Discover 5 proven best practices for achieving efficient growth

- Gartner client? Log in for personalized search results.

Efficient Growth: Insights for CFOs

5 key lessons from efficient growth companies

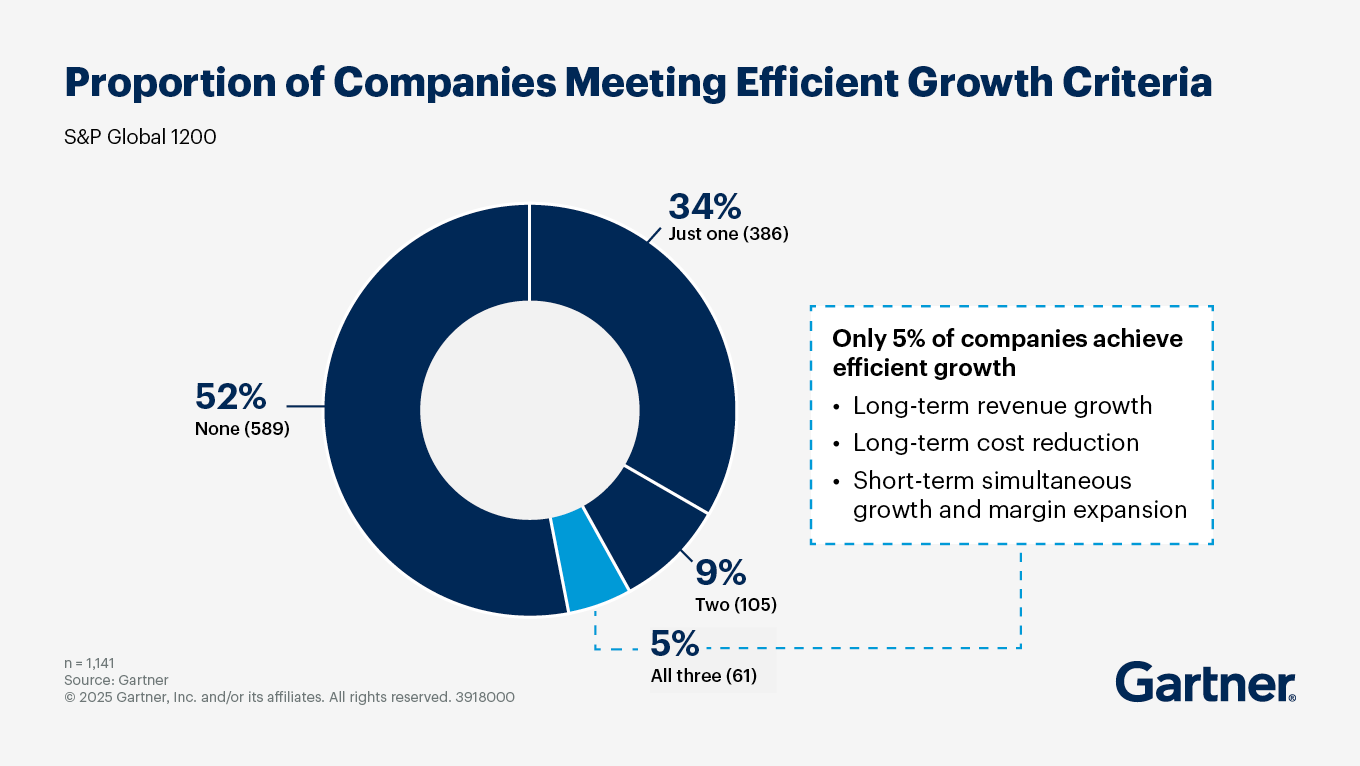

Companies that achieve efficient growth are rewarded with a 7.1% return premium over their peers. Yet, since 2010, only 5% of S&P Global 1200 organizations have successfully achieved it.

Download "What CFOs Can Learn From Efficient Growth Companies" to:

- Understand the 3 criteria for achieving efficient growth

- Discover 5 critical lessons from efficient growth leaders in the S&P Global 1200

- Identify common pitfalls that prevent 95% of organizations from achieving it

About Efficient Growth

Efficient growth is achieving top-quartile performance relative to industry peers in all of the following criteria: long-term revenue growth, long-term cost reduction, and short-term simultaneous growth and margin expansion.

Although CEOs, boards and investors expect efficient growth, no more than 5% of companies are able to achieve it. Yet, since 2010, only 5% of S&P Global 1200 organizations have been able to outpace industry peers on all three of the efficient growth criteria. This means efficient growth is rare but achievable. This research helps CFOs understand efficient growth and summarizes critical lessons learned from efficient growth companies for delivering long-term value.

Efficient Growth FAQs

What is efficient growth?

Efficient growth is a balanced growth profile that combines both top-line and bottom-line growth. Efficient growth companies have achieved sustained long-term revenue growth with simultaneous margin improvements over the past 20 years. Measured against peers, these companies meet the following three criteria:

- Top quartile for eight-year compound annual revenue growth (relative to industry peers)

- Bottom quartile for median total costs (relative to industry peers)

- Top quartile for number of years expanding both revenue and earnings before interest and taxes (EBIT) margins simultaneously

Why is efficient growth important for CFOs?

CFOs, as the stewards of a company’s financial resources, are the primary architects of a company’s growth trajectory. Efficient growth is the optimal strategy because it outperforms alternative growth strategies (e.g., growth at all costs, purely bottom-line-focused growth) across industries and across business cycles. Moreover, equity markets have rewarded efficient growth.

What challenges do CFOs face in achieving efficient growth?

Several practices prevent 95% of organizations from achieving efficient growth. These include chasing competitors’ capabilities, aversion to risk taking, overfocus on underperforming investments, and unprincipled cost management and investment decisions.