Slash waste, align every dollar to strategy and ensure all stakeholders understand their roles to create transparency across functions and elevate budget ownership.

- Gartner client? Log in for personalized search results.

Companies need cost transparency now more than ever

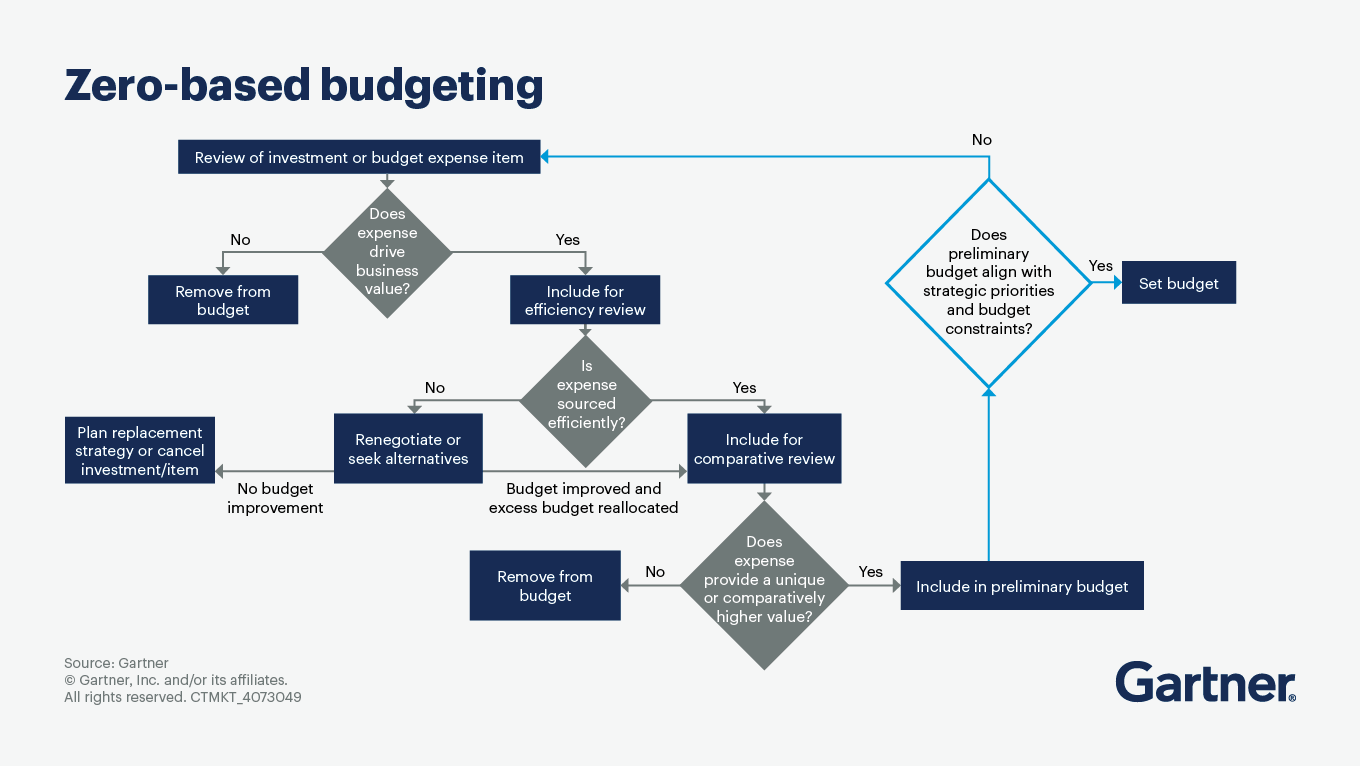

Major cost constraints are forcing function leaders to prioritize, whether they’re dealing with cuts or making room to invest in innovation. Zero-based budgeting (ZBB) is an effective way to discern what to keep and lose in your current budget.

Where traditional budgeting typically assumes a year-on-year continuation of activity and cost, ZBB starts with a blank slate. ZBB forces stakeholders to review all expenses and ensure that resources and budget allocations align with strategic priorities.

See Gartner research in action at our finance conferences and events.

Zero-based budgeting fosters accountability and ties spending to strategy

Reduce costs, align spending with company goals and create a culture of cost transparency by following these steps.

Plan for zero-based budgeting

Creating a zero-based budget requires time and resources, but the outcomes — reduced costs, less waste, strategic alignment, a clear idea of headcount, and greater cost transparency and accountability — are well worth the effort.

Start by resourcing for the following roles, making sure all participants understand their responsibilities, processes and timelines:

Function leaders prioritize their department activities, allocate funds and drive cost reduction or process improvement efforts.

Cost center owners evaluate activities within their cost centers and propose a budget that supports funding decisions.

Financial planning and analysis (FP&A) business partners help departments estimate required costs and resources, and facilitate budget review discussions.

HR supports change management efforts and gives data on headcount allocations and salaries.

A finance-led, cross-functional ZBB implementation team designs the budgeting process, gains leadership buy-in and trains department and finance staff.

Cost-category owners review and monitor enterprise-level spending in their expense categories.

The CFO, COO and corporate budget committee review and approve the final budget.

Choose and prepare the departments that will benefit from zero-based budgeting

The ZBB process can be unwieldy for some areas of the business and doesn’t require whole-enterprise adoption. Instead, choose the departments and cost centers that would most benefit from using the ZBB approach, and educate them on the ZBB process by doing the following:

Define the scope, highlighting areas where specific department budgets are misaligned with company objectives and where there are opportunities for cost reduction.

Develop guidelines and deliver training on process, expected outcomes, and cost center owners’/department heads’ role in achieving them.

Plan a rotating schedule where departments engage in ZBB every two to three years. Follow the standard budgeting process during the in-between years.

Propose zero-based budgets for each cost center

Work with selected cost centers to analyze and assess their activities against business and function objectives.

List activities for each cost center. Document the activity owners, key performance indicators and negotiated service levels for internal services.

Identify nonessential or redundant activities that can be eliminated and inefficient ones that can be modified to free up resources.

Hold open conversations about opportunities and outcomes versus cost cutting. Focus on “must-haves” versus “nice-to-haves” and necessary trade-offs based on department and business goals.

Document and justify the costs of each activity in a budget proposal document. Include people-related, capex, general and administrative, sales and marketing, and distribution costs — and the benefits of each activity versus the consequences of not funding it.

Prioritize activities and allocate resources

Rank all of the proposed cost center activities within a department based on their criticality to the business.

Discuss outliers and differences of opinion within your team to establish the final ranking, and allocate resources accordingly.

Pressure-test cost estimates and resource allocation decisions with each department and make any needed refinements.

Submit the zero-based budget to the corporate budget committee.

Iterate and finalize the budget based on the committee’s feedback until they approve.

Review your zero-based budgeting process and budget performance

With the ZBB process in the rearview, ask for feedback from key stakeholders who helped build the budget to identify opportunities to improve.

Going forward, monitor the budget’s performance by comparing actual results periodically against targets, and make adjustments as needed to reflect market and business changes.

Zero-based budgeting FAQs

What are the advantages of zero-based budgeting?

Although implementing ZBB requires a significant effort and change to the traditional budgeting process, organizations facing cost pressures report the savings are worth the time investment. Applying ZBB principles can give functional leaders a strong lever to defend budgeting priorities and allocations in terms of the value they deliver to the enterprise.

How can we sustain zero-based budgeting beyond the budgeting cycle?

To encourage adoption of ZBB, executives should actively demonstrate and reinforce behaviors at its core, such as encouraging honest trade-off discussions evaluated in terms of business outcome impacts and making tough resource sacrifices. When executive leaders target procedural changes as part of ZBB implementation, they risk their functions viewing it only as a new method for budgeting, rather than as a principle for making better spending decisions.

Attend a Conference

Join Gartner experts and your peers to accelerate growth

Gather alongside your peers in National Harbor to gain insight on emerging trends, receive one-on-one guidance from a Gartner expert and create a strategy to tackle your priorities head-on.

Gartner Finance Symposium/Xpo™

National Harbor, MD

Drive stronger performance on your mission-critical priorities.