Learn five ways CFOs can make scenario planning faster, smarter and more impactful.

- Gartner client? Log in for personalized search results.

Financial scenario planning requires an agile approach

In an ever-changing economic climate, scenario planning is one of the most effective tools for navigating risk in your enterprise’s financial strategy. But as tariff costs rise and markets shift, CFOs can no longer rely on traditional scenario planning methods. Instead, this volatility requires greater agility, faster responses and a more analytical approach. In fact, according to a Gartner study, 53% of CFOs want to adjust their financial scenario planning in the face of changing U.S. trade policy. Adaptive scenario planning reflects this shift that CFOs are hoping to make. It not only increases organizational agility but does so in the face of growing economic uncertainty.

See Gartner research in action at our finance conferences and events.

Navigate economic uncertainty with adaptive scenario planning

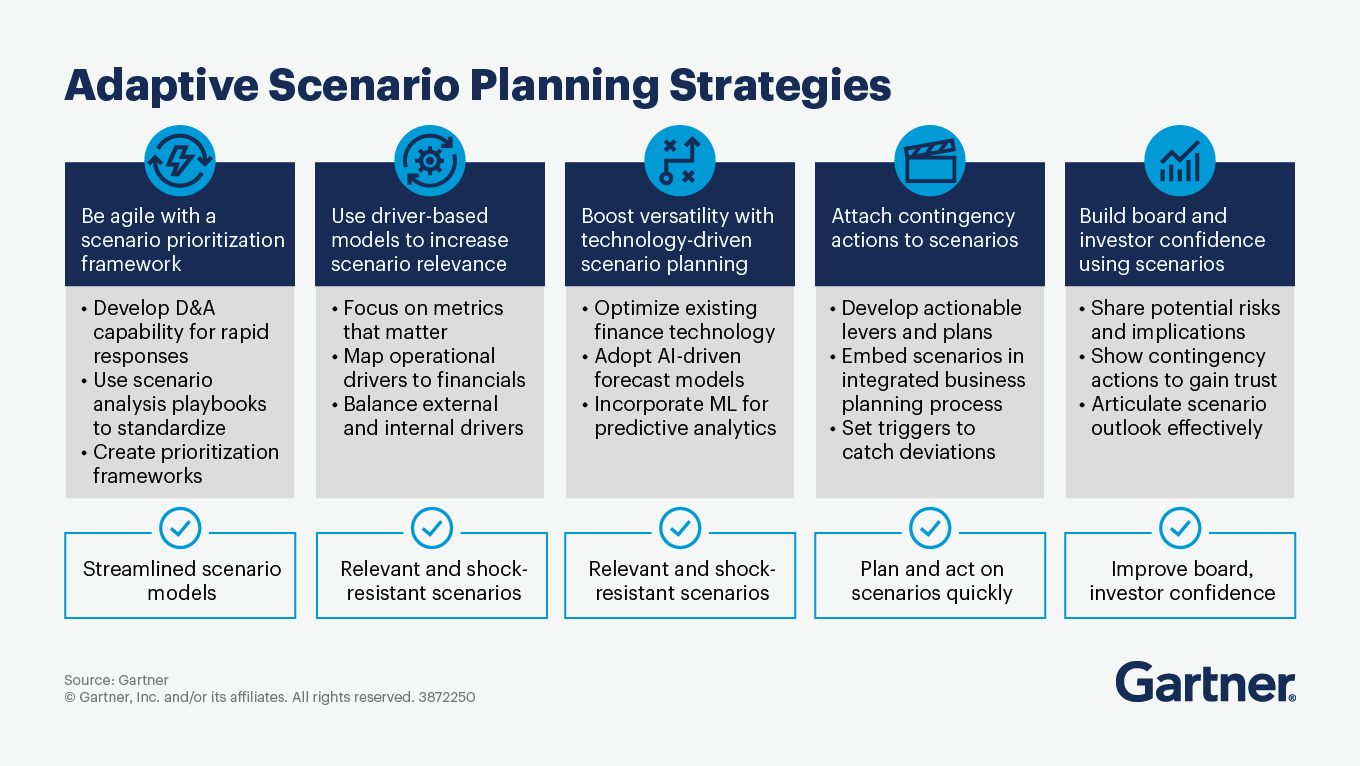

The path to maximizing the value of financial scenario planning starts with streamlining current workflows. From adopting AI tools to empowering your teams, here are five ways CFOs can employ adaptive scenario planning.

Streamline financial scenario prioritization frameworks

When FP&A (financial planning and analysis) teams have more time on their hands, they’re better able to focus on high-impact work like financial scenario planning. That’s why it’s so important to create efficient processes that allow these teams to properly delineate work and prioritize stakeholder requests. New and efficient frameworks such as adopting rolling forecasts, shorter planning cycles and preestablished scenario rules allow finance to quickly and easily update scenarios. FP&A teams should also create scenario catalogs — a documented archive of past scenarios — so they can avoid duplication but also reuse past scenario work to avoid building models from scratch.

Build driver-based models

Create a financial scenario forecasting model that structures the team’s work around the main drivers of business performance. This means focusing your team around variables that have the most impact, not just forecasting every line item. With a simpler driver-based model, financial planning scenarios are more quickly run and so are the outcomes. Not only does this speed up scenario analyses but it also gives FP&A teams time to quickly make decisions and respond to disruption. However, CFOs should make sure that these models are regularly updated to reflect real-time changes and timely responses.

Take advantage of scenario planning technology

Once the foundation is set using the two methods above, use technology to support and streamline scenario planning processes. Employ AI scenario planning models to track key metrics in real time, and autogenerate scenarios based on real data, not just guesses.

This all goes toward helping your team make decisions faster, especially in the face of high-pressure situations. Get started by optimizing preexisting — and underutilized — financial planning tools like multiscenario analysis and predictive modeling.

Create contingency plans for your scenarios

Financial scenario planning isn’t just about reducing risks; it also helps uncover new opportunities. For each potential scenario, CFOs should be developing actions that allow organizations to respond quickly. To save time, they should also be thinking about actions that could apply to multiple scenarios, such as locking in supplier contracts or accelerating product launches. From strategizing ways to capitalize on favorable scenarios, to creating contingency plans in case things go wrong, this kind of proactive planning ensures that businesses are able to quickly act in a variety of situations.

Use scenarios to build investor confidence

Financial scenario planning is also a powerful tool for investor meetings and earnings calls. CFOs can build investor confidence by offering insight into the planning process. However, sharing too many scenarios can make the organization seem indecisive, while sharing only one may suggest a lack of preparedness. The key is to strike a balance and focus on a strategy based on one scenario while also detailing plans in case another scenario comes up.

Financial scenario planning FAQs

What is financial scenario planning?

Financial scenario planning involves creating multiple plausible scenarios based on different assumptions about future events, like changes in market conditions, regulatory shifts or economic factors. With this type of scenario planning, organizations can evaluate the potential impacts of these scenarios on their financial performance.

What is a forecasting model?

The quantitative arm of scenario planning, a forecasting model, helps estimate how variables like sales, demand and cost act under different circumstances. These models can be based on various methods, including time-series analysis and driver-based.

Why does financial scenario planning matter?

Financial scenario planning is a critical tool for organizations, especially in today’s volatile and uncertain economic environment. It allows CFOs and other finance leaders to anticipate market shifts and economic changes so they can develop contingency plans and set key initiatives. This proactive approach helps businesses navigate disruptions and make decisions faster.

Attend a Conference

Join Gartner experts and your peers to accelerate growth

Gather alongside your peers in National Harbor to gain insight on emerging trends, receive one-on-one guidance from a Gartner expert and create a strategy to tackle your priorities head-on.

Gartner Finance Symposium/Xpo™

National Harbor, MD

Drive stronger performance on your mission-critical priorities.