies to maximize shareholder value?

According to the 2025 Gartner Board of Directors Survey, technology is the best lever to maximize shareholder value. Of the 10 areas of investment that the largest share of non-executive directors (NEDs) believe will deliver the most shareholder value in the next two years, three include technology: AI, cybersecurity and non-AI technologies. Many of the other levers in the top 10, including new product and service investments, mergers and acquisitions, talent and supply chain investments, also imply a technology component.

Attend a Conference

Experience Information Technology conferences

With exclusive insights from Gartner experts on the latest trends, sessions curated for your role and unmatched peer networking, Gartner conferences help you accelerate your priorities.

Gartner Data & Analytics Summit

Orlando, FL

Drive stronger performance on your mission-critical priorities.