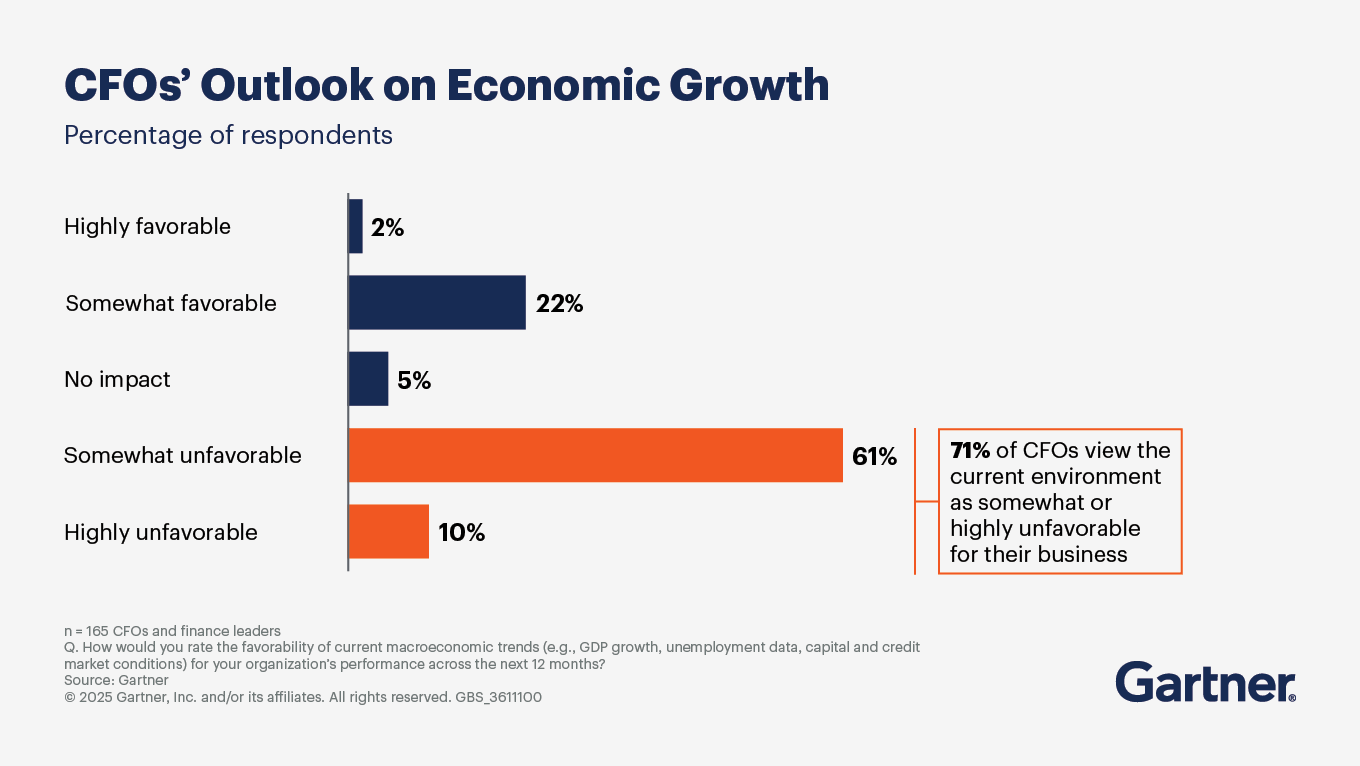

Seventy-one percent of CFOs view current economic conditions as unfavorable for their organization’s growth.

- Gartner client? Log in for personalized search results.

Recent optimism about corporate growth takes a sharp turn

The outcome of the November 2024 U.S. election, the potential of interest rate reductions, the extension of 2017 tax cuts and growth-friendly deregulation quickly sparked optimism among a broad swath of executives, consumers and economic pundits. However, finance leaders have been far more cautious in their growth expectations, especially in the face of tariff hikes and an escalating trade war, government spending reductions and immigration restrictions.

The following insights offer a starting point to inform your strategic planning around finance tariffs and to shape an organizational response.

See Gartner research in action at our finance conferences and events.

Amid uncertainty, CFOs need a concrete way to assess risk and update strategy

Benchmarking how peers are navigating a shifting U.S. federal policy environment — and its impact on customers, suppliers, cost and supply chain — is essential to creating an informed, effective action plan.

Uncertainty creates mixed CFO sentiment around growth

Just over half of CFOs see capital market conditions as favorable or highly favorable to performance, and 44% view GDP growth and credit market conditions favorably. This indicates that many CFOs are spotting opportunities to access financing options to support growth initiatives and drive innovation and expansion.

At the same time, half of CFOs view geopolitical conditions as unfavorable to their organization’s performance, highlighting uncertainties around tariff escalation and government contracts.

CFO concerns around tariff policy and cost pressure temper optimism around demand

CFOs’ views of economic conditions by industry-specific factors mirror their feelings about the macroeconomic climate. Reflecting their GDP growth optimism, 52% of CFOs view demand conditions as favorable for organizational performance.

But beyond demand conditions, a significant number of CFOs are pessimistic about regulation, input prices, labor costs and a proposed $2 trillion reduction in government spending that is projected to decelerate economic growth. Further:

Four in 10 CFOs are pessimistic about the regulatory environment.

Nearly 50% of CFOs cite input price conditions as unfavorable, at least in part due to the prospect of higher tariffs on energy, steel, aluminum, automotive, machinery, semiconductors and a variety of electronics.

Sixty-three percent of CFOs view current trends in personnel cost unfavorably as low unemployment, higher costs to provide benefits, and restrictions on immigration create cost pressures for many industries.

Overcome uncertainty, inform strategy and drive resilience amid the volatility

Work cross-functionally with senior leaders from IT, supply chain, legal and regulatory affairs to inform scenario planning.

Monitor developments to executive orders and legislative changes.

Create a watchlist of countries, sectors and goods impacted by tariffs.

Use price-to-value positioning against competitors to inform any decisions about pricing strategies.

Partner with your CHRO to evaluate personnel cost structure implications.

Partner with your chief supply chain officer (CSCO) to assess the impact of tariff escalation across the value chain.

Establish an appropriate level of board involvement in tariff strategy. Plan to engage with the board at least quarterly.

Attend a Conference

Join Gartner experts and your peers to accelerate growth

Gather alongside your peers in National Harbor to gain insight on emerging trends, receive one-on-one guidance from a Gartner expert and create a strategy to tackle your priorities head-on.

Gartner Finance Symposium/Xpo™

National Harbor, MD

Drive stronger performance on your mission-critical priorities.