By Wade McDaniel | March 07, 2025

Tariff Analysis to Action

August 29 2025

By Wade McDaniel | March 07, 2025

Organizations must prioritize building responsive supply chains in today's volatile global economy to navigate trade tensions and fluctuating tariffs. This requires a multifaceted approach that encompasses strategic awareness, proactive mitigation planning and continuous adaptation.

Tariffs will be a significant catalyst for reconfiguring the supply chain, but Gartner’s 2025 Tariff Volatility Survey tells us that 79% of surveyed CSCOs feel equipped to deal with today’s emerging trade environment. However, specific sectors, such as U.S. hospital systems, may face challenges due to reliance on products manufactured in Mexico and difficulties in cost pass-through.

To understand why CSCOs generally feel equipped to deal with tariff volatility, look towards how their recent network relocations help them mitigate geopolitical and trade risks.

In 2024, S.E. Asia, India and the U.S. emerged as top destinations for relocated operations. This trend continues in 2025, with CSCOs surveyed by Gartner identifying all three of these places as emerging bright spots for increasing manufacturing capacity.

While CSCOs may feel equipped to deal with tariff volatility, recently signed executive orders may expose the community to significantly increased tariff risk. Reciprocal tariffs based on a country’s value added tax (VAT) scheme would potentially widen the tariff risk to include over 160 countries.

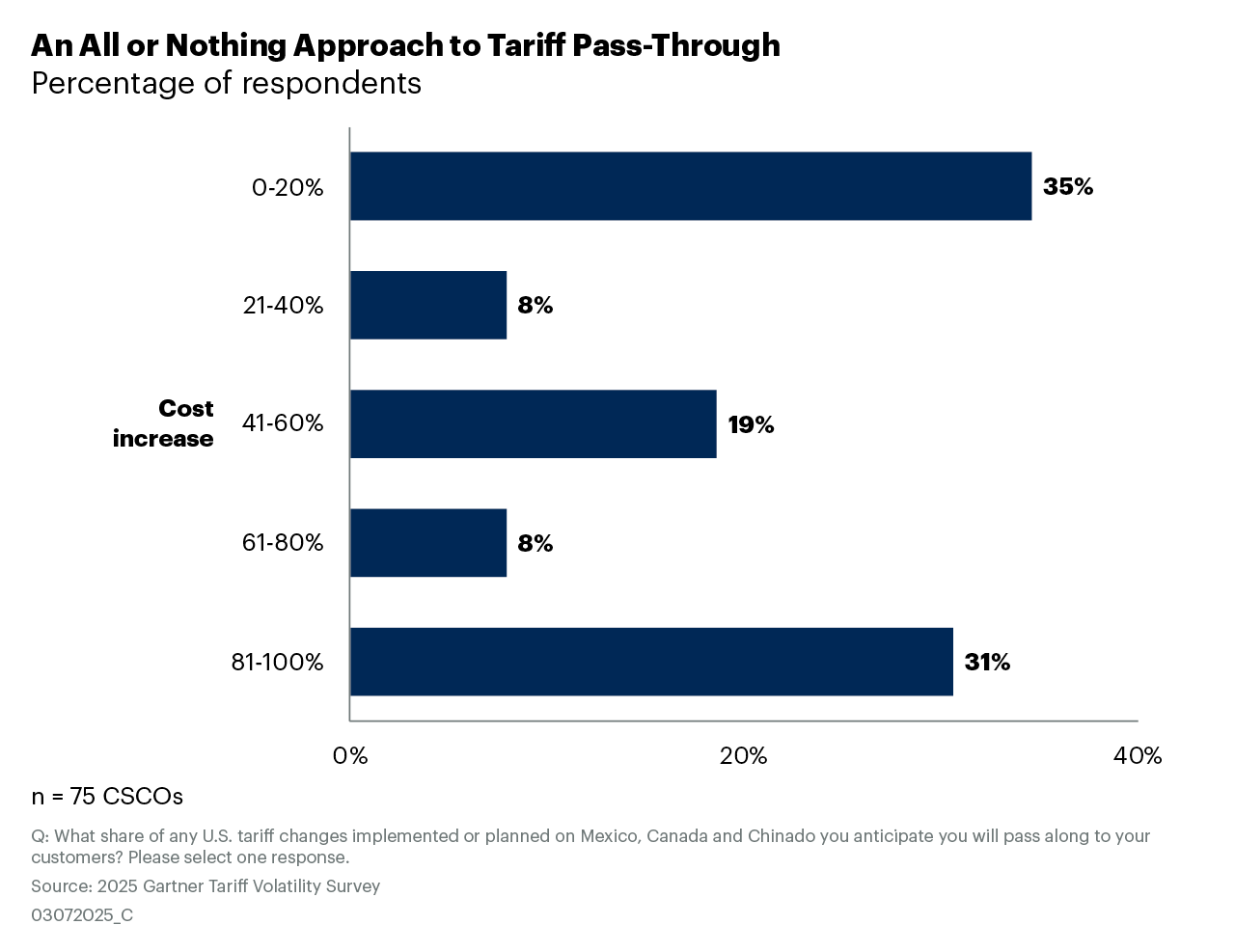

If and when tariffs increase, organizations must determine how much of the cost to absorb and how much to pass on to the consumer. About 35% of CSCOs told us they intend to pass on 20% or less of the tariff increase to their customers. We’ve heard this group is employing cash conservation strategies as a mitigating action.

Overall, when it comes to passing along tariff increases to customers, the majority are mostly all or nothing, with about one third splitting the difference.

Agility is also paramount in this volatile environment. Survey results indicate that almost half of the CSCO community (across industries) believe they can regionalize 25% of their supply chain capacity within 12 months. This is a solid indication that supply chains are becoming more agile and responsive.

Over the years, we’ve provided guidance to our CSCOs on a wide range of actions to help make the networks more resilient and agile to geopolitical and trade tension, and they’ve taken our advice.

So, what are we saying about the current environment, given the increased tensions? The same things:

Sorry to say this, but it depends. It would be great if we could predict that all companies that move to India will experience a simple lift and shift. Some might, but others will experience the still-maturing industrial infrastructure and port capacity.

Shifting to S.E. Asia could be the right move, and it has been for many so far. However, geopolitical shifts could overrun supply chain efficiencies in a very abrupt way.

What about the “factory of the world”? China will retain significant sway in global supply chains and raw materials in the coming years. Could it be possible that China-based supply chains have some advantage over other regions due to average tariff rates? Perhaps so.

Once again, cost to serve will become a critical supply chain analytical tool. Understanding the through line from supply to customer has never been more important. The field will remain volatile, and instability will be the baseline scenario. But in a way, this is reassuring news because we know what to expect.

Wade L. McDaniel

VP Distinguished Advisor

Gartner Supply Chain

wade.mcdaniel@gartner.com

Join live on March 17th or watch back on demand: 5 Actions to Seize the Shift: Business Implications of New U.S. Government Policies

Beyond Supply Chain

Subscribe on LinkedIn to receive the biweekly Beyond Supply Chain newsletter.