Published: 26 February 2024

Summary

DXPs compose, manage, deliver, contextualize and optimize digital experiences via multiple channels across the B2C, B2B and B2E use cases. This research will help application leaders responsible for digital and customer experiences to find the most suitable vendors for their needs.

Included in Full Research

Overview

Key Findings

Demand for composable digital experience platforms (DXPs) increased in 2023. Many clients buy only what is needed from the DXP vendor, but are selecting vendors who have wider capabilities they can add later through “curated composability.”

Vendors have responded to the composability trend, but the size and scope of their individual packaged business capabilities (PBCs) vary significantly; there remain monolithic cloud-enabled PBCs that were not developed as cloud-native.

Generative AI (GenAI) integration as an assistant to authors is universal and, at the basic level, not differentiated. Demand has been low for GenAI integration in client requirements, as legal, intellectual property

Clients can log in to view the entire

document.

Strategic Planning Assumption(s)

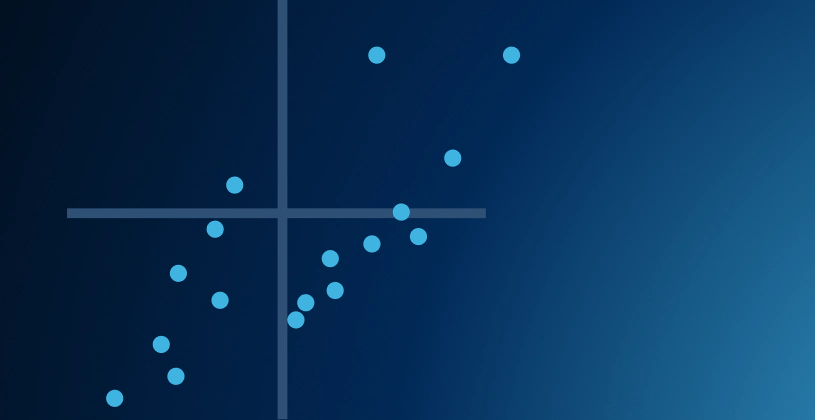

- Acquia

- Adobe

- Bloomreach

- CoreMedia

- Crownpeak

- HCLSoftware

- Kentico

- Liferay

- Magnolia

- OpenText

- Optimizely

- Progress

- Sitecore

- Squiz

- Account Services

- Analytics and Optimization

- Applied Artificial Intelligence

- Cloud Support

- Collaboration and Knowledge Sharing

- Composable Architecture

- Content Management

- Customer Data Management

- Customer Journey Mapping

- Integration and Interoperability

- Navigation and Search

- Personalization/Context Awareness

- Presentation and Orchestration

- Security and Access Control

- B2C Experience

- B2B Experience

- B2E Experience

Critical Capabilities Methodology