Boost profitable growth and financial health through optimized capital allocation, growth strategy and cost management.

- Gartner client? Log in for personalized search results.

3 Essential Profitability Strategies & Guide for CFO Success

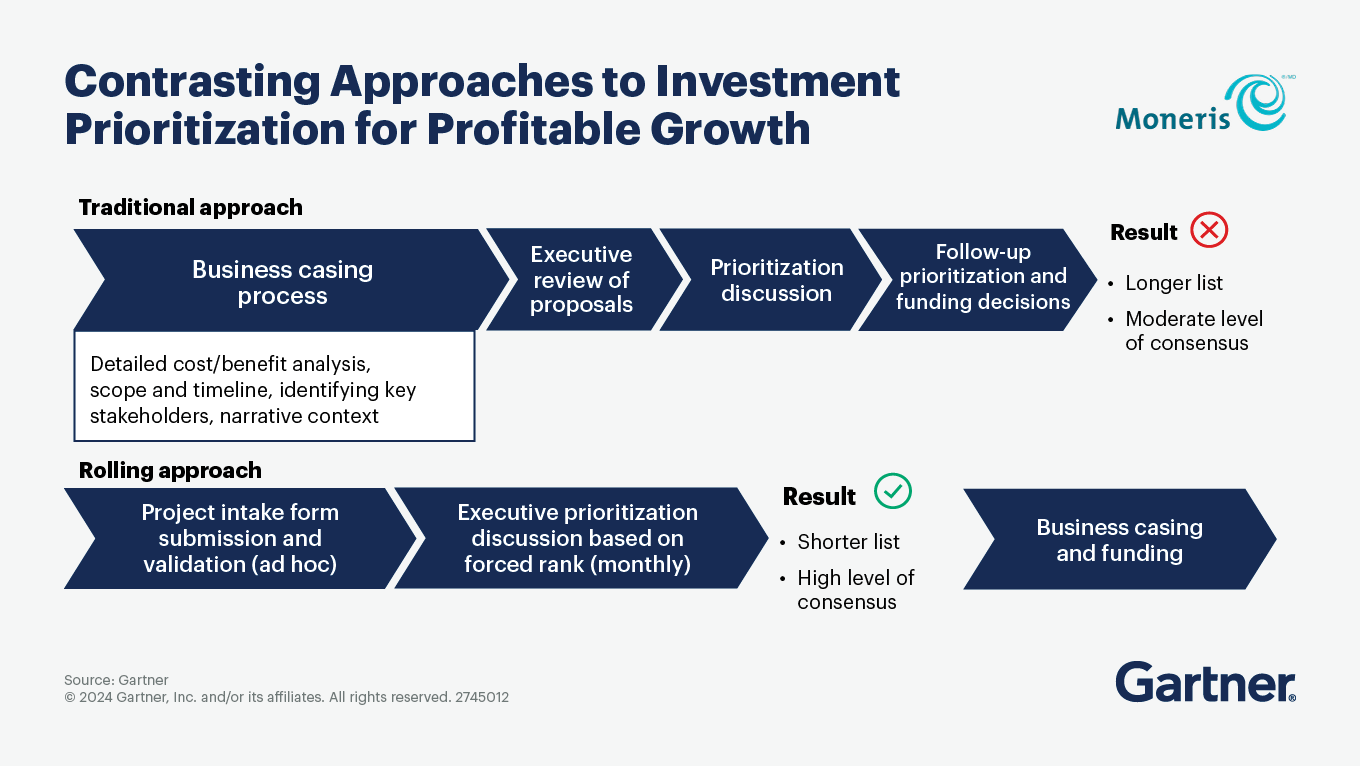

Simplify decisions and clarify trade-offs for better project performance

Through 2026, more than two-thirds of organizations will see returns on digital investments underperform because of poor prioritization. Move past old methods and find new ways to confidently prioritize the right investment mix. Download your investment prioritization guide and discover:

Why current macroeconomic trends raise the stakes for prioritization

Which tools and processes enable clear, strategic, disciplined evaluations

How to unburden your portfolio and boost returns to drive profitable growth

Achieve efficient, profitable growth in a challenging economy

Evaluate capital allocation, growth strategy and cost management optimization decisions for capital-efficient profitable growth and financial health.

Confront Cost Realities

Navigate Hidden Challenges

Cultivate Overperformance

Intervene early to mitigate instability and safeguard profitable growth

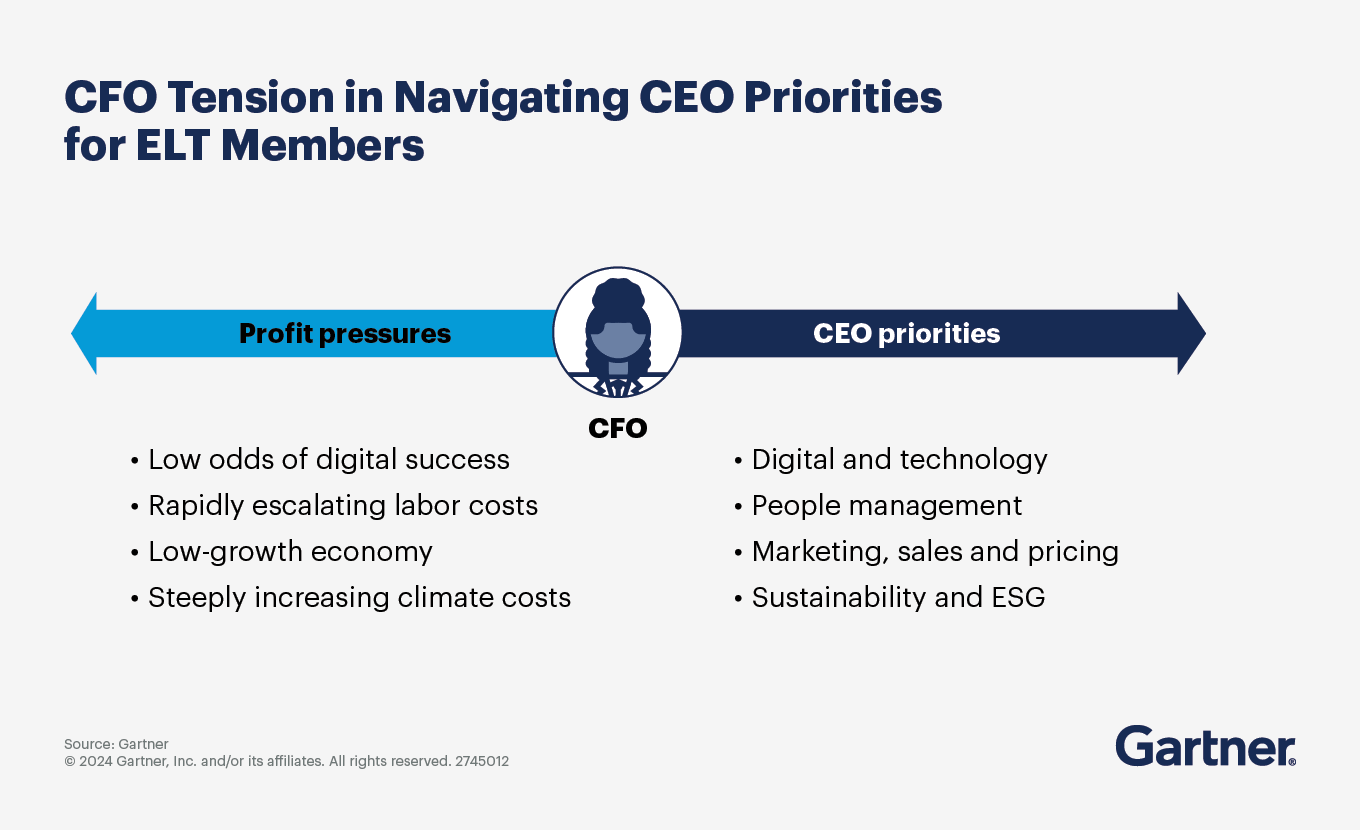

Rising cost and uncertainty create pressure for today’s CFOs to balance profitable growth priorities with cost realities and business strategy.

Externally, geopolitical events, supply chain disruptions, more frequent insurance events, inflation, failed or stalled transformation efforts, and demand for talent in key markets continue to compress margins.

Internally, the following CEO priorities are likely to incur higher costs:

Digital transformation. In a profitability-challenged landscape, digital investments often miss the mark on ROI and fall short of closing profitability gaps. By 2027, only 20% of CFOs will amass 80% of the total revenue and efficiencies that organizations gain through digital investments.

Marketing, sales and pricing. In the next three years, CFOs will grapple with substantially lower profitability as consumer debt, pricing, and material and borrowing costs converge.

People management. As labor costs rise in developed economies, organizations might be tempted to cut salary and benefit expenses. Underfunding these areas will not only lead to higher attrition and turnover but also increase overall personnel costs.

Sustainability and environmental, social and governance (ESG). By 2028, climate change effects will increase enterprise structural costs by 10%. Organizations will be required to spend significantly more on mitigation efforts and adapting current operations to increase resilience against climate-related disruptions.

To deliver on executive priorities amid these pressures, focus on how to manage costs while maximizing investment returns.

Recalibrate stakeholder expectations around financial models and stress-test financial assumptions around run rates for revenue, volumes and costs. Reassess business units’ contribution margins, the “margin of safety,” and increase cost transparency through driver-based cost allocations.

Navigate acute labor cost growth by determining appropriate wage and benefit increases, factoring labor intensity as a criterion as you evaluate strategic investments, prioritizing digital capabilities to remove labor burden, and identifying labor shortage and skill deficits across the organization. By 2028, organizations that competitively raise total compensation will spend 50% less on total personnel cost growth than those actively suppressing wages.

Reduce future climate change and extreme weather costs by modeling business disruption risks and related expenses; then craft a financial transition plan to steer budgeting and bolster investor confidence.

Prioritize digital investments that focus on high-complexity, high-visibility business problems. This will lead to meaningful and business-oriented digital ROI, in part by consistently removing underperforming investments.

Take action to drive profitable growth amid economic headwinds

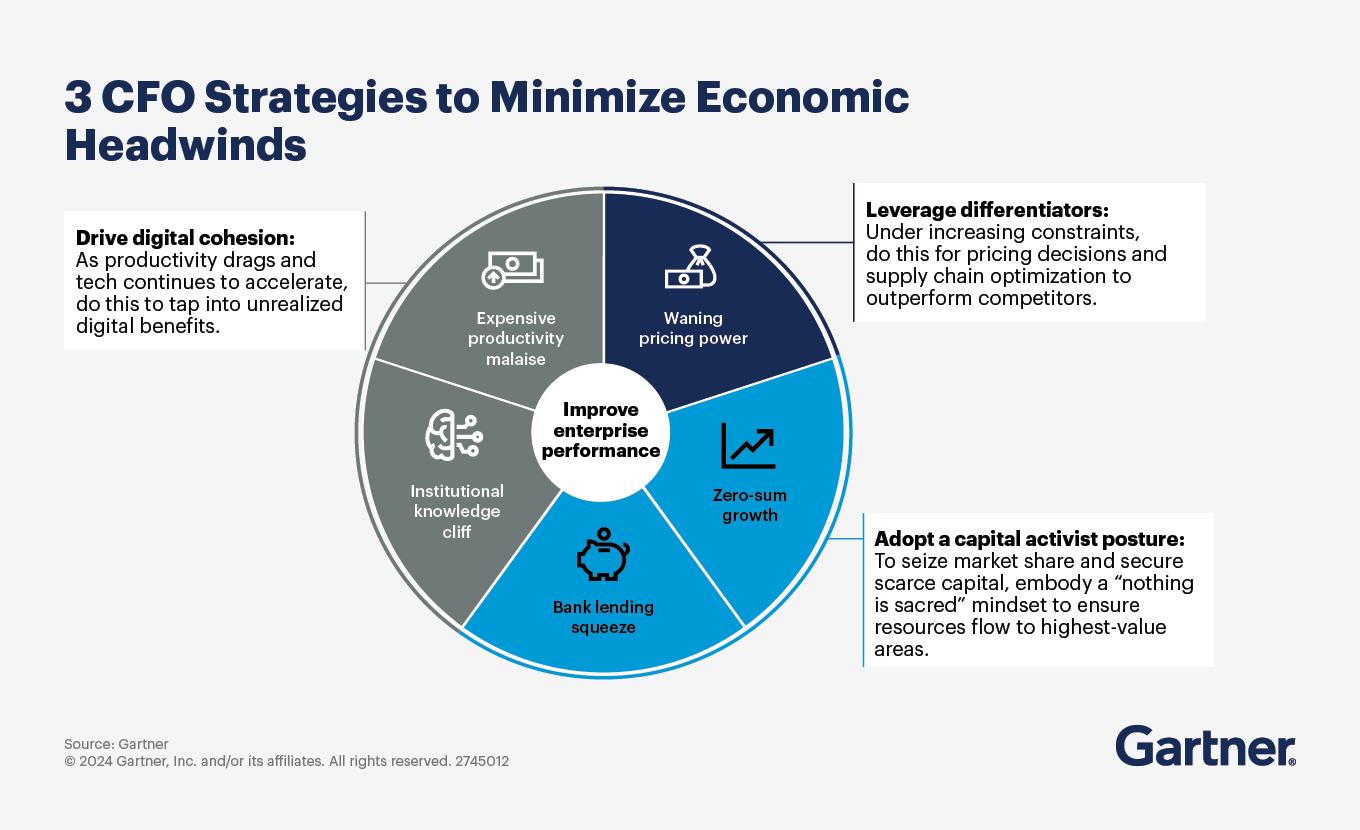

Recent social, political and economic shifts and events bring new and unique challenges to today’s CFOs. Navigating five key challenges can dramatically improve your organization’s performance trajectory and profitable growth.

Challenge 1: Zero-sum growth. In a low-demand economy, it becomes harder to grow top-line revenue and profitability without stealing market share from larger competitors. To maintain profitable growth, today’s CFOs have to deaverage segmentation of markets, customers and value chains to identify growth opportunities and customers that are underserved by industry giants.

Challenge 2: Waning pricing power. Steep, persistent inflation has driven price sensitivity and consumers’ propensity to switch products and brands to new highs — a pattern consistent across industries.

Challenge 3: Expensive productivity malaise. Faced with margin pressure, worker shortages and high turnover, many organizations have sped up digitalization efforts to automate processes and transform business models. But more than two-thirds of CFOs believe digital spending has underdelivered in terms of productivity and time savings.

Challenge 4: Institutional knowledge cliff. The demand for digital talent exceeds supply — and expensive digital talent requires institutional knowledge to deliver on ROI expectations. But many of the employees who have that institutional knowledge are nearing or above retirement age, and their younger colleagues who grew up with automation have less grasp on how underlying processes really work.

Challenge 5: Bank lending squeeze. Higher interest rates and hybrid work have decreased the demand and value of commercial real estate. This has weakened the balance sheets of small, regional banks and diminished their ability to lend. Higher fee structures and loss of negotiating power with large banks amplify the issue. Many CFOs now have to consider alternative financing to maintain profitable growth and cash reserves.

To maximize the impact of capital allocation, digital performance management and budgeting/spending decisions, adopt the following strategies for sustainable growth and profitability:

Focus on points of differentiation. Impress upon executive peers the criticality of driving spend and resource allocation toward capabilities and technologies that will help ensure your organization’s products, services, talent acquisition, retention efforts and delivery models outperform competitors.

Become a capital activist. To position the organization to pursue profitable growth, evaluate multiple sources of nontraditional funding, and diversify based on market conditions and capital availability. Adopt the mindset that “nothing is sacred but the strategy” — and only fund a shortlist of most-critical strategic initiatives.

Drive digital cohesion. To realize productivity gains that drive profitability, assess interdependencies between and across digital initiatives, enterprise capabilities, data and skill sets. Work with the CIO and chief data and analytics officer (CDAO) to understand digital interdependencies. Use that knowledge to inform funding and project performance management decisions.

Reduce risk aversion, aid growth investment returns and drive profitable growth

Over 70% of finance teams are more concerned about losing money to bad investments than failing to fund initiatives that actually need it. But even if a company’s investment strategy is above average at “minimizing misses,” growth investment portfolios tend to underperform for two reasons:

The approach often filters out riskier but more transformational, high-potential initiatives.

Business conditions and priorities change, invalidating initial business case assumptions.

Being above average at cultivating overperformance — versus minimizing misses — in growth investments can increase your chances of contributing to profitable growth.

Cultivating overperformance requires actively creating an environment where investments can exceed initial expectations. Steps to optimize investment outcomes and growth include the following:

Remove unintended barriers to overperformance in growth investment evaluation. Barriers such as bureaucracy, fear of failure and short-termism impede overperformance because they make it harder for CFOs to fund riskier high-potential growth investments. Work to remove these barriers so it’s easier to allocate more funds to growth investments that have a higher chance of overperforming. Do this by:

Forgoing traditional hurdle rates when evaluating and prioritizing growth investment opportunities

Focusing more on testing and learning methods versus typical metrics; one efficient growth leader asks the following risk assessment questions:

Experience: Do we have a history of evaluating this type of investment?

Predictability: Does the investment have a narrow range of outcomes if approved?

Speed: Do we expect the investment to positively impact this year’s profitability?

Upside potential: If successful, do we expect the investment to generate more than modest levels of return?

Data: Do we have historical figures for similar investments of this type?

Ensure sufficient funding for investments likely to overperform. Relatively few companies can consistently reallocate capital from low-value uses to higher-value uses amid business fluctuations. But the ability to flexibly allocate funding to growth investment is a hallmark of companies that achieve the desired internal rate of return (IRR) across their overall portfolio.

Knowing how to prioritize investments for maximum profitability is key. This means ensuring the initial release of funding is allocated to the right initiatives, while also allowing for ongoing reprioritization of existing, in-flight initiatives.

The following best practices for strategic investment planning can help ensure funding for critical initiatives:

Projecting an investment’s likely future performance to predict which investments have the potential to overperform, and then allocating funding from low-potential investments to those most likely to achieve outsized returns and improve profitable growth.

Maintaining growth investment “set asides”— typically 5% of total growth funding or more — for more deserving in-progress initiatives. Instead of having a discretionary fund that caters to a variety of uses, set asides specifically ensure the success of revenue-generating investments.

Attend a Conference

Join Gartner experts and your peers to accelerate growth

Gather alongside your peers in National Harbor to gain insight on emerging trends, receive one-on-one guidance from a Gartner expert and create a strategy to tackle your priorities head-on.

Gartner Finance Symposium/Xpo™

National Harbor, MD

Related profitability resources

Gartner clients: Log in for a complete suite of actionable insights and tools on profitability.

FAQ on finance profitability

What is finance profitability?

Finance profitability is the measure of a company’s ability to generate income relative to its revenue, costs and expenses over a specific period. It indicates how efficiently a company is using its resources to produce profit and is commonly assessed through metrics like net profit margin, return on assets and return on equity. Profitability is a key indicator of financial health, guiding investment decisions and strategic planning for sustainable growth and competitiveness in the market.

Why is profitability important for a business?

Profitability is vital for a business, as it ensures long-term viability and growth. It provides the necessary funds for reinvestment in new projects, research and development, and helps in paying dividends to shareholders. A profitable business can withstand economic downturns and invest in innovation, attracting investors and talent. Profitability also enhances a company’s reputation and market position, enabling it to expand operations, enter new markets and gain a competitive edge.

How can a company improve its profitability?

A company can enhance profitability by increasing revenue through expanding its customer base, improving product quality and optimizing pricing strategies. Cutting costs is also crucial — streamlining operations, reducing waste and negotiating better terms with suppliers can help. Investing in technology to automate processes and improve efficiency boosts productivity. Additionally, focusing on high-margin products and services and improving customer satisfaction can lead to repeat business and higher profits.

Drive stronger performance on your mission-critical priorities.